Apple Inc (AAPL) Should Listen To Warren Buffett s Advice

Post on: 23 Июль, 2015 No Comment

One recommendation that Warren Buffett gave Steve Jobs is that if he thought Apple Inc. (NASDAQ:AAPL )’s stock price was “cheap”, there was no better use of Apple Inc. (NASDAQ:AAPL )’s cash than buying back its own stock. Mr. Buffett not only gives this advice, he follows it, stating that he believes Berkshire Hathaway Inc. (NYSE:BRK .A) (NYSE:BRK .B) is worth at least 1.2 times its book value, he stands ready to buy Berkshire stock below that level.

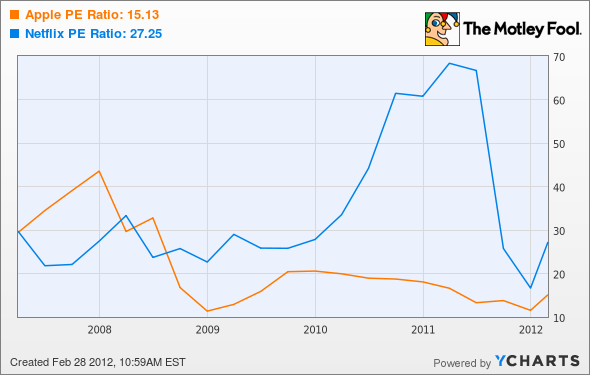

Research in financial economics suggests another reason why Apple Inc. (NASDAQ:AAPL ) should be paying attention to Mr. Buffett’s advice today. Stock prices serve as signals, not only for investors, but consumers as well. A collapsing stock price and a meager P/E ratio says that the market has little faith in the company’s future.

As a consumer, do you want to buy a product from a company whose future is bleak? How comfortable do you feel buying a Dell Inc. (NASDAQ:DELL ) computer today? Such a collapse in consumer confidence is no minor problem. As consumer confidence declines, prices fall and margins compress, leading to a vicious cycle.

To make matters worse, if Apple Inc. (NASDAQ:AAPL ) management does not begin a buyback it serves as another signal – namely that they do not think the price is “cheap.” That rightly exacerbates both investor and consumer concerns, particularly in light of how cheap the stock appears to be. Previously, I noted that the ratio of the value of business operations to earnings for Apple Inc. (NASDAQ:AAPL ) was only about half that of Microsoft Corporation (NASDAQ:MSFT ).

Perhaps even more surprisingly, it is significantly less than the same ratio for Dell Inc. (NASDAQ:DELL )! The market clearly is saying that Apple Inc. (NASDAQ:AAPL )’s future is bleak. If Apple Inc. (NASDAQ:AAPL ) management does not see this as valuing an enhancing buying opportunity, that speaks volumes as well.

Management may choose to be secretive about Apple Inc. (NASDAQ:AAPL )’s future products for strategic reasons, but there is no reason to be secretive about their confidence in the future of the company. If they are confident, then it is hard to believe they will fail to conclude that the stock is cheap at less than $400 per share.

If they reach that conclusion, they should say so publicly and act accordingly.

By Brad Cornell, Professor of Finance at Caltech