Balance Sheet Provides Insights for Debt Collection

Post on: 20 Июль, 2015 No Comment

3 Ways to Learn:

Video Series on Financial Statement Analysis

Transcript for the video:

In this presentation, we provide an overview of what a balance sheet is. A balance sheet is a statement of the financial position of a company at a specific point in time. Every company has a balance sheet each day. Typically they are reported at the same time as an income statement, so at the end of a month, the end of a quarter, or the end of a year. But it is for a specific point in time whereas the income statement is for a period of time. Sometimes the balance sheet is referred to as the statement of net worth, because it does show the equity value or net worth of the business.

BALANCE SHEET

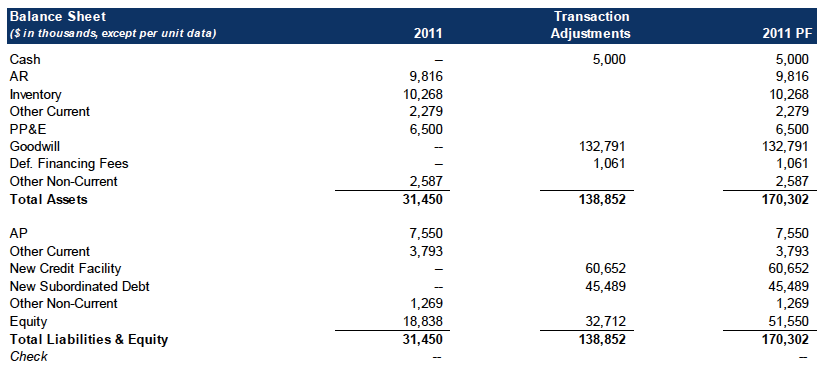

Here is a sample balance sheet. The first thing you will notice is that it is as of December 31, 2011, so it shows the amounts on that specific date, and again, it’s in thousands of dollars. You will notice that there are two sides to the balance sheet when we present it this way. On the left side is assets and on the right side there are two major categories with bolded titles: liabilities and stockholder equity. The balance sheet needs to balance, and that means the value of total assets, which in this case is $8,374,000, needs to equal the value of total liabilities and equity, which we see is also $8,374,000. If a balance sheet doesn’t balance, that means there is something wrong with the financial statements.

CURRENT ASSETS

Now we are going to look at each section of the balance sheet. First we are going to look at assets, and to start we are going to look at current assets. Current assets are cash, cash equivalents, and any asset that is expected to be turned into cash in the next twelve months. That is what makes an asset a current asset that it will become cash during the normal course of operations in the coming year. Cash equivalents are financial instruments that can easily be turned in to cash such as certificates of deposits or CDs. Marketable Securities are items like publicly traded stocks and bonds. Accounts receivable are the amounts that are owed to this business from its customers. These are assumed to have very short terms, typically net 30 or net 60 days, and therefore they can be turned into cash within a year and that’s why they are a current asset. Inventory includes raw materials, work in process and finished goods and the expectation is that the inventory on a specific date will be sold during the next year and will be replaced with new inventory. Other current assets include prepaid expenses. For example, if you pay your insurance bill at the beginning of the year and it’s good for 12 months, most of payment is a prepaid expense for insurance coverage to be provided throughout the year, not just the day the bill was paid. Deposits with utility companies or for short-term leases are also included in other current assets. In this example, the value of current assets is $6.67 million.

LONG-TERM ASSETS

After current assets are long-term assets. These are items that have value but are not expected to be turned into cash during the next year in the normal course of operations. In this case we have first, the fixed assets: the company’s investment in property, plant, and equipment. Examples include land, buildings and machinery. The cumulative amount originally spent to purchase fixed assets is shown as the Gross Value, which for this company totaled just over $2 million. Next we show accumulated depreciation expense. Depreciation expense is determined by accounting rules to expense the cost of fixed assets over their useful life. For example the computer on your desk may have cost the company $1,000 when purchased and this $1,000 is included in the gross value. The company will have depreciation expense of $200 a year for 5 years if that is the expected useful life of the computer, and after three years of $200 depreciation expense annually, the accumulated depreciation would be $600. The net value of property, plant, and equipment is calculated by subtracting the accumulated depreciation from the gross value. Another long-term asset is a note receivable for $349,000 that is not due in the next 12 months. If some of the note receivable was due in the next 12 months, that portion would be shown in the current assets category. We take the total of these non-current assets, including the fixed assets, and we add that to the current asset, and that gives us a total value of assets of $8,374,000.

LIABILITIES

Now we’ll look at the other side of the balance sheet, which has liabilities and stockholder equity, and initially we’ll focus on liabilities. Just as with assets, there are current liabilities, those items that need to be paid within the next twelve months, and long term liabilities, or those items that aren’t due for more than a year. Typical current items would be accounts payable, the bills from vendors that have not yet been paid, and the current portion of long-term debt. That means any debt that needs to be paid back in the next year. Current liabilities will also include any taxes that aren’t paid or other expenses that we know we have to pay but we don’t actually have an invoice for yet. These are called accrued expenses. An example of accrued expenses is when you use a law firm, and you know by the end of the month that you owe them money but they havent sent their invoice yet, so you estimate the amount owed and show that as an accrued liability. Adding up all these current liabilities, also known as short-term liabilities, shows a total of $1,839,000 for this company. This company also had some long-term debt that does not have to be paid back in the next 12 months, so that’s recorded as a long-term liability. We add the long-term liabilities to the current liabilities and we get the total liabilities of $4,171,000.

STOCKHOLDERS EQUITY

The next section of the balance sheet is stockholders equity or shareholders equity. This is the net worth of the company. This is the book value of the company for the people who own it. It is called book value because it is an accounting measure, and not necessarily what the business would actually sell for. Shareholders Equity is made up of two components: the amount of money that was invested in the company by shareholders by purchasing stock and then the retained earnings over the course of the operation of the company. Retained earnings is the net income that is made each year and it keeps adding up. It is reduced when dividends are given to shareholders, since those earnings are no longer retained but are being distributed. Retained earnings will also go down if there is a net loss in any period. So for this company the amount of investment was relatively small—only $194,000—but over the years they have accumulated over $4 million in net income as shown in the value of retained earnings. The total shareholders equity is $4,203,000. Now as we said before, the balance sheet needs to balance, so we add total liabilities and total shareholders equity together, which $8,374,000, and as we saw, this is the same amount as total assets.

Next Video

The next video in this series is Beginning Balance Sheet Analysis. Remember, you can download the Financial Statement Analysis eBook. which includes over 50 definitions and ratio calculations. It also includes an excel spreadsheet that will calculate key ratios when you input financial data. If you need debt collection assistance, we are specialists in large business to business claims and we can refer you to other agencies if your needs do not fit with our expertise. Just fill out the Request A Quote form or give us a call.

At our collection agency, our debt collectors are trained to look for assets recorded on the balance sheet that don’t have any real value or can’t easily be turned in to cash. This typically includes intangible assets and some fixed assets. When dealing with internally prepared financial statements, our debt collectors often see very creative asset categories. This gives us something to talk to the debtor about, and gives us insight into how the business owner thinks – or how well he understands accounting and financial statements. As a commercial collection agency, we also focus heavily on the liability side of the balance sheet. What is the level of accounts payable? What is the typical days outstanding? Do they have secured debt which would make judgment collection difficult or impossible? Debt collection can be as much art as science. Our debt collectors use the science of financial statement analysis to help generate superior results for our clients.