AssetBacked Security

Post on: 11 Октябрь, 2015 No Comment

An asset-backed security (ABS) is a fixed income instrument structured as a securitized interest in a pool of assets. The 2010 Dodd-Frank financial reform act broadly defined asset-backed securities to encompass all securitizations:

a fixed-income or other security collateralized by any type of self-liquidating financial asset (including a loan, a lease, a mortgage, or a secured or unsecured receivable) that allows the holder of the security to receive payments that depend primarily on cash flow from the asset, including (i) a collateralized mortgage obligation; (ii) a collateralized debt obligation; (iii) a collateralized bond obligation; (iv) a collateralized debt obligation of asset-backed securities; (v) a collateralized debt obligation of collateralized debt obligations; and (vi) a security that the Commission, by rule, determines to be an asset-backed security for purposes of this section.

Traditionally, finance professionals have used the term more narrowly to refer to securitizations other than mortgage-backed securities (MBS). When collateralized debt obligations (CDOs) and collateralized bond obligations (CBOs) became popular in the early 2000s, they too were excluded from the definition. For the most part, asset-backed securities are understood to be securitizations of auto loans, credit card receivables, home equity loans and student loans.

Asset-backed securities have credit risk . Diversification of the underlying assets, credit enhancements or tranching can mitigate this. Following the 2008 financial crisis. asset-backed securities didnt suffer nearly the credit losses that MBSs did.

Asset-backed securities can be subject to prepayment risk. but this is slight compared to that of MBSs. Consumers are more likely to refinance a home than an auto in response to a drop in interest rates.

Asset-backed securities are appealing to issuers because the structure allows them to get assets off their balance sheets, freeing up capital for further receivables. However, the Dodd-Frank Act requires issuers of all securitizations to retain some of the credit risk of those instruments. Asset-backed securities do make it possible for issuers whose unsecured debt is below investment grade to sell investment grade debt.

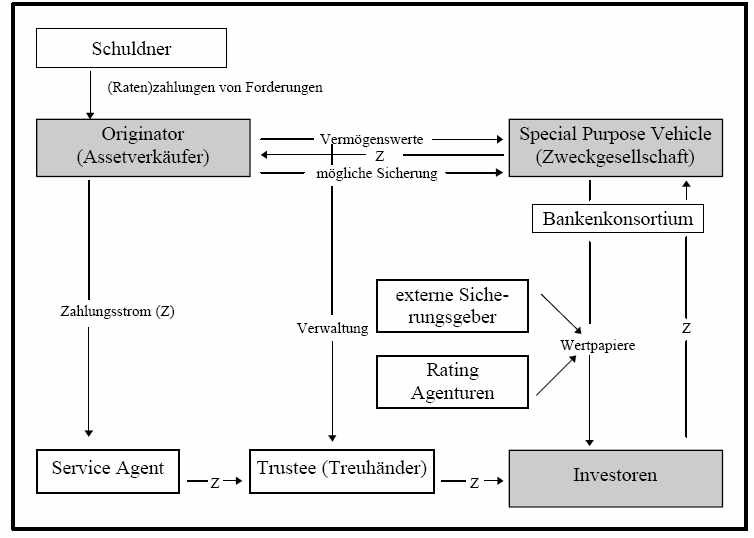

To create an asset-backed security, a corporation creates a special purpose vehicle to which it sells the assets. While is is common to speak of the corporation as the issuer of the asset-backed security (we do so above), it is legally the trust or special purpose vehicle that is the issuer. It is the trust or special purpose vehicle that sells securities to investors.

To protect investors from possible bankruptcy of the corporation, there are three legal safeguards:

- Transfer of assets from the corporation is a non-recourse, true sale.

- Investors receive a perfected interest in the assets cash flows.

- A non-consolidation legal opinion is obtained certifying that assets of the trust or special purpose vehicle cannot be consolidated with the corporations assets in the event of bankruptcy.

These same safeguards allow the corporation to remove the assets from its balance sheet. The corporation generally continues to service the assets—collecting interest and principal payments, pursuing delinquencies, etc. It is paid out of asset cash flows for providing these ongoing services. For investors, asset-backed securities are an alternative to highly-rated corporate debt. They generally offer similar or superior liquidity. Because the underlying assets are diversified, they are less subject to credit surprises. asset-backed securities can be structured into different classes or tranches. much like collateralized mortgage obligations (CMOs). There may be senior or subordinated classes of debt, which have different credit ratings. Tranches may be structured with different average maturities. Choice of structure depends upon investor demand as well as the nature of the underlying assets.