Asset Allocation – How To Allocate Your 401(k) and Other Retirement Assets

Post on: 16 Март, 2015 No Comment

Objective Readers will be able to allocate retirement assets based on their individual goals, constraints, risk tolerance, and return objectives.

During 401(k) enrollment periods I often get asked about how investors should allocate and invest retirement assets. You know it is a good idea to “ pay yourself first, ” but when your 401(k) plan provides you with a variety of stock. bond. mutual fund. and cash-equivalent options, most investors become overwhelmed and confused about how to best allocate their money. The next few posts will help you. Though all situations are different, I will provide guidance regarding allocating and investing your retirement assets.

As discussed in “The Portfolio Management Process – How To Create An Individualized Investment Plan ,” determining how to invest your assets is influenced by a variety of individual factors pertaining to YOUR life. These factors include your return objectives, risk tolerance, financial goals, liquidity and lifestyle constraints, economic outlook, and time horizon. I cannot stipulate this strongly enough – You should choose your asset allocation and investments based on YOUR objectives and situation. There is no identical plan that works for every individual.

Asset Allocation, Not Security Selection

Today, I am not talking about security selection, or picking individual investments within an asset class. Also, the financial goal I am discussing is saving and investing for retirement, and not a down payment on a house, your kids’ college tuition, or other nearer-term goals. To allocate (or divide) your retirement money across asset classes, consider the following:

- Stocks –

- Stocks typically have had the highest historical return over long time periods, and tend to outpace inflation more than savings accounts and bonds. From 1962 to 2011, stocks averaged a 9.2% annual return. 1

- Relative to bonds and cash-equivalent investments, stocks have had a higher return. But, stocks also have had higher risk, or the potential for volatility and loss.

See the inset graph below for the performance of stocks (S&P 500), bonds (U.S. Intermediate Government Bond Index), short-term investments (U.S. Treasury Bills), and inflation (Consumer Price Index) over time.

Data Source: Ibbotson Associates, 2006 (1956–2005). Retrieved from Fidelity brochure, “Choosing Investments That Are Right for You.”

For this discussion, I will only discuss stocks, bonds, and cash-equivalents, including mutual funds that hold stocks, bonds, and cash-equivalents. A more sophisticated analysis and discussion would include commodities, international securities, real estate, private equity, hedge funds, and other alternative investments as part of the asset allocation process.

Goals, Return Expectations, and Risk Tolerance

Part of the portfolio planning process includes setting goals and understanding your risk tolerance. Given we are discussing retirement goals, you should have a target for your retirement nest egg. Typically, it is an amount that can provide you with 60-70% of your annual pre-retirement income in retirement, assuming a conservative annual return of 5-6% post-retirement.

Regarding your risk tolerance, there are no “one size fits all asset allocations.” Based on factors of the average investor, individuals tend to fall into broad categories such as the following:

- Conservative – This type of investor prefers capital preservation to significant growth in his or her investments. An allocation may represent 20% stocks, 50% bonds, and 30% cash-equivalents.

- Balanced – Low to Moderate – An allocation may represent 50% stocks, 40% bonds, and 10% cash-equivalents.

- Growth – Moderate to High – An allocation may represent 70% stocks, 25% bonds, and 5% short-term investments.

- Aggressive – This type of investor is willing to tolerate more significant volatility in his portfolio for the potential of a higher expected return. An allocation may represent 85% stocks and 15% bonds.

Asset Allocation The Age Formula

Once you have a grasp on your goals, risk tolerance, return expectations, and constraints, you must evaluate your time horizon. In this case, the time horizon is the number of years to retirement. For the average investor, there are formulas for estimating the allocation to stocks, bonds, and cash-equivalents based on this time horizon. As noted in the previous post, some experts recommend you should subtract your current age from 100 to arrive at the percentage of the assets that should be invested in stocks.

Typically, the longer time horizon the more risk you should be comfortable taking, and thus you should have a higher allocation to stocks relative to bonds and cash-equivalents. In general, an investor with a longer time horizon is more tolerant of the ups and downs of the market and investments, as he or she will have several economic cycles until retirement.

For illustrative purpose only, as each investor is unique, use Bankrate’s asset allocator calculator to exhibit how age impacts the asset allocation. Use the calculator to run the following two examples:

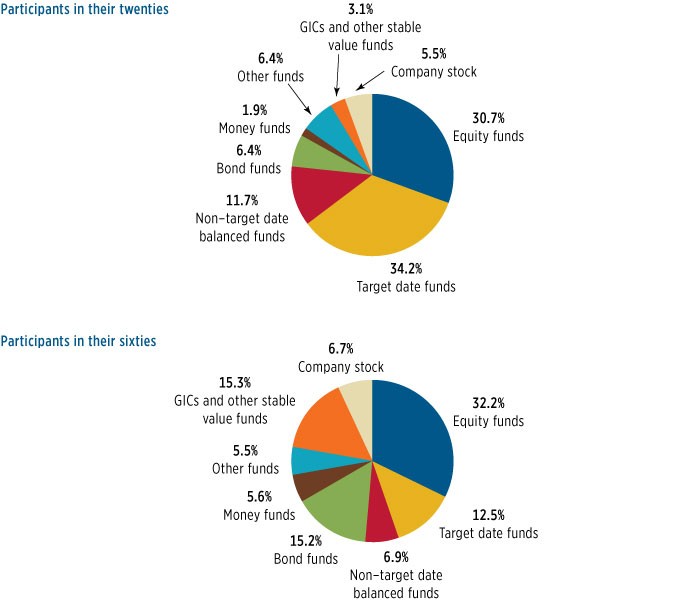

- 25 year-old saving for retirement – At age 25 he has current assets of $12,000, saves $5,000 each year, is in the 25% tax bracket, requires no income from his investments, has an average risk tolerance and an average economic outlook. The model suggests that he should allocate 83% to stocks (large, mid, and small cap, and international), 6% to bonds, and 11% to cash.

- 60 year-old saving for retirement – Assume he has the same details as above, but is age 60. By changing only the age and keeping all other factors identical, the allocation goes to 48% stocks, 19% bonds and 33% cash.

- The result – By only changing the age and keeping all other factors constant, the 60 year-old’s stock allocation decreased by 35%, the bond allocation increased by 13%, and the cash allocation increased by 22%.

Perfecting the Age Formula Asset Allocation

The age formula is only a starting point for determining an appropriate asset allocation, because it is giving a heavy weight to your time horizon, and assuming you are going to retire at age 65. These formulas imply a stock allocation based on age and make the following assumptions:

- If you have greater than 10-15 years until retirement, these formulas would suggest a higher allocation to stocks and a more aggressive mix, as you may be able to ride the ups and downs of economic cycles better. It would argue you should be focused on capital appreciation .

- If you are 5-10 years to retirement, these formulas would recommend a moderate balanced to moderate growth weight for your assets. There is less time to recoup losses and ride out market cycles as you approach retirement age.

- In retirement or near retirement, these formulas would suggest a conservative allocation. as you may be concerned with safety of principal, as opposed to higher growth and greater risk.

The problems using solely an aged-based formula include the following:

- All investors are not identical, as they have different constraints and factors.

- You could have a higher or lower risk tolerance than the average investor.

- The age formula would suggest someone that is 35 should be 65% invested in stocks (100-35=65).

- If an individual is conservative, he needs to adjust this typical allocation to align with his conservative risk tolerance.

- If an individual is more of a risk taker, he may adjust his stock allocation up moderately.

The Importance of Asset Allocation

As noted, the higher the risk implies the higher the potential return . If you underweight your allocation in stocks over the long term, and historical returns are realized, you will have significantly less in retirement assets than the average risk” investor of similar age. Allocate your assets to earn the highest return for your level of risk. When making your 401(k) investment choices, it is important to do the following :

1. Evaluate your retirement goals, including how much you want to have saved by retirement.

- To determine how much you need at age 65, use the Present Value Annuity Calculator .

- Estimate your annual income at age 65, and assume you will need 65% of that amount each year in retirement. This goes in the “Annuity Payments” cell. In this example, I use $25,000.

- Assume a 5% annual return in retirement, and put this in the “Annual Interest Rate” cell.

- Assume you will live for 25 years, and this goes in the “Payment Period” cell.

- It will provide how much money you need at 65 to meet your needs.

- Using $25,000 as the “Annuity Payment” necessary, a 5% “Annual Interest Rate,” and 25 years for the “Payment Period,” you would need $352,349 at age 65. (This ignores inflation)

2. Determine your risk tolerance and return objectives . Are you a conservative investor, moderate investor, or aggressive investor? What is your desired and required return to meet your goals? How does your desired and required return align with your risk tolerance?

3. Use your time horizon to estimate your asset allocation. Use an age based-formula or reputable asset allocation calculator to get an estimate for the percentage of stocks, bonds, and cash-equivalents for your portfolio.

4. Adjust step 3 for your individual constraints, risk tolerance, and return expectations . If you are risk-averse, you may want to revise down your stock allocation slightly, and invest more in bonds and cash equivalents. But, you must realize that based on long-term historical returns you may sacrifice returns for reducing risk.

5. After allocating assets, you must determine what mutual funds, stocks, bonds, etc. to buy within each asset class. Read through the prospectuses of mutual fund offerings and evaluate the performance and fees of the funds offered by your 401(k) provider. You can research and find the characteristics of the funds offered in your plan.

Asset allocation is a major decision, and it can be complex. The points made above are a general overview. Every investor is different, but these tools and this guide will give you necessary foundation before considering specific investments. The asset allocation decision is only part of the investment process, and I will discuss more details in the upcoming posts.

Feel free to-

- Post a comment below

- Tweet this article

- Like this post on our Facebook page

- Become a fan of the Personal Finance Teacher Facebook page . This will allow you to get posts in your Facebook feed.

- Follow me on Twitter @financefitz

- Enter your email into the subscription tab on the sidebar and this will direct future posts to your email

- Subscribe to the RSS feed by clicking the button at the top of the page

- Send in a question – see contact page

Upcoming post-

1. Name a few factors that influence your asset allocation?

2. Why is an Age formula only a starting point for choosing your asset allocation?

3. Review your current retirement investments. It will prepare you for the next post regarding investing your retirement assets.