AxiomOil Investment Thesis

Post on: 13 Июнь, 2015 No Comment

Axiom is focused on creating value and shareholder returns from a strategy of disciplined capital allocation across the exploration and production lifecycle with an appropriate risk/reward balance.

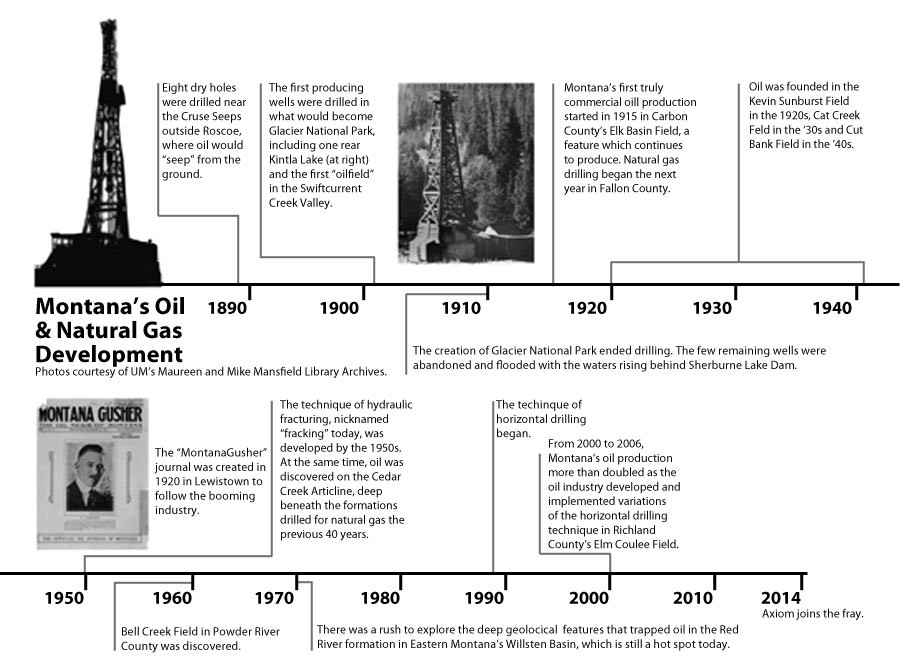

Axiom Oil and Gas Corp. is an oil and gas exploration and development company, formed initially, to develop oil and gas leases in Toole County, MT. The Company provides investors with exposure to producing oil and natural gas interests with significantly lower production costs.

With a strong management and operations team and low risk development drilling, the Company intends to build a solid base operation with stable cash flow to ensure corporate longevity and minimal dilution as it grows its shareholders’ value with additional oil and gas opportunities.

OUR FOCUSED GROWTH STRATEGY

Our strategy for oil and gas exploration centers around our objective to maximize the potential return on investment and to attempt to minimize the potential risk for our investors and the Company.

The optimal strategy for minimizing the risk in a prospective venture is to drill in areas where there are known oil and natural gas reserves in the target formation indicated by the presence of any past or present producing wells.

This strategy requires Axiom to focus on the drilling of development wells versus the drilling of exploratory wells. That means drilling wells in areas where there are wells known to have been completed that have produced from the target formation in the fields which our geologists believe there to be substantial oil and natural gas reserves to be present that can be unlocked by utilizing the latest in science and technology.

INVESTMENT CONSIDERATIONS

- Experienced management and operations team.

- Existing production in area of 38 API Bakken oil, low risk offsetting development drilling.

- Kevin-Sunburst Dome has produced 130 MMBO and 150 BCFG.

- 70 drill locations identified in

15,000 acre lease package.

- East Kevin Field is located in the best Nisku porosity area discovered on the dome – average EUR – 50,000 barrels.

- Shallow Vertical wells – 3,200 to Nisku Formation. “Free Look” on 7 upper zones.

- Long-term cash flow potential (+20 years).

- Low production costs.

To participate in the exciting and lucrative business of oil and gas production and exploration contact us to learn more about recent developments and special opportunities.