Balance Sheet Basics

Post on: 27 Май, 2015 No Comment

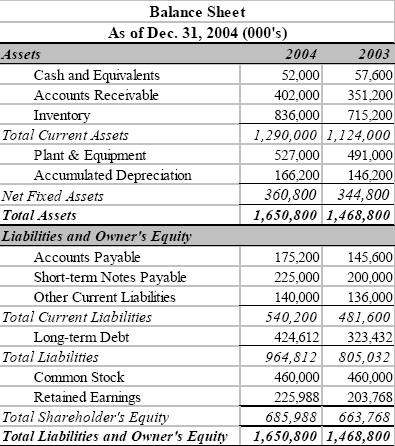

A balance sheet is financial statement that represents a snapshot of a companies financial situation at a point in time; it is split out into three key segments which are Assets, liabilities, and Shareholders Equity. A standard formula on the balance sheet is A — L = SE. In other words, assets minus liabilities should equal shareholder equity or assets should equal liabilities plus shareholders equity. When coupled with the income statement. which displays the companies profit, the two reports provide an overall view of the companies financial position.

Assets drive a company; they allow them to operate while liabilities and shareholders equity support those assets by providing the funding to acquire them. Every company will have different accounts on their balance sheet to reflect their lines of business; there is no universal template.

Balance Sheet Example

Assets

The asset portion of the balance sheet will include current assets and non-current assets. Current assets are essentially assets which have a useful life of less than one year; therefore, they are more liquid in nature than property or longer term assets. Typically you will find accounts (line items) such as cash & cash equivalents, inventory, and accounts receivables here.

Non-current assets, as you can see in our balance sheet example above, will include items such as Long Term Investments, Property Plant & Equipment, Intangible Assets, and Goodwill.

Liabilities

Liabilities are financial obligations that a company will owe on; these could have been incurred such as loans, bonds issued, and other long term liabilities. Similar to the current asset account, current liabilities are short term in nature and due within a short term timeframe, typically under one year. This can include a companies accounts payables. or short term loans that were taken, or even interest payments due on longer term loans.

Shareholders Equity

Finally, shareholders’ equity represents the ownership interest in the company that is spread out amongst shareholders of the company stock. Typically, companies will issue different classes of shares which offer priority to those shareholders in upper classes in the unlikely event of bankruptcy or liquidation. Preferred stock is one of those upper classes.

The term retained earnings refers to the portion of the net income which is kept within the company, rather than distributed to its shareholders as a dividend. Conversely, if the company ends with a loss for the reporting period; the loss is retained and consided a retained loss. These losses will lower earnings.

Cummulatively, shareholders equity plus retained earnings represent the funding for the business.