Average Directional Index Indicator

Post on: 16 Март, 2015 No Comment

Today we cut open the Average Directional Index, a well known tool in the indicator trading community.

The Average Directional Index is abbreviated ADX for short.

We are ripping open the Average Directional Index to discover what are the driving components inside this indicator that make it go. We will also discuss why traders may choose use it in their trading systems and how we can do better with price action trading techniques.

But first, it’s important to know that the Average Directional Index is actually built on top of the DMI Indicator, so before we move on with the Average Directional Index autopsy, it’s important that you’ve first read and understand the Directional Movement Index Autopsy. otherwise this report will may confuse you more than a chameleon stuck in a bag of Skittles.

What does the Average Directional Index do?

With the DMI in the main driver’s seat here, there are going to be some similarities between the DMI and ADX. Due to this tight relationship, the two indicators are generally bundled up together in the same indicator package.

You will generally find the bundled package listed under the ADX indicator in your charting terminal’s indicator list. When you load the Average Directional Index indicator onto your chart you’re going to be asked for the input period.

Like most indicators the input period is how many candles are passed into the guts of the indicators core algorithm for data processing.

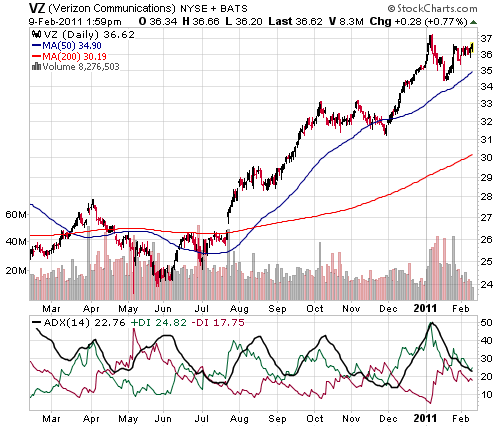

When you load up the Average Directional Index indicator youre going to end up with a display similar to this.

The Average Directional Index opens up in its own separate indicator window and displays 3 lines.

This is an oscillator based indicator so the values of these outputs range between 0-100, anything down near 0 is a weak value and anything up towards 100 are strong values.

You will notice the familiar +DI and -DI values, these are the outputs from the original Directional Movement Index. The new Teal output is the ADX value that we are going to be focusing on in this report.

How is the ADX used in the markets?

The Average Directional Index is a momentum indicator; this means traders will use the value of the Average Directional Index output to determine trend strength, or try to spot an emerging trend by increasing ADX levels.

Traders must remember that the Average Directional Index value is an absolute value; this basically means that it will never go below zero. So it doesnt matter if the charts trending up or down, the ADX will still output a positive figure.

Notice how the ADX doesnt care if the chart is falling or rising in the chart above, the Average Directional Index always remains positive. The main function of the ADX indicator is to quantify the trend’s strength with a number.

Even though the ADX’s oscillating range is between 0-100, the Average Directional Index generally prints values between 10-60.

ADX analysis believe values under 20 indicate a weak trend, whereas higher reading around the 40 mark indicator a fairly strong trend. When the ADX prints value up near 60 you’re basically looking at a runaway freight train.

Above is a visual representation on how traders generally relate the Average Directional Index values to the market. Basically anything over 20 is meant to indicate building momentum and signal ‘it’s ok to trade’.

We had a look around and found a consistent simple Average Directional Index trading strategy that the ‘ADX gurus’ are recommending. Traders must wait for the ADX line to climb from under 20 and cross over.

Go long if the +DI is above the -DI line.

Go short if the -DI is above the +DI line.

The Average Directional Index crossed the 20 trigger level and signals a buy trade. The market eventually pushed upwards in line with the signal.

Let’s have a look at a short trade example using the 20 trigger line.

When the ADX line crossed the 20 level this time the -DI was above the +DI so a sell signal was triggered.

We now have a general understanding of the ADX, what it’s used for and how traders are applying it to the market.

Now it’s time for the fun part, where we cut it open and reveal what’s actually the driving force of this indicators operation.

The Autopsy

As we stripped down the layers of the Average Directional Index for a full analysis, we noticed that there were two other integrated systems which we were already familiar with.

The Directional Movement Index and the Average True Range indicators are interconnected with a few other bits and pieces to make up the ‘ADX system’; it’s almost like a Frankenstein Indicator.

The main formula that calculates the ADX output is as follows…

ADX = 100 * EMA of the abs(( +DI -DI ) / ( +DI + -DI ))

So it’s pretty easy to see what this formula does right? Can anyone explain to me what’s going on here?

Sigh… Ok let’s break down the formula.

What weve basically got here is 3 separate formulas and some moving average calculations mashed into a mathematical monstrosity.