Average Return on Endowment Investments Is Worst in Almost 40 Years Finance The Chronicle of

Post on: 4 Апрель, 2015 No Comment

By Goldie Blumenstyk

The value of college endowments declined by an average of 23 percent from 2008 to 2009, socked by the one-two punch of record investment losses and a precipitous drop in giving, a survey released on Thursday shows.

The average investment return for the 2009 fiscal year was minus-18.7 percent, the worst result in the history of the endowment study, which the National Association of College and University Business Officers has sponsored since 1971. Until 2009, the worst year was 1974, when the average return was minus-11.4 percent.

As they released the survey report, Nacubo officials took pains to note that while the 2009 fiscal year, which ended June 30 for most institutions, was the most difficult for investors since the Great Depression, volatility works both ways. Since March, most investments have been on the rebound.

The picture for endowments is a lot cheerier than it was a year ago, said John D. Walda, Nacubo’s president, on Wednesday at a news conference in New York.

He also noted that a majority of institutions had increased their spending from endowments to support programs and scholarships, even as their investments lost value. They stepped up to the plate, said Mr. Walda.

At the same time, the average level of colleges’ long-term debt rose, although that average was skewed by the big bond issues of wealthy private and public colleges.

Erosion at the Top

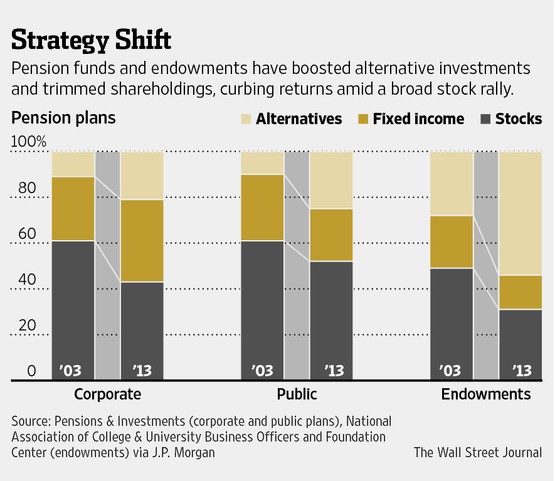

In a reversal of the trend of previous years, in 2009 the biggest endowments saw the biggest declines: Funds valued over $1-billion (there were 52) had an average return of minus-20.5 percent (see chart ). Such funds typically benefit from diversification and greater access to investments that often yield high returns. But in 2009, colleges’ investments lost money in all but the most vanilla of asset classes, bonds and cash.

Some wealthy institutions avoided the worst of the market, including Vanderbilt University, which managed a minus-16.3-percent return for the year. It reduced its stock holdings in the fall of 2008, right before the stock market began its dive. (Vanderbilt made the move because its investment managers were concerned about the frothy stock market, and because they needed to have liquid assets to meet commitments they had made to private-equity investments.)

The five richest endowments in the survey have all, separately from the survey, publicly reported major investment losses for the 2009 fiscal year: Harvard University (minus-27.3 percent); Yale (minus-25 percent); Stanford (minus-27 percent as of its fiscal year, which ended August 31); Princeton (minus-23 percent); and the University of Texas System (minus-22.6 percent).

At those institutions and others that depend heavily on their endowments to support general operations, the effects of the steep losses have already become apparent in layoffs, hiring freezes, and delays in construction projects.

And for some, like Wabash College, which counted on endowment income to cover 54 percent of its budget, it was a wake-up call. We were dependent on that lifeline, said the president, Patrick E. White. With a return of minus-23-percent, Wabash was forced to cut courses, offer incentives to staff members to encourage early retirement, and not renew some contracts for untenured professors. Within five years, Wabash plans to reduce its endowment dependency to below 40 percent by further cutting expenses, increasing fund raising, and gaining more net revenue from tuition.

Long-Term Growth

Still, even with the deep losses in 2009 and the minus-3-percent return in the 2008 fiscal year, the strong investment gains from several previous years kept colleges in a relatively stable position: The average five-year return for all endowments was 2.7 percent, and the average 10-year return was 4 percent. (For the biggest endowments, valued at over $1-billion, those figures were 5.1 percent and 6.1 percent, respectively.)

Investment returns for the year ending June 30 would have been worse had it not been for the general rise in stock prices that occurred in the last quarter of the fiscal year.

And the endowments, which even at their smallest tend to include a mix of bonds and alternative investments such as real estate, along with domestic and international stocks, performed better, on average, than the stock-market indices. The Standard & Poor’s 500 Index, for example, had a return of minus-26.2-percent for the same period.

The 210 endowments in the survey valued at less than $25-million, which reported having the greatest proportion of their investments in bonds and cash (27 percent and 9 percent, respectively), reported the highest average return, minus-16.8 percent.

The survey’s findings are based on responses for endowments and related foundations of 842 education institutions in the United States. In December, Nacubo and its new partner in the survey, the Commonfund Institute, released preliminary findings that showed an average return of minus-19 percent for the more than 500 institutions that had responded by then.

(The accompanying searchable database of endowments, which can be ranked by 2009 values, also incorporates information from 21 in Canada, but their results were not part of the analysis. The database shows changes in endowment values, which are affected not only by investment returns but also gifts and spending.)

Nacubo does not make public the investment returns of individual colleges, nor specifics on other factors that affect endowment values, such as spending and donations, but it publishes some of those data in aggregate, along with information on investment performance by asset class.

Sixty percent of responding institutions in the final survey reported a decline in giving in 2009, versus 26 percent that reported an increase. The median decrease was 45.7 percent.

For all institutions, the average endowment spending ratea figure calculated by dividing the amount of endowment funds spent by the value of the endowment at the beginning of the fiscal yearwas 4.4 percent. That was a slight increase over the 4.3 percent reported the previous year.

Because the spending rate is affected by the value of the endowment, a higher rate following a year of declining endowment values does not necessarily reflect a decision to expend more in actual dollars, just as a lower rate in a period of rising returns isn’t necessarily because of a decision to spend less.

The study found, however, that in the 2009 fiscal year, 54 percent of respondents chose to increase their actual spending even as the value of their endowments declined. The total amount expended from endowments was $13-billion in 2009, up about 10 percent from $11.8-billion in 2008.

Forty-three percent of respondents said their spending rate, which guides how much they withdraw from their endowments, had increased while 25 percent said it had decreased.

Rising Debt

As investment income decreased, debt grew, particularly among the wealthiest institutions. For the 654 institutions that reported carrying long-term debt, the average debt load grew to $167.8-million from $109.1-million, an increase of nearly 54 percent. The study notes that much of this was driven by the higher debt loads of institutions with endowments valued over $1-billion and by public universities. While the average debt level rose, 56 percent of institutions actually decreased their debt load compared with 35 percent that increased it.

Rich institutions borrowed sizable sums in 2009 to satisfy their previous commitments to invest in private-market deals, to keep construction projects on track, to satisfy the collateral requirements of some of their complex financial arrangements, or, as was the case at Princeton, to finance general operations without having to sell off other holdings at a loss to come up with the cash.

Some also chose to take advantage of low interest rates. For those who qualified, this was a great time to borrow, said Mr. Walda.

The full report on the 2009 Nacubo-Commonfund Study of Endowments will be available in February. For details see the Nacubo Web site .