Asset Allocation or Why Your Advisor is Failing You The Hard Trade

Post on: 16 Март, 2015 No Comment

Written June 24th, 2009

Earlier this week, we posted a piece by James Montier on the Efficient Market Theory (EMT) and where it has led us astray. Let us now go deeper into the implications of EMT for financial advisors and clients.

With EMT as our backbone, the advisory industry has been able to sell seemingly scientific – and certainly mathematical – approaches to asset allocation. Clients often fill out questionnaires or sit with advisors, discussing investment horizon, risk tolerance, liquidity needs, etc. Then the advisor goes into the laboratory and plugs in some characteristics into an off-the-shelf software or a home grown asset allocation model and comes out with an efficient frontier. Most programs also come out with charts, statistics, and qualifiers, such as “an 80% probability of achieving between $XX assets and $YY assets in 20 years”. In fact, here is one software packages description with the name omitted:

SampleAllocationModel is a state-of-the-art asset allocation and portfolio optimization software. It provides an investor with advanced tools to successfully tackle major problems of quantitative portfolio management: parameter uncertainty, nonnormality of returns and uncertainty in investors preferences. The analytical methods adopted include the Black-Litterman model, several Shrinkage Estimates, Robust Optimization, Walk-Forward Optimization, Target Shortfall Probability Minimization, and many others. At the same time, SampleAllocationModel is the only professional product in the market, affordable to individuals. It combines highly advanced and innovative analytics with a user-friendly, intuitive interface, perfectly suited to any level of expertise and experience.

It sounds incredibly impressive, and based on the EMT, this kind of product would certainly lead investors down the path of diversification between different asset classes along the efficient frontier. The implications of the EMT are not limited to individual investors and advisors. Large pension firms use the same methodology to achieve their efficient frontier and allocation. They use state of the art consulting firm to help them categorize, diversify, and hedge different risks. Just as importantly, the advisors love to use these models because it transfers accountability to “the market”, to “the long term”, to “anyone but me”. No advisor wants to leave out an asset class (citing diversification, but feeling like the asset might go up). In the end, however, Keynes was right when he stated, “It is better to fail conventionally than to succeed unconventionally,” and the EMT gave advisors the intellectual framework to fail conventionally.

The intellectual framework of the EMT rested three main elements: defining return as some “average return” over a long period, defining risk as volatility, and using historical correlations between asset classes. Let us start by critically examining these foundations:

Every advisor warns clients that “historical returns are not indicative of future returns”. Yet, the models advisors utilize predict future returns based on historical returns. For most advisors, that actually seems appropriate, alongside their recommendations to invest in last years star mutual fund. Models rarely take into account forward looking return projections based on fundamentals. In statistics there is a saying to draw attention to the dangers of averages: if your head is in the oven and your feet are in a bucket of ice, on average, you’ll be fine. The reality is far from it. Using historical returns fails to consider limitations in the data, the disparity of returns, and factors influencing returns.

That’s where risk is supposed to come in. Risk under the EMT focuses on distribution. Assuming that returns are normally distributed (a false assumption), risk measures the standard deviations based on historical volatility (again, a false methodology). Risk should help clients and advisors minimize the chances of permanent loss of capital. It should help clients recognize that risk is often NOT rewarded. In fact, under the EMT, the more risk the better, just increase your investment horizon. The number of errors in these assumptions has been widely discussed, yet the asset allocation models used by advisors and consultants continue to look at volatility and risk in the same light.

Lastly, we have correlation. Again, using historical correlations as stable (a false assumption), the EMT leads us to seek historically uncorrelated assets. In and of itself that’s fine, except that historical correlations fail to take into account the changing nature of correlation itself. This often happens just when you need diversification the most, such as in a down market when correlations often increase.

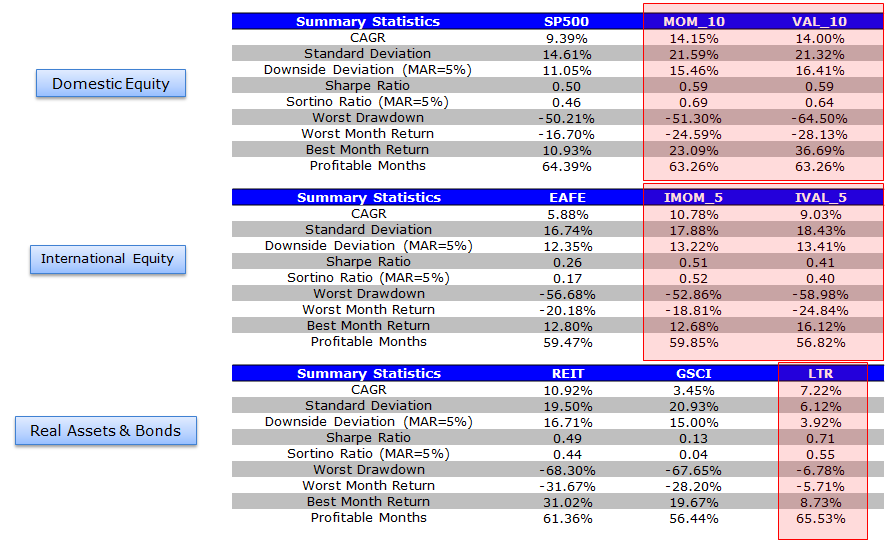

So where does that leave us? For starters, let’s recognize that the path we grew up on led us in the wrong direction. With this recognition comes the need for new tools. Asset allocation must move away from the “frontier” with an upward sloping trajectory (the more risk, the more return). Instead, valuation and price, confidence in NOT having exposure to overpriced assets, risk assessment based on permanent loss of capital and not on volatility, and a willingness to be critical and take a stand apart should drive our models and client interactions.