Are Stocks Headed for 1970sStyle Stagnation

Post on: 23 Июль, 2015 No Comment

Bring your mind back to 1970.

Chevy’s Impala was America’s top-selling car, Layla by Derek and The Dominoes was the top of the charts and the stock market was doing great.

The S&P 500 index rose a respectable 9% during that year. By the following spring, the S&P 500 would tack on another 9%, and then. nothing.

From April 1971 until March 1980, the index would go on to plunge, rebound and plunge anew, finding itself right where it started — nine years later!

Sound familiar? This decade is off to a similar start. Is the market headed for a lost decade, or will it turn out like the 1990s, which began with a whimper but finished with a bang? Let’s look at the bull and bear forecasts, and then draw conclusions.

The Bear Forecast: Why the Market Will Look Like the 1970s

There are ample reasons to shun stocks at this point, including:

- Government debt is way too high, without any clear solution in sight.

It’s that last point that has the attention of many economists. The U.S. economy flourished in the 1950s and 1960s as our nation’s factories exported autos, major appliances (i.e. dishwashers, refrigerators, and so on), airplanes and early versions of today’s powerful computers. The U.S. held such a wide lead in terms of technological expertise that companies like GM (NYSE: GM ). Boeing (NYSE: BA ) and U.S. Steel (NYSE: X ) had few global rivals. That’s not the case anymore.

Yet the other negative factors really don’t hold as much water. Our government debt is indeed way too high, but corporate balance sheets have never been stronger. Yes our education scores are slipping, but we still have the most impressive and extensive university system in the world, which foreign students are applying to in increasing numbers. Our society is aging, but not as rapidly as in China, Japan and many European countries. And Europe, which looks ill right now, will eventually get back on its feet after a coming period of retrenchment that may last a year or two.

The Bull Forecast: Why the Market Will Look Like the 1990s

On the other side of the coin, there are many factors that could lead to a bright future for the U.S. economy and the market. Europe will always remain an appealing export market for U.S. goods and services. Companies like McDonalds (NYSE: MCD ). Procter & Gamble (NYSE: PG ) and Ford Motor (NYSE: F ) have had great success there, and they will in the future. But these companies are thrilled to note the global changes taking place beyond Europe.

From Brazil to Turkey, from Indonesia to Poland, new export opportunities are emerging daily. Coca-Cola (NYSE: KO ). for example, has just announced plans to invest $3 billion to expand operations in Russia over the next five years. In effect, the market for U.S. goods and services has expanded from a few hundred million consumers in the 1970s to more than one billion today.

The challenge is for these emerging trade partners to uncover the up-and-coming middle-class consumers. Whether it’s selling Big Macs in Sao Paolo, a Buick in Beijing, or a new Pizza Hut in Jakarta, that’s precisely what’s happening. Thanks to these global middle-class market opportunities, analysts expect construction-machinery company Caterpillar (NYSE: CAT ) to increase its worldwide market share by 23%.

The Main Difference between the 70s and Now

There’s another simpler explanation that investors have far more reason to be optimistic than pessimistic for the next decade — low inflation .

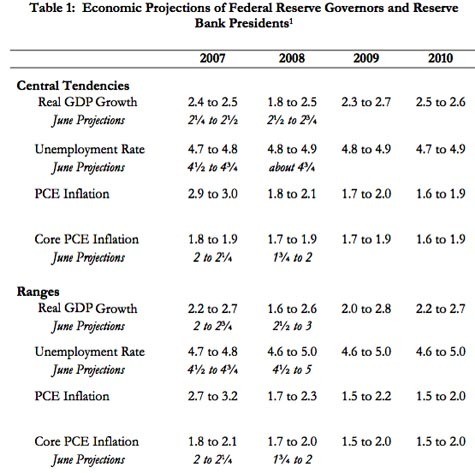

Stocks were a lousy investment in the 1970s because inflation kept rising. In 1973, it more than doubled to 8.8%. Later in the decade, it would jump to 12%. By 1980, inflation was 14%. Why would anyone during that time want to risk investing in stocks when risk-free bonds that kept up with inflation rates (called TIPS) would guarantee investors double-digit returns?

Fast forward to today. Inflation is low, so investors must either settle for low (but guaranteed) interest rates on bonds or take a chance in the ultra-volatile stock market.

[I recently touched on stocks vs. bonds in a low-inflation environment in a previous article ; it’s an important concept that I encourage you to read now if you haven’t done so yet.]

But it’s not just low inflation — there’s another crucial aspect of the current stock market climate that bodes well for investors. Even in a time when consumer confidence is low and our government’s debts are mounting, U.S. companies are in top shape, posting record profit margins and sporting record amounts of cash reserves. And many of these companies are trading at bargain prices only seen in times of extreme fear and panic.

The Investing Answer: There’s ample reason to think that the current decade has more in common with the 1990s than the 1970s.

For those that had the temerity to load up in stocks in the 1990s, when the economy was mired in recession. major profits were had. The S&P 500 was at 353 when the 1990s began, and by the end of the decade, it stood at 1,469. That’s a 400% gain. The coming decade is unlikely to deliver that kind of scorching return, but if history is any guide, a 100% gain can be reasonably expected.