Archived Financial Ratios

Post on: 16 Март, 2015 No Comment

Primary Reserve Ratio

A ratio that measures expendable resources is an important indicator of financial health and addresses the question — Is an institution financially healthy at a reporting date? The Primary Reserve Ratio is a reasonable measure of financial viability and a broad measure of the liquidity of the institution. Because this ratio measures expendable resources within the context of operating size, it is a measure of relative wealth or wealth against commitments of the institution. The Primary Reserve Ratio serves as a direct measure of an institution?s viability and an indirect measure of its liquidity.

In the short-term, substantial amounts of expendable capital can counter the effects of poor profitability or an inability to borrow. Likewise, insufficient expendable capital is a clear warning sign of poor financial health. Without sufficient expendable capital, an institution will be unable to meet its obligations (salaries, supplies, etc.) and could be forced into bankruptcy.

Expendable resources include all resources available to an institution in the normal course of business to satisfy ongoing business obligations. For all institutions receiving Title IV funds, this excludes net equity in plant, permanently restricted net assets, unsecured related party receivables and intangible assets.

Operating size is the total of all expenses incurred by the institution in the course of business. This would exclude expenses reflecting the cumulative effect of changes in accounting principles, extraordinary items, and discontinued operations (these represent one-time events and are discussed later in this chapter). Under the new AICPA Audit Guide for Not-For Profit Organizations (paragraph 12.05), most scholarships and other allowances which represent tuition discounts will be reported net of the corresponding revenue. In this regard, revenues from Title IV programs are not considered tuition discounts. A more detailed discussion of the accounting for scholarships and other allowances can be found in a December, 1996 discussion paper published by NACUBO entitled, Accounting and Reporting Scholarship Allowances to Tuition and Other Fee Revenues in Higher Education.

The Primary Reserve Ratio provides a measure of a school’s expendable or liquid resource base in relation to its overall operating size. It is, in effect, a measure of the institution’s margin against adversity.

Measuring expendable resources against operating size is significant because it is an institution specific measure. Operating size is a key financial data element because it is the best way to compare available resources against the impact of increased costs, educational activities, and commitments on current spending patterns. Total expenses is used as the measure of operating size in this ratio as opposed to total assets, revenue, or some other indicator because it represents actual obligations that the institution will likely have to meet again in the coming year. Depreciation expense is considered part of the operating size of an institution because it represents a charge to operations for use of the existing facility for operations. For non-profit colleges and universities, this charge replaces the actual cash outlays for equipment and repairs reported in the revenues and expense statement under the previous accounting model.

The relationship of expendable resources to operating size could be viewed as the length of time that a school could continue to survive, given current operational needs, without additional revenue or support. For instance, a ratio result of 1.0 or greater indicates that the school has sufficient expendable resources available to continue its operations for a full year without receiving any additional revenue and without selling off or borrowing against any of its infrastructure. It is important to note that this ratio does not assume that no additional resources will be forthcoming. It is only a measure of amounts in reserve in case of an adverse economic event (margin against adversity).

The logic for excluding net investment in plant (net of accumulated depreciation) is twofold. First, plant assets are sunk costs to be used in future years by an institution to fulfill its mission. Plant assets will not normally be sold to produce cash since they will presumably be needed to support on going programs. In some instances, there is a lack of ready market to turn the assets into cash, even if they are not needed for operations. Second, excluding net plant assets is necessary to obtain a reasonable measure of liquid equity available to the institution on relatively short notice.

In addition to excluding net plant assets from the Primary Reserve ratio; intangible assets, permanently restricted net assets, annuity and life income funds, and term endowments are excluded from expendable resources. Intangible assets generally represent amounts that are not readily available to meet obligations. The largest intangible identified in KPMG’s empirical testing was goodwill. Clearly there is not an established market for such assets (short of sale) and inclusion of a value for purposes of measuring liquidity would not meet the intended purpose of the test. Permanently restricted net assets (generally represented by endowment or trust agreements) are not expendable except in the event of some legal action, and therefore are not a part of the institution’s resources that are available in short order to satisfy obligations. Likewise, annuity funds and term endowment funds meet this same criteria and are not considered expendable. Liabilities related to post employment and post retirement benefits represent obligations that generally will not be due for very long periods of time. Their value has been added back to owner equity (net assets) in arriving at the numerator of the Primary Reserve Ratio since this methodology focuses on a significantly shorter twelve to eighteen month time frame.

Equity Ratio

Equity (Net Assets) Total Assets

The Equity Ratio measures the amount of total resources that is financed by owners’ investments, contributions, or accumulated earnings and how much is subject to claims of third parties. The ratio captures an institution’s overall capitalization structure (resources) and by inference, its overall ability to borrow. The ratio provides insight into the ability of the institution to access debt and capital in the marketplace. The ratio also helps answer the question; Is the institution financially healthy? For example, an institution with small levels of capital may have difficulty obtaining additional financing or handling its existing debt burden.

The Equity Ratio provides a measure of an institution’s ability to borrow and its capital resources.

Equity, for purposes of this ratio, represents the total equity of the institution, excluding intangible assets and unsecured related party receivables. Total assets are the total of all assets of the organization, excluding intangible assets and unsecured related party receivables.

The Equity Ratio, by measuring equity as a percentage of total assets, demonstrates the share of assets shown on the school’s balance sheet that the school actually owns. Thus, if any school has a large amount of assets but proportionately large amount of liabilities, the actual amount that the school owns is relatively small and the ratio will reflect that fact. Conversely, the ratio will positively reflect an absence, or relatively small amount, of liabilities because in those cases, most or all assets shown on the balance sheet will be available to support the school’s mission.

Indirectly the Equity Ratio provides insight into the capital structure of the institution and will indicate whether an institution has acquired a disproportionate amount of its assets utilizing debt. Excessive amounts of debt will adversely affect the ratio (produce a lower ratio result) and little or no debt will have the opposite effect.

It is important to understand when considering the utility of the Equity Ratio that it is not intended to provide a direct measure of the amount of resources or dollars at an institution’s disposal to meet obligations. For example, if an institution has what is considered a favorable Equity Ratio of .50 indicating that the value of its assets are twice that of its liabilities, one cannot necessarily conclude from this ratio alone that the institution has sufficient resources to fund its operations. Rather, the ratio provides a high level view of the institution’s overall capitalization. A favorable Equity Ratio may be an indication of greater commitment on the owners’ part since a greater percentage of their capital is at risk than in the case of a highly leveraged institution. Thus, the Equity Ratio is an effective tool in assessing an institution’s ability to borrow and overall financial condition.

While this methodology was being developed, some raised concerns that the relationship expressed by the Equity Ratio could be less than useful if an institution’s operating size was disproportionately large in relation to its asset base. The Equity Ratio measures the proportion of an institution’s assets that is not subject to claims by third parties so its utility is not related to operating size. Institutions that have a disproportionately large amount of their assets subject to claims of third parties will generally have to pay a premium when borrowing additional funds because they can’t offer collateral that isn’t already subject to claim. Private non-profit institutions with proportionately large amounts of permanent endowment funds (a condition measured by the Equity Ratio) have distinct capital resource advantages because these assets will, typically, produce predictable operating support. The Equity Ratio provides useful information in assessing institutions’ ability to borrow and capital resources which are fundamental elements of financial health.

In addition, the empirical data shows that institutions’ operating size, as measured by total expenses, is generally proportionate to the value of their assets. A hypothetical example was posed where an institution might have revenues, of approximately $100,000 and little or no assets, say $500. If this hypothetical institution had no debt, it might have a very favorable Equity Ratio of 1.00 even though it only had limited resources to support its mission. This hypothetical example presents an interesting theoretical discussion but the empirical data demonstrates that this hypothetical example is not realistic. Of the 507 proprietary schools sampled, five had a ten to one relationship of expenses to assets (adjusted for intangibles and unsecured related party receivables) and one additional institution was between eight to one and ten to one. All those schools had total revenues of less than $500,000. The proportion of expenses to assets for all other proprietary institutions was less than eight to one. In fact, approximately 60% of the proprietary schools had expenses no greater than twice their adjusted assets. In the non-profit sector, there was only one institution with a proportion of expenses to adjusted assets greater than ten to one. There were no other institutions greater than five to one. Over 97% the non-profits had an expenses to assets relationship of two to one or less. The relationships of the size of an institution based upon adjusted assets articulates very well to operating size (as measured by expenses) except in an insignificant number of cases with institutions that have revenues of $500,000 or less.

Finally, the concern that the Equity Ratio could be rendered useless by extremely large operating sizes provides insight into the way the three ratios, when viewed together, measure total financial condition. A large (measured by total expenses) school that has very limited dollar amounts of equity (net assets) would be unable to achieve a favorable Primary Reserve Ratio result.

Exclusion of Intangible Assets From Primary Reserve & Equity Ratios

Intangible assets are balance sheet items that have been excluded from the numerator of the Primary Reserve Ratio and numerator and denominator of the Equity Ratio because they generally represent amounts that are not readily available to meet obligations. Although this exclusion has a greater impact on institutions in the proprietary business segment since they are more likely to have material intangible assets like goodwill, intangible assets like patents, trademarks, and goodwill may also be found on the balance sheets of certain non-profit entities. Accounting Principles Board (APB) Opinion No. 17, Intangible Assets, defines intangible assets to specifically include patents, franchises, trademarks, and goodwill. Items such as deferred tax assets and liabilities, deferred direct response advertising costs, deferred enrollment expenses, and prepaid expenses do not meet the definition of an intangible asset in accordance with the APB Opinion No. 17.

The most common intangible asset is goodwill. Goodwill is the common name used to describe the excess of the cost of an acquired enterprise over the sum of identifiable net assets. The first challenge in deciding whether to include or exclude such assets from the ratios deals with valuation. Although some amounts on financial statements are estimates to varying degrees, goodwill valuation is particularly subjective. Since every business is somewhat unique, there is no established market and valuation therefore, is more susceptible to non-objective factors and would not be appropriate to consider for purposes of determining financial condition. Although less common than goodwill, other intangibles noted in our empirical testing like trademarks, franchises, covenants not to compete, and student lists, by their nature pose the same valuation problems.

In addition to the valuation issue one must consider the nature of the asset itself; that is, could schools sell the intangibles on their balance sheets to meet general obligations? In fact, if an institution finds itself in need of liquidating assets during the normal business cycle to meet obligations, an asset such as goodwill is likely to have little or no value at all since the business from which the goodwill arose probably lost its value in the marketplace.

Finally, in reviewing comparable financial responsibility standards from other industries, reduction in intangibles in calculation of regulatory equity is a generally accepted practice. Securities and Exchange Commission (SEC) Rule 15c3-1 specifically excludes the value of intangible assets in computing broker/dealers’ net capital.

Exclusion of Unsecured Related Party Receivables From Primary Reserve & Equity Ratios

Unsecured related party receivables are also excluded from the numerator of the Primary Reserve Ratio and the numerator and denominator of the Equity Ratio. Like goodwill, the availability of unsecured related party receivables is subject to a number of factors that substantially decrease ED’s potential to recover such assets in administrative proceedings. This issue principally arises in the proprietary sector where schools are often one entity in a commonly-controlled business group. As a result, various intercompany activities, including shifting cash from one entity to another, result in these types of assets. Because collection of such unsecured receivables and payables can be controlled by a group, and the program participation agreement and financial statement submission requirement are with the contracting institution, ED generally has no access to the cash supporting such an asset in the event of the school closing. In fact, ED confirmed to KPMG that they are unaware of any successful attempts to recover such assets. They further indicated that related party receivables are usually unrecoverable in bankruptcy proceedings and quickly written off by the trustee. If there is no bankruptcy, an unsecured loan to a related party would not be treated as an asset in evaluating whether to file suit against the corporation to recover an ED liability. Inclusion without further analysis increases the risk to the Title IV programs. The type of individual analysis that would be required to assess whether to include or exclude the asset would result in an unmanageable methodology for ED. Accordingly, we recommend excluding such assets in the determination of these ratios.

Again, as is the case with intangible assets, comparable financial responsibility standards in other industries like the securities and banking industries generally exclude the value of unsecured related party receivables.

Deferred Marketing and Other Accounting Issues

During KPMG’s empirical testing, we noted a significant number of other deferred items which significantly impact the quality of the assets reported in the financial statements for purposes of determining financial health. Because approximately 60% of the 507 institutions sampled had total assets of less than $500,000, these amounts when reported can have a significant impact on the conclusions reached with respect to any regulatory test. Deferred items we noted include deferred marketing costs, start up costs, program / curriculum costs, license costs, accreditation costs, development costs, relocation costs, closing costs and capitalized financial aid costs. In addition to its regulatory tests performed on these financial statements, ED should be cognizant of the recording of these assets in the financial statements and should make efforts in cases where assets are significant to determine whether the items meet the spirit of the published accounting literature. As one example, direct response advertising is now subject to criteria in the Accounting Standards Division — Statement of Position 93-7 entitled, Reporting on Advertising Costs. The criteria under this SOP are stringent as to the accounting support, in the form of customer logs and links to the advertisement, in order for the deferral to be recorded. Deferred marketing costs are one example of an accounting issue that ED should monitor and consider when making decisions about whether to include or exclude items to from the ratio numerators and denominators.

Net Income Ratio

Net Income

Total Revenue

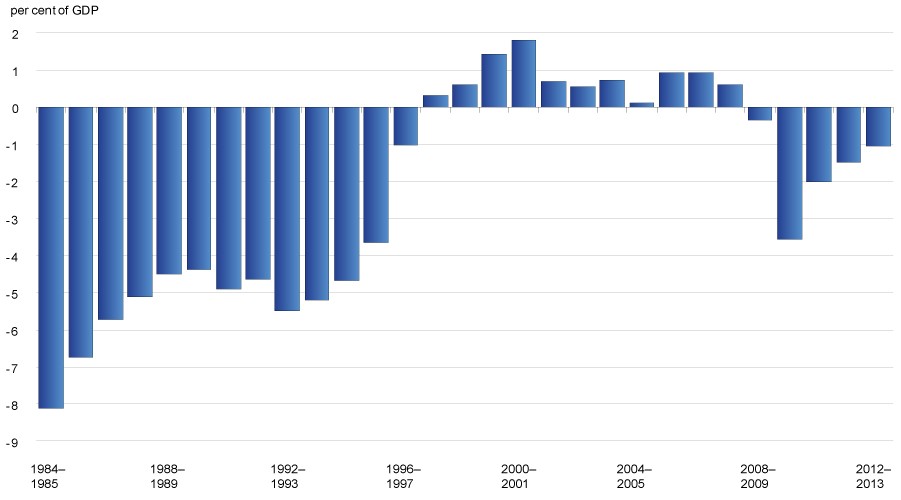

Profitability is one of the primary indicators of the underlying causes of a change in an institution’s financial condition because of its direct effect on resources reflected in the balance sheet of an organization. Non-profit entities, such as private and public colleges, must, at a minimum, break-even or generate surpluses over time in order to remain financially viable. As investor-owned entities, the primary goal of proprietary institutions is to generate an economic return. This ratio helps answer the question: Did the institution live within its means for the year being measured? Significant operating losses can impair the ability of an institution to continue operations.

The Net Income Ratio provides a direct measure of an institution’s profitability or ability to operate within its means. Continued gains or losses measured by the ratio will impact all the other fundamental elements of financial health over time.

Net Income is the total change in unrestricted net assets for private non-profit institutions and is pre-tax earnings for for-profit institutions. A non-profit’s change in unrestricted net assets represents the same element as net income for a for profit entity. Total revenues are all operating and non-operating revenues of the institution, limited to the unrestricted net asset category for private non-profits. Under the new AICPA Audit Guide for Not-For Profit Organizations most scholarships and allowances at private colleges and universities will be treated as discounts from revenue, not as expenses.

The numerator of the Net Income Ratio is calculated on a pre-tax basis to treat all institutions similarly. Non-profit institutions are generally not subject to substantial income taxes and proprietary schools may or may not have income taxes recorded on the income statement depending on their overall tax structure (e.g. subchapter C or S corporations). By calculating net income on a pre-tax basis, the methodology attempts to put all institutions on an equal scale.

Throughout this project, some raised concerns about the different ways owners can take capital out of a business (e.g. dividends, salaries, or management fees) and their effect on the calculation of net income. KPMG rejected the idea of adjusting net income to exclude the effects of owner compensation because such adjustments would add an inappropriate degree of complexity to the methodology. In addition, the necessary adjustments may not be readily obtainable from general purpose financial statements and would be subject to interpretation. Questions like Do fees paid to a specific related entity constitute owner compensation? would be difficult to answer uniformly and could make the methodology unnecessarily cumbersome.

In addition, net income for purposes of this ratio excludes the effect of extraordinary gains and losses, effects from any change in accounting principle, and gains or losses from discontinued operations. The methodology does not consider these items when analyzing profitability because they represent one time events and generally do not reflect operating results on an ongoing basis.

The Net Income Ratio measures the ability of an institution to live within its means in a given operating cycle. A positive ratio indicates a surplus or profit for the year. Generally speaking, the larger the surplus or profit, the stronger the institution’s financial position as a result of the year’s operations. A negative ratio indicates a deficit or loss for the year. Small deficits may not be significant if the institution has large expendable capital, but large deficits or losses are usually a warning signal that major program or operational adjustments should be made. Because of its direct effect on an institution’s resources, the Net Income Ratio is an important indicator of the underlying causes of a change in an institution’s financial condition.