Attribution Analysis for Gauging Mutual Fund Risk Financial Web

Post on: 11 Апрель, 2015 No Comment

Attribution analysis is a valuable, sophisticated tool used to evaluate the performance of a mutual fund and the fund manager. Here are the basics of attribution analysis.

What Is Attribution Analysis?

Attribution analysis is a system designed to reveal the impact of a fund manager’s investment decisions. It looks at the overall investment policy of the fund and determines whether the fund manager adhered to that policy. It also looks at the asset allocation decisions of the fund manager as well as which securities the manager chose. It even takes into consideration the active management level of the portfolio. This provides an overall picture of how the fund manager did over a certain period of time and helps an investor determine whether to stick with the fund or liquidate the shares.

Who Uses Attribution Analysis?

Attribution analysis, although a valuable tool, is not utilized by every investor. Traditionally, it is used by institutional investors. It requires very detailed information to be analyzed and can take a great deal of time. Individual investors often do not have the knowledge or the time required to complete this process.

Investors use this strategy to determine whether their money is being well spent. Managing a mutual fund costs money. Investors want to know what sort of results the management they are paying for is netting. Attribution analysis allows the investor to determine if a fund manager is doing the job well or whether it is best to turn elsewhere for investment needs.

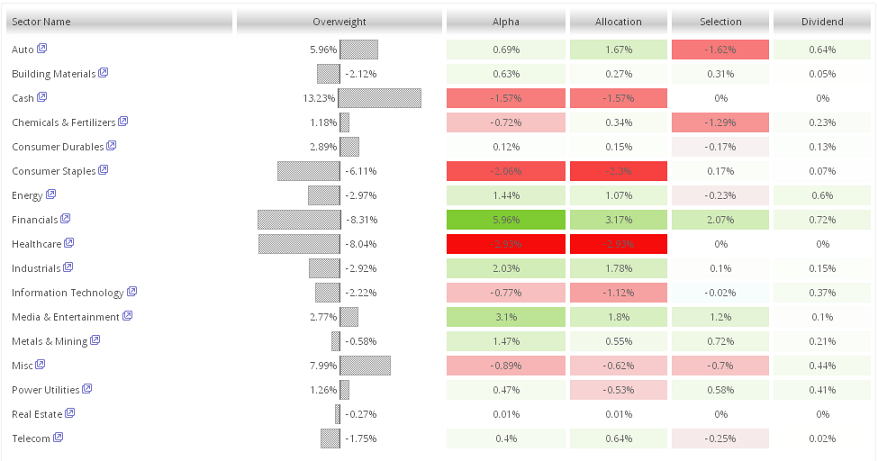

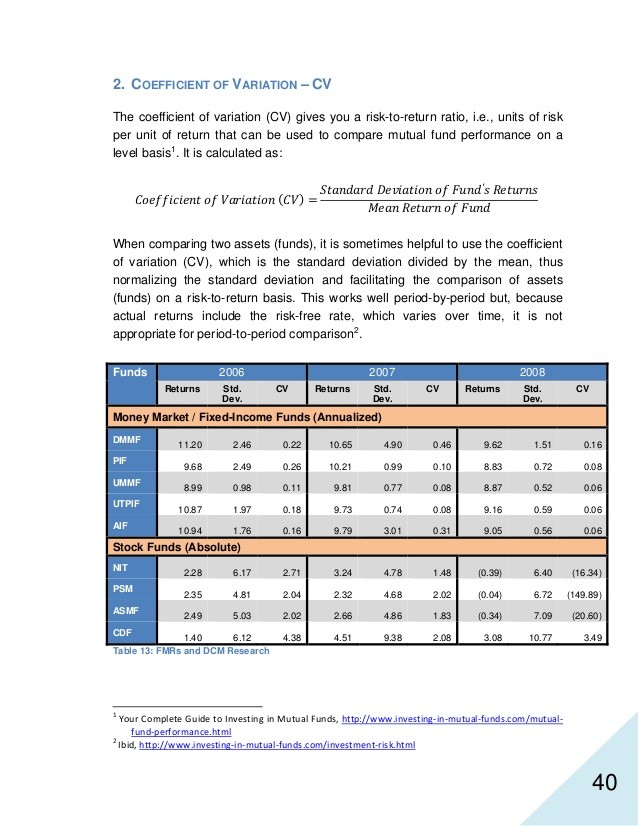

Asset Allocation

One of the most important factors in attribution analysis is asset allocation. Many studies have shown that this is the most important factor in the success of a mutual fund. The success of the mutual fund is not necessarily determined by which securities are chosen to make up the fund. However, the way that the assets are allocated within the fund plays a vital role in the way that the fund performs overall.

For example, during an economic downturn, one fund manager might liquidate 30 percent of the stock holdings and keep cash in the fund. Another fund manager might keep all of the stock holdings and end up losing a significant percentage of the portfolio for the investors. In that case, the fund manager who decided to hold cash instead of stocks would have served mutual fund investors better.

It is these types of decisions that are analyzed by the attribution analysis process. Looking at these things can help an investor determine a fund manager’s decision-making abiliities and whether to stick with that manager.

$7 Online Trading. Fast executions. Only at Scottrade