B W mPower cover story about lack of interest is bogus Atomic Insights

Post on: 27 Апрель, 2015 No Comment

Update: (June 20, 2014)

Here is the chart of B&Ws stock price during the past year. It is interesting to note the 10% drop between May 9, 2014 and May 18, 2014 and the fact that the stock continues to trade in a range centered around the new, lower price established after that drop.

BWC June 2013 through June 2014

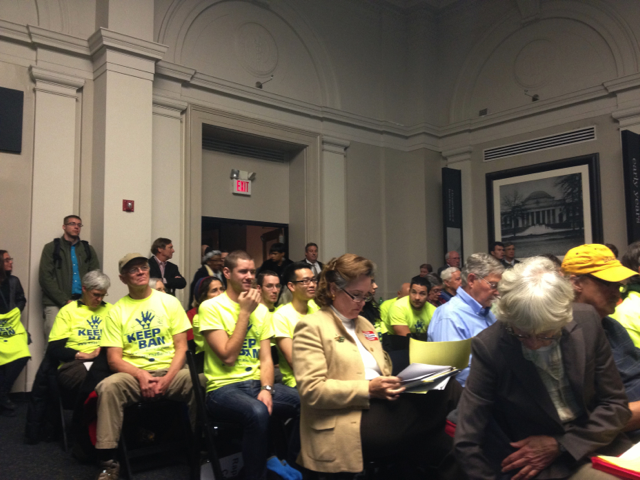

In late February 2014, the Babcock & Wilcox company (B&W) made an announcement that sent shock waves through the nuclear energy industry and initiated even more intense shock in a couple of office buildings in my current hometown of Lynchburg, VA and in Charlotte, NC.

During a call with investors, Jim Ferland, B&Ws CEO, announced that spending on the mPower reactor development project would be slashed by approximately 75%. By the end of the week, the company had issued 60 day warning notices of pending layoffs to more than 200 engineers, project managers, administrators, and sales people.

The official explanation was that the company had failed in its effort to find additional major investors to participate in the project. Supposedly, potential investors were not interested because there were not yet any customer commitments to purchase B&W mPower TM reactors, even though anyone who knows anything about the power business knows that no customer will make a firm commitment for a product that does not yet have a final design or a license to be built.

The underlying impression given, perhaps purposely, was that SMRs were not attracting customer interest and were thus just an expensive distraction to keep nuclear-focused development teams busy.

That cover story leaves out a lot of details. It glosses over the fact that a group of Wall Street investment funds have purchased enough B&W shares to impose a restructuring plan that directs spending away from the mPower development project. It also obliterates the fact that there was an investor that was ready to commit until Ferland made his surprise announcement.

However, even people who know a little about that underlying story may not have heard my interpretation of why the mPower project was an attractive target.

There is a May 6, 2014 story on The Street titled Babcock & Wilcox Change Looms as Blue Harbour Takes 6% Stake that starts off with the following false statement.

Energy solutions specialist and mission critical defense contractor Babcock & Wilcox is quietly becoming a target of value-seeking hedge funds after years of cost overruns and weak stock performance.

Here is a graph of B&Ws stock price during the four years since it was spun out from McDermott, the oil and gas focused engineering, procurement, construction and installation (EPCI) conglomerate that had owned B&W since a highly publicized takeover battle in 1977.

The Babcock & Wilcox Company stock price 2010-2014

There was sharp drop in the stock price in March of 2011, but that Fukushima-inspired weakness was common among companies known to have a focus in nuclear energy. Since bottoming out at approximately the same level as the initial public offering price, B&W has been a reasonably strong performer and its current stock price is 40% higher than it was during its initial public debut in 2010. Compared to its former parent company, B&Ws stock price performance in the past four years has been spectacular.

McDermott Int. stock price 2010-2014

It wasnt stock price weakness that painted a bullseye on B&W for Wall Street.

The Street article goes on to provide more clues on the real target for the four big funds that have so far accumulated nearly 25% of the company and greatly influenced its long term decision-making process. Here is the list of funds involved:

- Janus Capital Management 6.2% of B&W on Dec 31, 2013

- Mason Capital Management 10% of B&W on Feb 27, 2014

- Blue Harbor Group 6.0% of B&W on Apr 21, 2014

- Starboard Value 1.8% of B&W (date unknown, no SEC filing required)

However, as activist investors take an increasingly vocal role on Wall Street, Blue Harbour may be able to accomplish its objectives without making much of a fuss.

Babcock & Wilcox is in the process of dramatically reducing its investment in a struggling mPower nuclear reactor project, which has weighed on shares amid spiraling costs, obscuring the companys stronger performing nuclear energy, operations, and services businesses. The mPower unit cut $81 million from Babcock & Wilcoxs 2013 total segment income and $27.7 million in the fourth quarter, a significant hit to both full-year and fourth-quarter profits.

While Babcock & Wilcox had been shoveling about $100 million a year into mPower and initially provided guidance of between $60 million and $70 million of investment in 2014, those forecasts were revised by management in mid-April to just $15 million a year. That reduced spending plan for mPower caused analysts at William Blair and UBS to increase their full-year estimates for Babcock & Wilcoxs earnings.

For Blue Harbour, which began buying Babcock & Wilcox shares in early March, the companys reduced mPower spending is just one move the company can take to improve its earnings and stock performance.

Besides mPower spending reductions, Babcock & Wilcox may be able to better manage its coal-related businesses to stem declining margins. Given its low debt load, Babcock & Wilcox may also be able to take up its leverage as a means to buy back stock, potentially increasing the value of its shares when that turnaround plan is complete.

As a former B&W employee who was inspired to move to my current home in Lynchburg, VA to work on the B&W mPower TM reactor development team, I have a different perspective. The mPower reactor and the associated Generation mPower -led mPower America initiative was the main pillar of the companys growth strategy.

(Note: I left B&W mPower, Inc. in October 2013 to pursue a career as a writer, blogger, podcaster, consultant and pro-nuclear advocate.)

The leaders who decided to invest in the development of the B&W mPower reactor made a carefully-considered decision to build on the core competencies that the company had developed during its more than 150 year-long history as one of the worlds leading steam companies. B&W leaders saw value in taking advantage of its position as the only US company that has continuously manufactured the major components of light water nuclear power plants in North America for the past 60 years.

Aside. B&W is such a force in steam-related manufacturing that it literally writes the book on steam and recently released the 41st edition of Steam. I recommend borrowing or buying a copy of that new edition. Once you have your copy, pay careful attention to the extremely well-written sections on the mPower reactor project. End Aside.

In my opinion, the fund managers were specifically looking to kill the mPower reactor and deal a damaging blow to the nascent small modular reactor (SMR) industry. By focusing on the company that everyone thought was the market leader and concocting a cover story about lack of customer and investor interest, they did a pretty good job of initiating some confused reactions by people who have been looking at SMRs as the one bright spot in the US new nuclear industry.

See, for example:

Nuclear Intelligence Weekly (Feb 28, 2014) Newbuild: B&W May Pull Back From SMR Development

Charlotte Business Journal (Feb 28, 2014) No sale: Babcock & Wilcox can’t find buyer for Generation mPower

Charlotte Business Journal (April 14, 2014) Babcock & Wilcox slashing investment in small reactor venture

Forbes (Apr 28, 2014) mPower Pullback Stalls Small Nuclear

Taxpayers for Common Sense (May 5, 2014) DOE Continues Funding for Small Modular Reactors Despite Industry Concerns

People who have read the smoking gun posts here over the past few years may be as suspicious as I am about the motives of investors who sabotage new nuclear technology development. There is a large universe of people who prosper from the fact our modern society is addicted to hydrocarbons with few, if any, reliable alternatives.

By discouraging investments in the only alternative that works actinide (uranium, thorium, plutonium) fission they sustain the enormous revenue streams that come from selling coal, oil and gas into undersupplied markets where consumers cannot get enough to meet all of their needs and desires.

In this case, there is also evidence of involvement in the sabotage effort from within the nuclear industry. The vultures from Wall Street have nominated Bob Nardelli to represent their interests on B&Ws Board of Directors. Before earning a reputation as one of the Worst American CEOs of all time. Nardelli was one of the top three contenders to replace Jack Welch at GE. B&Ws current CEO, Jim Ferland, came to B&W directly from Westinghouse. Both of those companies have products that directly compete with the 180 MWe B&Ws mPower reactor. Westinghouse is developing a 225 MWe Westinghouse SMR and GEs is marketing a 300 MWe PRISM reactor.

Now that the relatively recently hired CEO has taken it upon himself to mangle B&Ws long-term strategy, stockholders should vociferously question the company about its growth plans.

Where will the companys future revenues come from as the US government scales back on defense spending? How likely is it that the Department of Energy will look favorably on facility services bids that include a company that competed strongly for a cost share support program and then bailed out of the project less than a year after getting the first multimillion dollar check from the government? How much trust which is a big deal in government contract decision making did Ferlands abrupt decision to kill mPower lose for the company?

There is no doubt that developing a new nuclear power system in the US is fraught with difficulty. Many hurdles have been purposely erected in the development path and it takes a company with a strong cash position and a great deal of management skill to negotiate its way through the maze. It also requires courage and a long-term vision, but the end result could be a world-leading technology that would provide solid profits for many decades into the future.

I suppose that is too much to expect from executives in todays pay me now culture. Apparently, Ferland has been guaranteed a rather generous golden parachute roughly $18 million if the Wall Street funds have their way and break up one of the few heavy industrial firms left in the United States with the cash, vision, and experience required to begin an innovative nuclear power system development project that showed signs of being able to succeed in the near future.

If you think stories like the ones you have read about here today are useful in your investment decisions or career planning, please consider a donation to Atomic Insights LLC. Donations are not tax deductible; Atomic Insights is a for-profit, tax-paying organization with a mission.

We are passionate about finding and sharing accurate information and analysis about atomic energy, fuel choices, energy industry, hydrocarbon-fueled politics, and the difficult energy choices that we all need to make.

If you think, but Ive already donated, ask yourself how many times you have tipped your favorite bartender, waitress, garbage man or valet. Is the service provided here any less valuable?