Asset Allocation is Dividing Assets to Minimize Asset Correlation

Post on: 21 Май, 2015 No Comment

by KenFaulkenberry

What is Asset Allocation?

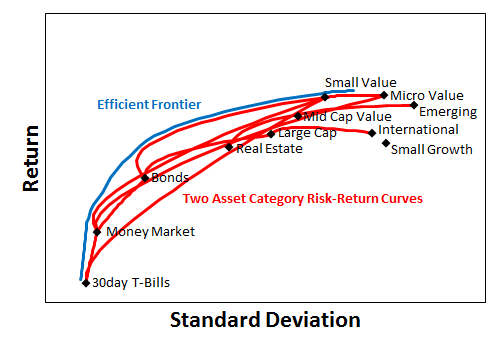

Asset allocation is dividing an investment portfolio on a percentage basis among different asset categories. The concept of an asset allocation portfolio is that when some asset categories are decreasing, others will be increasing. By combining assets with low correlation the volatility of the portfolio, as a whole, is lowered. This increases the importance of proper asset allocation in investment management.

Dividing Assets

Ecclesiastes 11:2

Divide your portion to seven, or even eight, for you do not know what misfortune may occur on earth.

There are many different ways of dividing assets. I have chosen 8 major asset categories as examples of categories an investor should consider as part of an investment portfolio:

Cash and Cash Equivalents

Cash provides an asset category with a zero correlation to most assets and provides preservation of capital in bear markets. The zero correlation makes cash an important asset allocation category even in periods of low interest rates.

Fixed Income

Fixed income examples include Certificates of Deposit (CD’s); U.S. Treasury Bonds, Notes, and Bills; Treasury Inflation Protected Securities (TIPS). Corporate Bonds, and Foreign Bonds – Historically bonds have had a low correlation with other major asset categories.

Domestic Large & Mid-Cap Stocks

Historically dividend income provides more than half of long term portfolio returns. Look for large and mid-cap stocks with solid balance sheets. and growing cash flow.

U.S. Small & Micro-Cap Stocks

Due to the difficulty of researching, and the higher risk of small and micro-cap stocks, investors should consider using ETFs. ETF’s provide a low cost means of diversification in the small and micro-cap stocks.

Foreign Developed Markets Stocks

The value of including foreign stocks is a greater universe of choices. In addition the correlation of these stocks might be lower than owning all domestic stocks, providing some additional diversification. Both individual common stocks and ETFs are appropriate vehicles for this asset category.

Emerging & Frontier Markets

The last couple of decades emerging and frontier economies have gravitated towards free market economics. This has tilted the developed markets or emerging markets debate in favor of more investment in developing emerging economies. Here again I favor using ETFs for investing in this asset category.

Precious Metals

Precious Metals have the advantage of a lower correlation with many other investments. They also can be very volatile, providing opportunities and risks.

Real Estate

Depending on the size of your portfolio, many investors who own real estate directly, including their home, may want to ignore this in their investment securities portfolio. The concept of owning different assets is diversification; and for many investors the real estate they own would be more than sufficient diversification. If not, Real Estate Investment Trusts (REITs) are readily available.

Minimize Asset Class Correlation

Asset correlation is important because a portfolio manager can combine asset classes to minimize correlation and lower the volatility of the portfolio as a whole. This allows the portfolio manager, willing to take a given amount of risk, to invest in higher reward/higher risk assets. This is called portfolio optimization.