Balance sheet disclosures

Post on: 15 Июль, 2015 No Comment

Balance sheet disclosures

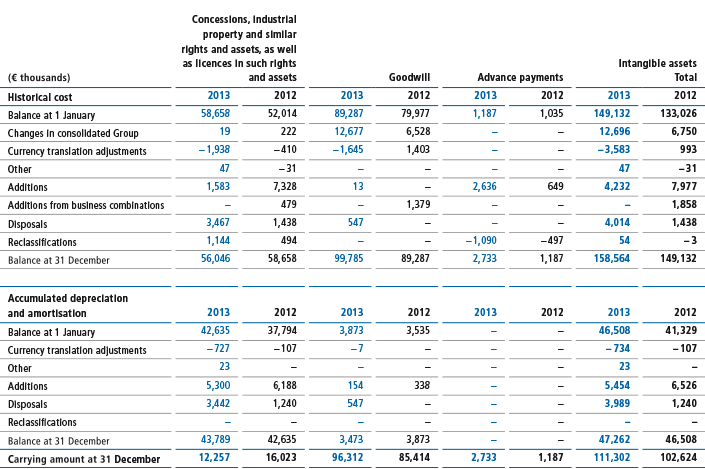

1 Fixed assets

As in the previous year, we did not capitalise any development costs in the year under review because not all of the comprehensive recognition criteria defined in IAS 38 were met.

We conduct our impairment tests once a year. If an additional impairment test is deemed to be required because there is an indication that an asset may be impaired (trigger event), the test is performed promptly. As in the previous year, this proved unnecessary in the year under review.

We apply the discounted cash flow model to determine the recoverable amount (value in use). The future earnings (EBIT in accordance with IFRS) applied were taken from a four-year plan, the basis of which was approved in December. We carried out this planning based on certain assumptions which were drawn from both forecasts from external sources (e.g. current VDMA publications) and our own knowledge of markets and competitors. For the first year we anticipated figures to remain basically on a par with those of the year under review. Over the subsequent years we expect a positive economic trend again. In our calculations we consistently extrapolated the result of the fourth plan year as a constant; we did not apply any growth rates. The reconciliation to cash flow is performed to adjust for the effects of scheduled investments for expansion. If the planned depreciation and amortisation amounts deviate significantly from planned replacement investments, the cash flows recognised are also adjusted.

The carrying amounts of cash-generating units do not contain any items related to taxes or financing activities.

To determine the discount rate, the weighted average cost of capital (WACC) method is applied in conjunction with the capital asset pricing model (CAPM). Under this method, first the cost of equity is determined using CAPM and the borrowing costs are defined, and then the individual capital components are weighted in accordance with the capital structure. The interest rate for risk-free ten-year Bunds was used as a base rate. In response to the global economic recovery we have lowered the market risk premium from 5 % to the pre-crisis level of 4 %; as in the previous year, a beta factor of 1.0 was used. The individual discount rate before taxes which was derived for each cash-generating unit ranges – depending on each country’s individual tax rates – between 7.40 % and 9.11 % (previous year: between 8.69 % and 10.69 %).

The impairment test did not identify any impairment requiring a write-down. Last year’s impairment test revealed the need for write-downs of € 3,332 thousand at a cash-generating unit in Belgium due to economic difficulties.

A 10 % increase in the relevant discount rate would require write-downs of € 648 thousand (previous year: € 0 thousand).

Of the carrying amount of all goodwill totalling € 38,185 thousand (previous year: € 33,810 thousand) € 18,285 thousand (previous year: € 18,285 thousand) was attributable to the Dutch Group company DP industries B.V.; € 3,710 thousand (previous year: € 3,710 thousand) to the Italian company KSB Italia S.p.A.; € 2,980 thousand (previous year: € 2,980 thousand) to the German company Uder Elektromechanik GmbH and € 3,358 thousand (previous year: € 2,790 thousand) to the South African company KSB Pumps (S.A.) (Pty) Ltd. € 3,710 thousand was attributable to the companies included in the consolidated financial statements for the first time (of which € 1,353 thousand to KSB Service Italia s.r.l. € 1,280 thousand to KSB Lindflaten AS and € 1,077 thousand to KAGEMA Industrieausrüstungen GmbH). The remaining € 6,142 thousand (previous year: € 6,045 thousand) is attributable, as in the previous year, to another 12 companies.

As in the previous year, we did not recognise any impairment losses on other intangible assets in the year under review.

The volume of investment in property, plant and equipment declined by 20 % compared with the previous year’s level. After major investments were made in previous years, we returned to the usual level of investments in the year under review as anticipated in the previous year.

Assets resulting from finance leases (almost exclusively real property) are recognised as fixed assets in accordance with IAS 17, and corresponding financial liabilities are recognised. The carrying amount of these recognised assets amounts to € 7,076 thousand (previous year: € 7,167 thousand).

Disposals of items of property, plant and equipment resulted in book gains of € 1,781 thousand (previous year: € 1,538 thousand) and book losses of € 1,219 thousand (previous year: € 1,235 thousand). The book gains and losses are reported in the income statement under other operating income and other operating expenses.

As in the previous year, we did not recognise any impairment losses on property, plant and equipment in the year under review.

Investments in affiliates and other equity investments reported under non-current financial assets declined. Additions, above all resulting from the increase in our interest held in an Italian motor manufacturing firm, were more than offset by effects resulting from the first-time consolidation of six companies and by write-downs. These write-downs relate primarily to five smaller companies in Germany, Belgium and the Netherlands. Our impairment tests at these companies identified impairment losses due to economic difficulties. The planned first-time consolidation of further companies in financial year 2011 is expected to result in another decline in this balance sheet item in 2011.

The increase in loans is attributable to financing measures for a newly formed company in the Americas. For financial year 2011, we expect a significant decline in this item, too, as a result of the planned changes in the consolidated Group.

We currently have no plans for the sale of investments in affiliates and other equity investments.

€ 9,434 thousand (previous year: € 1,817 thousand) of the loans are loans to affiliates.

The effect of currency translation adjustments taken directly to equity on fixed assets was a gain of € 14,112 thousand (previous year: gain of € 5,877 thousand).

The list of shareholdings is included at the end of these Notes.

2 Deferred tax assets

Explanations on deferred tax assets are presented under “Taxes on income”.

3 Inventories

€ 31,711 thousand (previous year: € 27,455 thousand) of the inventories is carried at net realisable value. The impairment losses recognised as an expense in the period under review amount to € 2,147 thousand (previous year: € 6,387 thousand). We reversed write-downs totalling € 3,431 thousand (previous year: € 3,742 thousand) where the current net realisable value was higher than the prior-period value. Inventories amounting to € 778,595 thousand (previous year: € 749,468 thousand) were recognised as expenses in the period under review.

4 Receivables and other current assets

Intragroup and associate receivables include loans to unconsolidated KSB companies amounting to € 5,823 thousand (previous year: € 5,945 thousand). Associate receivables totalled € 4,565 thousand (previous year: € 2,512 thousand).

Construction contracts under IAS 11 include recognised profits of € 26,539 thousand (previous year: € 27,224 thousand) and costs of € 195,182 thousand (previous year: € 184,200 thousand). Sales revenue in accordance with IAS 11 amounted to € 328,716 thousand (previous year: € 349,428 thousand). The gross amount due to customers for contract work is included in other provisions.

The other receivables and other current assets include receivables from employees and deferred interest. They also include recoverable taxes (primarily from VAT) in the amount of € 11,294 thousand (previous year: € 6,319 thousand) and other financial assets from currency forwards in accordance with IAS 39 in the amount of € 1,519 thousand (previous year: € 2,037 thousand). As in the previous year, there are no receivables relating to interest rate derivatives.

At the reporting date, the notional volume of all currency forwards was € 139,105 thousand (previous year: € 112,179 thousand), and the notional volume of all interest rate derivatives was € 5,532 thousand (previous year: € 16,430 thousand).

The contractual maturities of payments for currency forwards are as follows:

€ 21,638 thousand (previous year: € 15,699 thousand) of all receivables and other assets is due after more than one year.

5 Current financial instruments, cash and cash equivalents

Current financial instruments amount to € 500 thousand (previous year: none).

Cash and cash equivalents are primarily term deposits with short maturities and call deposits. The German Group companies use € 18,900 thousand of cash and cash equivalents (previous year: € 16,100 thousand) for hedges of credit balances prescribed by law for partial retirement arrangements. They are available to us at any time due to the underlying contractual structure.

6 Equity

There was no change in the share capital of KSB AG as against the previous year. In accordance with the Articles of Association, it totals € 44,771,963.82 and is composed of 886,615 ordinary shares and 864,712 preference shares. Each no-par value share represents an equal notional amount of the share capital. The preference shares carry separate cumulative preferred dividend rights and progressive additional dividend rights. All shares are no-par value bearer shares.

The capital reserve results from the appropriation of premiums from capital increases in previous years.

In addition to revenue reserves from previous years, the revenue reserves primarily include currency translation adjustments and consolidation effects taken directly to equity. These effects resulted in deferred tax assets in the amount of € 230 thousand (previous year: € 128 thousand) and deferred tax liabilities in the amount of € 20 thousand (previous year: € 11 thousand).

A total of € 21,241 thousand (dividend of € 12.00 per ordinary share and € 12.26 per preference share) was paid from equity by a resolution of the Annual General Meeting of the Group’s parent company KSB AG, Frankenthal, on 19 May 2010.

Equity also includes changes in the fair value of derivatives used to hedge future cash flows amounting to € – 750 thousand (previous year: € – 480 thousand). They changed as follows:

Non-controlling interest relates primarily to PAB GmbH, Frankenthal, and the interests it holds, as well as to our companies in India and China. KSB AG holds a 51 % interest in PAB GmbH, while Klein Pumpen GmbH, Frankenthal, holds a 49 % interest.

Details of the changes in equity accounts and non-controlling interest are contained in the Statement of Changes in Equity.

The proposal on the appropriation of the net retained earnings of KSB AG calculated in accordance with HGB is shown at the end of these Notes.

Capital disclosures

Adequate capital resources and sufficient financial independence are key requirements for sustainably increasing KSB’s enterprise value and safeguarding the company’s continued existence in the long term. Obtaining the necessary funds for ongoing business operations is also extremely important for us. In addition to order intake and sales revenue, our key performance indicators are the return on sales and our net financial position (i.e. the difference between interest-bearing financial assets on the one hand, and financial liabilities on the other). The changes in the equity ratio are also relevant for us. We regularly monitor the development of these indicators and manage them through active working capital management and by constantly optimising our financial structure, among other things.

We present the development of these indicators in the management report.

7 Deferred tax liabilities

Explanations on deferred tax liabilities are presented under “Taxes on income”.

8 Provisions

Provisions for pensions and similar obligations

More than 90 % of the provisions for pensions result from defined benefit plans of the German Group companies. These relate to direct commitments by the companies to their employees. The commitments are based on salary and length of service. Contributions from employees themselves are also included. There are smaller benefit plans at certain foreign Group companies. At the US companies, there are post-employment medical care obligations for employees. These are measured using comparable principles.

The amounts provided for these defined benefit obligations and the annual expense for pension benefits are measured and calculated each year on the basis of actuarial reports using the projected unit credit method (IAS 19).

The actuarial assumptions are as follows: The discount rate applied to the obligations was reduced from 5.4 % to 5.3 %. As in the previous year, the assumed rate of future salary increases is 2.7 %, and the assumed growth rate for the pension trend is 2.0 % per annum. The biometric assumptions are based on the 2005G mortality tables published by Prof. Klaus Heubeck. A mean fluctuation rate (2.0 %) was applied to staff turnover. The retirement age used for the calculations is oriented on the Rentenversicherungs-Altersanpassungsgesetz 2007 [ RVAGAnpG – German Act Adapting the Standard Retirement Age for the Statutory Pension Insurance System]. Actuarial gains and losses outside the 10 % corridor around the present value of the DBO are recognised. Where the cumulative gain or loss exceeds the 10 % corridor, the excess amount is spread over the average remaining working lives of the employees and recognised in the profit or loss of future periods.

The present value of pension commitments amounted to € 217 million for 2008, € 215 million for 2007 and € 230 million for 2006.

The current service cost as well as actuarial gains and losses are recognised in staff costs under pension costs, and the interest cost is recognised in financial income / expense under interest and similar expenses.

Contributions totalling € 25,849 thousand (previous year: € 23,361 thousand) were paid to state pension insurance funds in the year under review.

Other provisions

Provisions for taxes contain amounts of tax still payable for the year under review and for previous years for which no final tax assessment has yet been received. Provisions for other employee benefits relate primarily to profit-sharing, jubilee payments, compensated absence, partial retirement and severance payments. The provisions for warranty obligations and contractual penalties cover the statutory and contractual obligations to customers. The provisions for miscellaneous other obligations include provisions for expected losses from uncompleted transactions and onerous contracts (primarily from construction contracts with gross amounts due to customers in accordance with IAS 11 in the amount of € 840 thousand for 2010 and € 4,577 thousand for 2009), customer bonuses, accrued costs and environmental measures.

€ 40,203 thousand of the other provisions is non-current (previous year: € 43,482 thousand). This relates mainly to provisions for jubilee payments, partial retirement and warranty obligations.

9 Liabilitiess

To safeguard liquidity in the medium term, in 2009 KSB AG took the precaution of placing a loan against borrower’s note worth € 100 million with a 3-year and 5-year maturity. This originally served to ensure the solvency of the company even in a protracted crisis situation.

Assets amounting to € 5,242 thousand (previous year: € 2,753 thousand) have been pledged as security in the KSB Group for bank loans and other liabilities on the basis of standard terms and conditions. Of these, € 124 thousand (previous year: € 184 thousand) relate to property, plant and equipment, € 3,674 thousand (previous year: € 1,254 thousand) to inventories, € 506 thousand (previous year: € 302 thousand) to receivables and € 938 thousand (previous year: € 1,013 thousand) to cash and cash equivalents, as well as other securities.

€ 9,389 thousand (previous year: € 8,648 thousand) of the liabilities were secured by land charges or similar rights in the year under review.

The weighted average interest rate on bank loans and overdrafts as well as on an open-market credit (loan against borrower’s note) was 3.70 % (previous year: 3.05 %). Interest rate risk exists for the major portion of the loan against borrower’s note mentioned above.

There were no covenant agreements for loans in the year under review. In 2009 covenant agreements had to be observed for three loans totalling € 60 million. These loans were repaid before maturity in the year under review due to the sound liquidity situation. In the previous year, two of these loans totalling € 50 million were subject to a creditor-defined indicator (equity ratio) which was not allowed to fall below 25 %. The covenants of the third loan in the amount of € 10 million referred to compliance with a dynamic debt to equity ratio and debt service coverage ratio. Here, too, both indicators were defined by the creditor.

Taxes classified as other liabilities also relate to taxes that Group companies must remit for third-party account.

Miscellaneous other liabilities include changes in the fair value of hedging instruments amounting to € 3,008 thousand (previous year: € 2,395 thousand). € 350 thousand (previous year: € 514 thousand) of this amount relates to interest rate derivatives. Deferred income amounts to € 2,030 thousand (previous year: € 848 thousand). This also includes investment grants totalling € 3,171 thousand (previous year: € 2,189 thousand) received for new buildings in Germany.