Apple s Record Bond Issue (AAPL)

Post on: 8 Июль, 2015 No Comment

New issues in U.S. corporate bond markets topped $43 billion last week, with the action dominated by big issuers. Here are a few of the highlights.

3.85% notes due 2043

Source: Apple 424B2 SEC filing dated May 1, 2013.

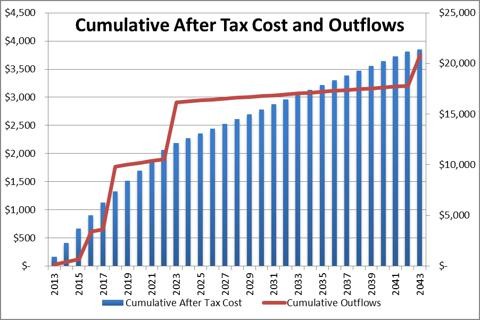

The money will be used for general corporate purposes, including repurchases of our common stock and payment of dividends under our recently expanded program to return capital to shareholders.

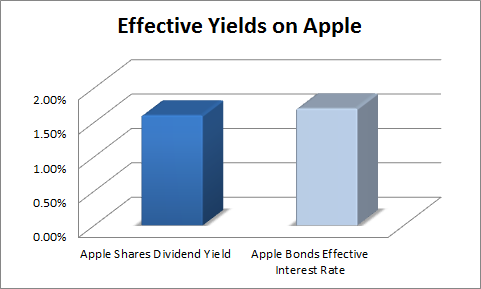

It may seem strange that a company with a large pile of cash on its balance sheet would borrow to finance dividends and share buybacks. but when much of that cash is offshore, borrowing can make more sense than paying taxes to bring the capital back to the U.S. CAPS player ikkyu2 posted a good blog write-up explaining why borrowing is a better deal for the company than repatriating the cash. Apple is essentially shorting bonds to buy its stock. Given the low rates on the bonds, investors might want to pass on the other side of that trade.

During an ordinary week, CNOOC ‘s ( NYSE: CEO ) four-part, $4.5 billion offering would have been the big deal. The money will be used to help repay a bridge loan that financed CNOOC’s acquisition of Nexen. If anyone still needs evidence that business is an international enterprise, the Chinese oil company borrowed U.S. dollars through its British Virgin Islands finance subsidiary to pay for the acquisition of a Canadian company.

Barrick Gold ( NYSE: ABX ) and its North American finance subsidiary dug up $3 billion over three issues. $2 billion pay down a revolving credit facility, $500 million will repay maturing notes, and the other $500 million goes to the ever-uninformative general corporate purposes.

IBM ( NYSE: IBM ) placed $2.25 billion split between three- and seven-year paper. The Use of Proceeds statement only listed general corporate purposes. A search at FINRA.org turned up four issues totaling more than $4.5 billion maturing over the next 12 months, so it’s a good bet that debt repayment will be the specific corporate purpose for the new money.

In the high-yield space, Constellation Brands ( NYSE: STZ ) popped the cork on eight- and 10-year paper totaling $1.55 billion. In this case, high yield is only 3.75% and 4.25%, respectively. The money will be used to help fund the company’s acquisition of the 50% of Crown Imports it doesn’t own, along with Grupo Modelo’s brands. The company will also be tapping credit facilities for about $3 billion in addition to this note issue to finance the deal.

Even with the big offerings from Apple and CNOOC, I think the low rates for high-yield deals are the most interesting part of recent new bond issues. Investors are bidding up the prices — which lowers rates — on these deals to the point where there isn’t much risk premium for the lower credit quality. The rates on the Constellation paper don’t leave much for either credit-rate or interest-rate risk.

There’s no doubt that Apple is at the center of technology’s largest revolution ever and that longtime shareholders have been handsomely rewarded. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool’s senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on reasons to buy and reasons to sell Apple, as well as what opportunities remain for the company (and your portfolio) going forward. To get instant access to his latest thoughts on Apple, simply click here now .

Russ Krull has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple and International Business Machines. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .