Assess Shareholder Wealth With EPS

Post on: 14 Апрель, 2015 No Comment

Introduction

Firms may have different objectives to achieve. However in theory, a firm should set its’ objectives to increase its value for its owners. Shareholders are the owners of a firm. Therefore according to theory maximising shareholders wealth is the fundamental objective of a firm. (Watson & Head -Corporate Finance principles and practice 2007)

Investors generally expect to earn satisfactory returns on their investments as they require increasing the value of their investments as much as possible. This is usually determined by dividend payout and or capital gains by increasing the market value of the share price. The managers of the company act on behalf of the investors, such as operating day to day activities and making decisions within the business. In another way they do have the control of the business entity. However, firms may have other objectives to achieve such as maximising of profits, growth and increasing its’ markets share. When achieving these objectives of a firm, conflicts may arise as a result of ownership and control. Managers may make their decisions on their own interests rather than achieving investors’ wealth.

Discussing the investor related goals as described earlier, in theory behaviour of management should be consistent towards maximising shareholders wealth, enhancing the value of the business (Basely & Brigham- Essentials of Managerial Finance).Value of the business is measured by valuing firms’ price of shares. It’s essential to consider maximising of stock prices, and its’ impact to the investors and the economy as a whole simultaneously.

Maximising profits is also an objective of a firm. It is determined by maximising the firm’s net profits. It is also can be described as a short term objective whilst maximising the value of the company is a long term objective for a firm (Financial Management -Kaplan Publishers 2009). Therefore it is not necessary, maximising profits as maximising shareholders wealth because there are number of potential problems can be occurred adapting to an objective of profit maximisation. It will be discussed in the latter part of the report.

Earnings per share (EPS) is one of the main indicators of the firms’ profitability and it is a broadly used method measuring firm’s success, as it is determined return to equity in theory(Financial Management — Kaplan Publishers 2009).However, EPS doesn’t expose the firm’s wealth since it is determined by using firms’ net profits. Therefore EPS is also exist the same criticism as profit maximisation above which will be discussing in the later part of the report.

During the past ten years have seen a much greater emphasis on investor related goals. The conflict of ownership and control can be recognised as one of the significant causes which were affected investors and the world economy in the past ten years. The corporate scandals such as Enron, Maxwell and World com which occurred recent past had been lost investors confidence towards capital markets. Therefore it’s essential to consider the ethical behaviour and social responsibilities towards shareholder wealth maximisation simultaneously. It can also be said the institutional investors such as insurance companies and pension funds had also made a significant influence on investor related goals in the recent past.

Review of Literature

OBJECTIVE OF PROFIT MAXIMISATION

According to Watson and Head 2007, whilst individuals manage their own cash flows, the financial manager involves in managing cash flows on behalf of the company, and its owners. In a firm financial management is concerned with taking decisions in three key areas which are financing, investing and dividend policy. Watson and Head also mentioned, shareholders wealth maximisation as the primary objective of the firm and at the same time the existence of other stakeholder groups such as creditors, employees, customers and community are also affected when adapting to a corporate goal. However the firm may adopt one or several objectives in short term whilst it’s pursued the objective of shareholders wealth maximisation in long term(Basely and Brigham; Essentials of Managerial Finance). Therefore it is essential to be considered the other possible objectives in short term as well as long term simultaneously.

Reviewing one of the main objectives of profit maximisation, a classic article of Milton Friedman in the New York Times magazine 1970The social Responsibility of Business is to Increase its profits (Poitras, Geoffrey 1994). Considering classical views of Friedman (1970), Grant (1991), and Danley(1991), Geoffrey analysed the connection between shareholders wealth maximisation and profit maximisation, as an foundation for establishing an ethical analysis for shareholders wealth maximisation. However, Friedman had a moderate view later relating to the concept of profit maximisation towards social responsibilities. (Pradip N Khandwalla, Management paradigms beyond profit maximisation 2004)

While there were similarities between these two objectives, Solomon; 1963, chp.2 highlighted the inconsistencies in his classic article (Poitras, Geoffrey 1994). Considering the above views from different authors, Geoffrey’s suggestion was Even though there are significant consistencies between these two goals, the goal of profit maximisation has designed for the traditional microeconomic environment and for the firms which do not have the conflict of ownership and control. It is also assumed that it’s applied for the environment where there was no uncertainty and no stock issues( Poitras, Geoffrey, 1994).

According to Keown, Martin and Petty, 2008; Lasher 2008; Ross Westerfield, and Jordan; 2008, Managers are encouraged to maximise its current stock prices by the shareholder theory, therefore the criticisms are understandable. This approach determines the existence of agency problem towards incentive schemes, as incentives are rewarded with the continuous growth of share price and leads to an unethical behaviour of managers, towards manipulating the firms current stock prices (Daniel, Heck & Shaffer).

CONFLICT OF OWNERSHIP AND CONTROL

The conflict of ownership and control was first identified by Adam Smith (RBS Review 1937) and he suggested that the Director cannot protect the other peoples’ money with the same way that he protects his money (Tony & Howell; Shareholder ship model versus Stakeholder ship model). It’s also mentioned in Tony and Howell’s article, that the separation of ownership and control make a significant influence for corporate behaviour and it’s deeply discussed by Berle and Means (1932). But La Porta et al. (1999) argued against Berle and Means, and he suggested it’s different from the large corporations, because the shareholders of large corporations involved in corporate governance actively where managers are unaccountable (Tony and Howell; shareholder ship model versus Stakeholder ship model).

Winch (1971) suggested the goal of profit maximisation is consistent with the ethical theory of utilitarianism whilst allocating resources under different circumstances. (Poitras, Geoffrey 1994). Having considered Winch’s suggestion related to the utilitarian theory and profit maximisation, Geoffrey’s (1994) view was that, inter temporal behaviour is important for firms and efficient investment has a significant affect towards maximising of profits as a result of uncertain future cash flows. It is also discussed the potential conflict of ownership and control. Therefore Geoffrey (1994) suggested the separation of ownership, the decision makers (managers) and owners (shareholders) are involved to the corporate structure.

SHAREHOLDERS Vs STAKEHOLDERS

Even though most of the economists and authors acknowledge the theory of shareholder wealth maximisation (Berle and Means, 1932; Friedman, 1962), other authors argued the criticisms of shareholder wealth maximisation. They argued that Shareholder Theory encourages the managers to make short term decisions and behave unethically as a result of the influence of the other stakeholders. According to Smith (2003) believed Shareholder theory is prepared to maximise short term objectives at the expense of long term goals (Daniel, Heck & Shaffer; Journal of Applied Finance; winter 2008). However Daniel, Heck and Shaffer analysed the reasons for the criticism and the misguidance of the shareholders theory in their article about shareholder theory, How Opponents and Proponents Both Get it Wrong? The misguidance has been occurred as a result of pursuing a long term objective in shareholder theory. Managers should maximise the future cash flows and it’s important to consider the stakeholders accordingly (Jensen, 2002; Sundaram and Inkpen, 2004a). According to Freeman (1984) a firm should consider both shareholders and stakeholders when making their business decisions. However Daniel, Heck and Shaffer describes that the stakeholder theory determines the same criticism as short term behaviour but the shareholder theory has got the protection for both shareholders and stakeholders in the long run. Therefore stakeholder theory is not predominant to shareholder theory. Daniel, Heck and Shaffer suggested the expected future cash flows to analyse the above scenario and they argued that it’s essential to undertake all the positive NPV projects to maximise shareholders wealth analysing towards maximising current stock price. If there was a goal of increasing of current share price, managers who are rewarded by incentives may attempt to boost the stock price of the firm. However Jenson (2005) and Danielson and press (2006) argued the effort to increase or maintain the stock prices by management could be destroyed the long term values of the firm by manipulation, unethical behaviour, delaying NPV positive projects, reducing or not spending on research and development. Jenson has taken Enron as an example for explaining the above scenario. The management of Enron had hidden their debts through off balance sheet activities and by manipulating the company accounts (Daniel, Heck and Shaffer). Therefore Daniel, Heck and Shaffer suggested that it’s essential to design strategies which are consistent with the objective of increasing future cash flows rather than adopting an objective of increasing of current stock price to maximise the wealth of shareholders.

Freeman, Wicks and Parmar (2004) argued that all the recent business scandals are oriented toward ever increasing shareholder value at the expense of other stakeholders (Poitras, Jefforey; 1994)

After a number of high profile firms collapsed i:e: Enron, WorldCom and Arthur Anderson in US and Maxwell, Polly Peck, BCCI, Barings bank in UK, it’s been determined the requirement of a good Corporate Governance (Tony & Howell; the shareholder ship model versus stakeholder ship model). According to Tony & Howell, Corporate Governance has been growing for the past 25 years and the foundation for Corporate Governance was placed, after the introduction of Cadbury report in 1992 (UK). Omran et. al.2002; Mills, 1998; Fera, 1997 suggested the importance of Corporate Governance as a result of the new entrance of Institutional Investors to Capital markets, Globalisation of Capital markets, increase of Stakeholder and Shareholder expectations(Tony and Howell).

Analysis

According to financial management theory, it’s assumed that the fundamental objective for a firm is to maximise shareholders wealth (Watson & Head 2007). Analysing the suggestions and arguments towards fundamental objective, it can be seen that not only in theory but also in the real world it is essential to maximise the wealth of shareholder.

Analysing the objective of profit maximisation, overriding the classical economics views by Hayek (1960) and Friedman (1970), other authors, Solomon (1963) and Geoffrey (1970) argued about the criticisms associated with the objective of maximisation of profits. The conflict of short term goal of profit maximisation and long term objective of shareholder wealth maximisation can be identified as the main conflict. If a firm adapts to an objective of profit maximisation and the managers are rewarded incentives for achieving it, the agency problem could be arise. Therefore in such a situation managers may take decisions towards their own selfish interests, rather than on shareholders. Achieving their self interest managers may reduce costs by cutting research and development costs, reducing quality control measurements, reduce advertising, using lower quality materials. At the same time the NPV positive projects could also be postponed to reduce their costs to determine more profits in short term. Producing low quality products, losing market share, losing customer trust on their products and finally reducing financial performance could be resulted as a result of using low cost strategies. It may lead the business towards insecure stock prices in long run.

The other criticism is profit maximisation does not appraise the associated risks. Therefore managers may undertake higher NPV projects to determine higher returns. However higher the required returns, higher the risk (Peter Atrill; Financial Management for Decision Makers, 2008). Investing on risky projects will result future cash flow problems. However, shareholders are assumed as rational investors who provide finance for firms to invest in future projects. As rational investors they require a reasonable return for their investments. Therefore it can be suggested that objective of profit maximising is different from the wealth maximising.

Even though shareholder wealth maximisation is the fundamental, firms are not being able to reject the profit perspective goals, because there are stakeholder groups who is interesting about financial activities in a firm. In addition to shareholders, Managers, Employees, Customers, Suppliers, finance providers and the community at large are included in the typical stakeholder group. Therefore it’s essential to take account of profit maximisation within the firm. As a result of these multiple objectives managers can easily pursue their own interest.

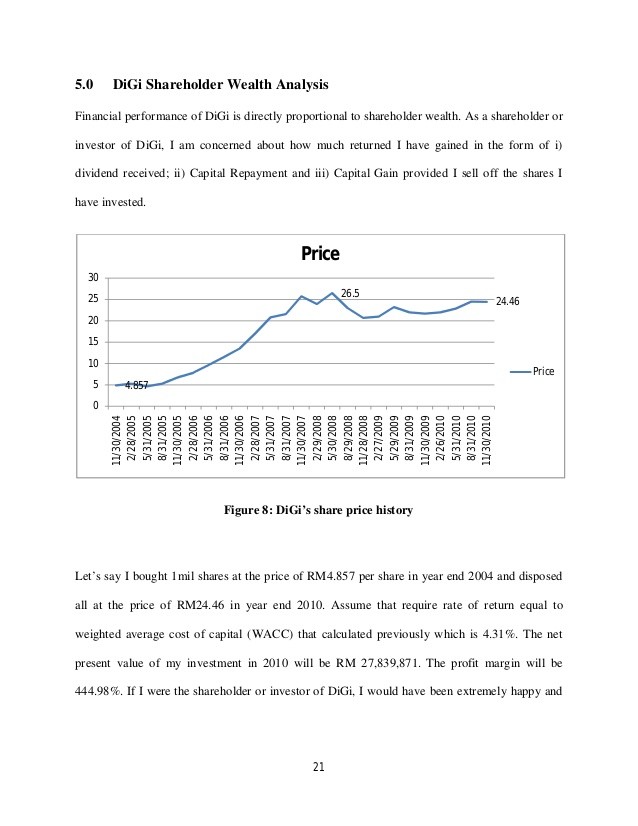

In real world, financial statements are used to assess firm’s performance. However, profits are defined as profit before interest and tax, profit after interest and so on. Therefore the ratio of Earnings per Share is often used instead of profit which is calculated using the net profits and the number of shares issued. Investors usually use EPS as a measurement of valuing stock. EPS is mostly used as it contains of net income of the firm, and it is also used as an indicator measuring firm’s future cash flows. Although the disadvantage is EPS does not determine shareholders wealth. However, firms value should be determined by the future cash flows and the risk also need to be considered which is associated to the cash flow. However as mentioned earlier, profits does not take account of risks. I:e:Reported profit figures such as Biotechnological companies and other new economy ventures have insignificant relationship on its stock prices (Financial Management -Kaplan Publishers, 2009). Therefore, in the short term there’s an inconsistence between profit maximisation and increase in stock prices in a firm.

According to Smith (1937), Berle and Means (1932) and Geoffrey (1994) the separation of ownership is involved the corporate structure. The conflict was mostly seen during the recent past, following the corporate scandals.

According to Maria and William in the article of Privatisation and the Rise of Global Capital Markets (Financial Management; winter, 2000) The past years there was significant growth in capital markets valuation, growth in security issuance as a result of the privatisation programmes. The impacts of share issue privatisation are increasing market liquidity, pattern of share ownership (i:e: Individual and institutional investors such as Pension funds and Insurance Companies), and increasing of number of shareholders in many countries. However, globalisation was also affected on firm’s activities simultaneously. Therefore the firms (i:e: Enron & Maxwell), which had poor Corporate Governance had the possibility to involving in unethical activities such as creative accounting and off balance sheet finance(Financial Management, Kaplan Publishers; 2009). At the same time Directors involved in high level of corporate takeover activities, achieving their personal interest such as empire building, large remuneration packages (Financial Management, Kaplan publishers; 2009).

Further analysis of Stakeholder theory and Shareholder theory by different authors, Jenson 2005) and Daniel and Press (2006) argued the criticism of stakeholder theory, whilst Daniel, Heck and Shaffer (2008) and Freeman (1984) argued the importance of both shareholder and stakeholder theory. However, it can be suggested that the stakeholders play a significant role towards increasing shareholders value. As an example to motivate employees of the firm, they should be treated in a good manner by rewarding increments, bonuses and so on. Long term employee satisfaction could drive the firm towards higher performance and the development of the business by increasing higher productivity and better quality of products. Simultaneously, building up a trust among customers and acquire and maintain the industry leadership.

At the same time shareholders provide finance for firms for its working capital management and noncurrent assets for its future projects. Therefore it can be seen an inter relationship and importance of shareholders and the other stakeholders.

According to Peter Atrill, (Financial Management for Decision makers. 2008)In the early years financial management theory was mainly developed as part of accounting and the suggestions and arguments were based on casual observations rather than theoretical frame work. But after the number of high profile firms collapsed, the requirement of corporate governance occurred. Number of committees met and discussed to improve the Corporate Governance and the main concern was the conflict between shareholders interest and managers. Enron was the seventh largest listed company in US when it’s collapsed in 2001 as a result of manipulation of financial statements. It’s affected to shareholders, more than 20000 employees worldwide, creditors and customers (Janis Sarra; St John’s Law Review ; Enron’s Repercussion in Canada). The 11 titled Sarbanes Oxley Act 2002

CONLUSION

By analysing the review of literature, it can be suggested that it’s essential to maximise shareholder value rather than maximising profits alone. However maximising profit is also can be defined as a performance measurement of a healthy business. Extremes of profit maximisation can also be caused unethical behaviour of management towards its shareholders and stakeholders.

Although, Earnings per Share inconsistent with the long term value of shareholder, its still can be used as a performance measurement, since its got firm’s net profit.

As a result of recent corporate scandals such as Enron, WorldCom and Arthur Anderson, shareholders and other stakeholder groups had given much emphasis on corporate behaviour. The unethical and illegal behaviour of those high profiled firms were lost investor confidence of capital markets. They identified the importance of Corporate Governance which provides the road map for managers to follow, pursuing different objectives towards the firm (Basley & Brigham). At the same time the arrival of Sarbanes Oxley Act 2002 provided investors a much more confidence and strength towards capital markets.

However, stakeholders are also important for firms. They are also treated well for the to maintain a Even there are conflicts between stakeholder theory and Shareholder theory, it’s necessary to balance these two theories.

According to Cathy Hayward’s article (Black — hole sums; Financial Management May 2003), during the period of May 2003 the pension funds in US and UK were in a bad condition. According to the assessment of National Association of Pension Funds, there was a drop in UK pension funds by more than Ј250 million in 2002. It’s being told that there were many reasons for the crisis but, the huge drop in stock market during the economic down turn 2000-2003 has mainly been affected. The pensions funds are heavily depend on the dividend payments and the stability of the equity markets, as a result of the drop in share prices the pensions funds struggled to meet their obligations.

References

- Besley & Brigham Essentials of Managerial Finance

- Daniel, Heck & Shaffer Journal of Applied Finance; Fall Winter 2008 — Shareholder theory, How Opponents and Proponents Both Get it Wrong?

- Denzil Watson & Antony Head Corporate Finance (electronic resource): principles and practice 2007

- Management paradigms beyond profit maximisation — Colloquium a debate by S K Chakraboty, Verghese Kurien, Jittu Singh, Mrityunjay Athreya, Arun Maira, Anu Aga, and Anil K Gupta.

- Maria K. Boutchkova & William L. Megginson Privatisation and Rise of Global Capital Markets. Financial Management; Winter, 2000, p31-76

- Peter Atrill Financial Management for Decision Makers 5th Edition 2008 (electronic resource)

- Poitras, Geoffrey Share Holder wealth Maximisation, Business ethics and social responsibility, Journal of Business Ethics; feb 1994;13,2;ABI/INFORM Global pg125

- Rebecca Stratling The Legitamacy of Corporate Social Responsibility ; Corporate Ownership and Control; Volume 4; Issue 4, Summer 2007

- Tony Ike Nwanji, Kerry E. Howell; A review of the two main competing models of Corporate Governance: The Shareholder ship model versus the Stakeholder ship model; Corporate Ownership and Control, Volume 5, Issue 1, Fall 2007

Struggling with your essay?

You can have your essay custom written to order by one of our experts. Plagiarism free, guaranteed grade, the perfect model answer.