Are Hedge Funds Worth the Risk

Post on: 16 Март, 2015 No Comment

Unfortunately, higher returns do not always follow when you assume a higher level of risk.

Posted on February 25, 2014 by Christian Mauser

Christian Mauser, CFP®

Financial Planner

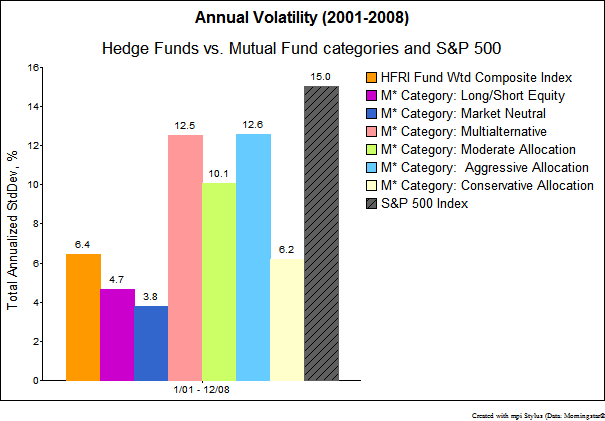

Hedge funds are companies that pool investors’ money and then reinvest the money, sometimes into complicated and high-volatility portfolios. The common goal of hedge funds is to outperform a stated benchmark – hopefully by a wide margin. This volatility, or risk, attracts investors who hope for a higher than average return.

Unfortunately, higher returns do not always follow when you assume a higher level of risk.

For example, let’s pretend that it is the beginning of the year and using my crystal ball I have hand-selected what will be the 100 top-performing large (over $1 billion in assets) hedge funds over the next 10 months. You are only allowed to pick one hedge fund for your investments.

What do you think the odds of picking a fund that will outperform the S&P 500 would be?

The answer: approximately 1 in 5, based on studies.

When looking through Bloomberg’s list of the 100 top-performing large hedge funds for the period ending October 31, 2013, only 18 of the funds with the S&P 500 index as their benchmark beat it, after fees. This means that if an investor selected randomly from just this list of top-performing funds, they would still have more than an 80% chance of underperforming the S&P 500 index – resulting in a smaller return on their investment.

On average, hedge funds are riskier and more expensive than the passive index investment and they do not, on average, perform better. In fact, based on 2013 data, hedge fund returns have trailed the passive index for the fifth year in a row.

When making the decision to invest your money, remember that high risk does not always mean high reward. Speculating investing in hedge funds with a shorter-term strategy, instead of investing with a long-term strategy, may not be the ideal method to maximize your investments.

Sources:

Lipper’s Fund Category Performance ending Oct. 31st

You’ve worked hard to save for retirement. How can you turn your wealth into an income that’s designed to last your lifetime?

Since 2002 Mark Eisenberger has been helping people just like you get answers. Simply call him at 717-560-3800 or 1-888-876-3437. He’ll answer your questions and, if you wish, can arrange for up to two hours of initial consultation with no cost or obligation and no sales pitch. He appreciates calls from readers of our website and is happy to talk with you.