Auto Sales Nowhere to Go but Up

Post on: 28 Апрель, 2015 No Comment

Hurting from the recession and bankruptcy talk about General Motors (GM ) and Chrysler. automakers were nevertheless upbeat in reporting March sales 37% lower than the same month a year ago, according to Autodata. That’s because sales picked up from a dismal February, and the automakers generally feel they have hit bottom and may be starting to limp back to normal selling rates.

March sales for the industry were 24% over February sales. This may be the first signs of life we have been looking for, says Mark LaNeve, head of sales and marketing at General Motors, whose chief executive stepped down this week at the request of President Obama as the White House considers lending more money to GM. Maybe these are seeds we can nurture to grow, said Chrysler Vice-Chairman Jim Press about the better-than-expected results. GM sales were down 45%, and Chrysler’s were down 39.3%.

A question facing both executives is whether a slightly improved month will be a prelude to a bloodbath in April. The White House has given Chrysler 30 days to make its case for more loans to keep it afloat. And it has given GM 60 days. Obama was emphatic this week that a quick Chapter 11 is possible for GM, assisted by the government, but that Chrysler’s only hope of survival lies with a deal being cut with Italian automaker Fiat, not the U.S. Treasury.

All this talk about bankruptcy and the government having to guarantee warranties for GM and Chrysler has got to scare off a lot of would-be car-buyers.…There are so many choices out there that don’t involve bankruptcy, which most consumers don’t understand, says independent marketing consultant Dennis Keene.

But GM’s LaNeve, for one, believes April sales may be even better than March despite the bad news and bankruptcy chatter. I think it’s very encouraging that we are down 45%, about equal with the whole industry, says LaNeve, who thinks car buyers who are skittish about buying a GM vehicle have already made their decision. It’s not like we are down 70% and others are down 20%.

Declines Were Widespread

The pain is felt far beyond Detroit. Toyota (TM ) and Honda (HMC ) reported sales down 39% and 36%, respectively. Nissan (NSANY ) was down 38%. Kia sales were practically flat, down less than 1%. Luxury car makers, which tend not to suffer as much in a recession as mass-market brands, fared a little better. Audi sales were down 19%. Mercedes-Benz (DAI ) was down 25%. BMW (BMWG ) was down 24%.

Ford (F ), which has been spared negative publicity because it has not taken government loans and has not been a part of any bankruptcy talk, reported sales down 41%. But the company reported that its share of retail sales—those made to consumers rather than to government and rental fleets—was up to almost 14%, compared with 13% a year ago. And that was despite Ford dropping its incentive spending by $1,000 per vehicle since the end of last year.

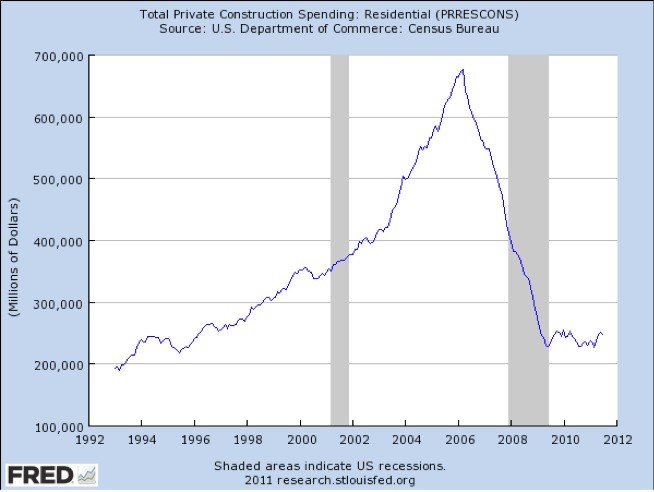

We think we’re getting close to turning the corner, said Ford’s senior U.S. economist, Emily Kolinski Morris. She cited a slight uptick in the University of Michigan’s consumer confidence index, as well as a firming of housing values and an increase in the stock market in March. History, Morris says, shows that better auto sales may follow sustained stabilized economic indicators in about three months.

Ford’s global sales and marketing chief indicated that the automaker may be benefiting from decreased consideration of GM and Chrysler amid so many negative headlines. Consumers considering Ford, he said, were up 12% in March.

New Marketing Tactics

GM and Ford this week introduced marketing programs aimed at consumers who have stayed away from car dealerships because they are concerned about the economy or their own job security. The programs—billed as GM Total Confidence, which runs at least through the end of April, and the Ford Advantage Plan, which runs through June 1—cover monthly payments for buyers who lose their jobs. GM’s offer also helps buyers trade in or sell their vehicle at least three years later by covering any gap between the vehicle’s value and the outstanding loan balance. It is meant to quiet fears that the value of GM’s cars will drop faster than those of its rivals.

The programs are similar to one that Korean automaker Hyundai (HYMOF ) began in January. Hyundai sales were down just 4.5% in March.

Sales were also helped by increased cash incentives on vehicles. The average incentive on a vehicle sold last month was $3,169, up 30% from a year earlier, according to Edmunds.com. GM and Hyundai spent more on incentives than they ever have.

The federal government and Congress are considering a program that would add another $3,000 to $5,000 of incentive money for people who trade in vehicles older than eight or nine years for more fuel-efficient vehicles. Estimates from GM and Ford are that such a program could increase industry sales by 700,000 to 1.5 million in the next 12 months, if it passes Congress.

Kiley is a senior correspondent in BusinessWeek ‘s Detroit bureau.