APY Definition Calculations and Compare to APR

Post on: 16 Март, 2015 No Comment

Learning, Earning, and Calculating APY

Annual percentage yield (APY) is a tool for evaluating how much a deposit earns you — or how much a loan costs you. Why would you look at APY as opposed to APR? Because it is a standardized way of comparing investments. Your job as a consumer is to get the best deal. If you’re borrowing that means paying the lowest APY, and if you’re lending ( by depositing money in the bank) you want the highest APY.

As the name suggests, APY is the return on an investment over the course of a year. If you are the investor. it refers to your earnings – how much money you’re making. If, on the other hand, you are the borrower. it refers to the lender’s return — how much you pay them in interest (and possibly fees). Because we all want our money to work for us and grow, it is important to pay attention to APY.

What is Unique About APY?

APY is notable because it takes compounding into account. In very simple terms, compounding means making earnings on your earnings. This means that the quoted APY is telling you how much you’re really making on your money. Other ways of quoting a rate, such as APR, don’t necessarily show you the whole picture.

APR vs. APY

Annual percentage rate (APR) is similar to APY, but it does not take compounding into account. It is a simpler way of handling interest.

Unfortunately, is APY more accurate that APR in some situations (because it tells you what a loan really costs), but when you borrow money you typically only hear about the APR. In reality, you might actually pay APY – which is almost always higher with certain types of loans.

Credit card loans are a good example of the importance of understanding APR vs. APY. If you carry a balance, you pay an APY that is higher than the quoted APR. Why? Because interest charges are added to your balance each month, and in the following month you’ll have to pay interest on top of that interest (this is similar to earning interest on top of interest you’ve earned in a savings account ). The difference might not be huge, but there is a difference. The larger your loan and the longer you borrow, the bigger that difference becomes.

With a fixed rate mortgage. on the other hand, APR is accurate because you won’t add interest charges and increase your loan balance. For more information, learn about different types of APR .

How to Get the Best APY

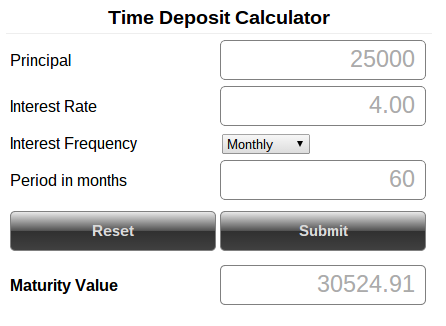

In general, you’ll find that the APY is higher for more frequent compounding periods. If you’re saving money in a bank account. find out how often the money is compounded. If your money is compounded daily as opposed to quarterly, you’ll be able to earn a better APY.

You can also pump up your own “personal APY”. Look at all of your assets as part of the larger picture. In other words, don’t think of one CD investment as separate from your checking account – they all go together and should be considered one. Think of yourself as the Chief Financial Officer of You, Inc.

To pump up your personal APY, find ways to make sure that your money is compounding as frequently as possible. If 2 CD’s pay the same interest rate, pick the one that pays out interest most often (if you’re using APY instead of interest rate. just pick the one with the higher APY because the calculation takes everything into account for you). For example, some accounts pay interest monthly, while some only pay yearly. Your interest payments will automatically be reinvested — the more frequent the better — and you’ll start earning more interest on those interest payments.

How to Calculate APY With Ease

Calculating an investment’s APY can be tricky. If you want to just find out what an APY is with Excel, here’s the function:

=POWER((1+(A1/B1)),B1)-1 where A1 is the Rate and B1 is compounding frequency.

Try pasting this formula into any cell on a spreadsheet (except A1 or B1). In cell A1 you’ll put the stated annual interest rate – in decimal format. For example, if the stated annual rate is 6%, you’ll type “.06” in cell A1. Then, you put the number of times you’ll compound each year. For example, for daily compounding you’d enter “365” (or 360 depending on the institution) in cell B1.

In the example I’ve used, you’ll find that the APY is 6.183%. In other words, if you get 6% annually with daily compounding, your APY = 6.183. Try changing the compounding frequency and you’ll get an idea of how the APY changes. For example, you might show quarterly compounding (4 times per year) or the unfortunate 1 payment per year (which just results in a 6% APY).

The APY Formula

If you like doing math the old fashioned way, here’s how to calculate APY:

APY = (1 + r/n ) n – 1 where r is the stated annual interest rate and n is the number of times you’ll compound per year.

Finance people will recognize this as the Effective Annual Rate (EAR) calculation.