Another Stock To Build A Retirement Portfolio Upon At Any Age The Procter & Gamble Company (NYSE

Post on: 18 Апрель, 2015 No Comment

Summary

- At any age of anyone’s life, this company supplies the products that make life better for everyone.

- A dividend growth investor should own this stock forever.

- The global importance of this company’s products is undeniable.

If you have been following this series, you should know where I am coming from at this point. It is all about having the greatest companies on the planet paying us superb dividends over an extended period of time.

How About The King Of Consumer Products?

Some would argue that the growth era of Procter & Gamble (NYSE:PG ) is well behind it, and that might be debatable. A dividend growth investor need only see the remarkable track record of paying shareholders simply by owning the stock and never selling it. I believe that if there is one company that eclipses its own brand with the very products it sells to every human on Earth that must be in every portfolio for retirement at any age, it is PG. To me that is not up for debate.

One may point to the various weak quarters or years PG has had. Or the strong dollar right now, but I myself turn a blind eye to those normal ups and downs because that is business. PG has been around forever and will be around forever. What other company comes close to supplying everyone anywhere, with products for everyone’s basic needs, not desires, every single day, for a lifetime.

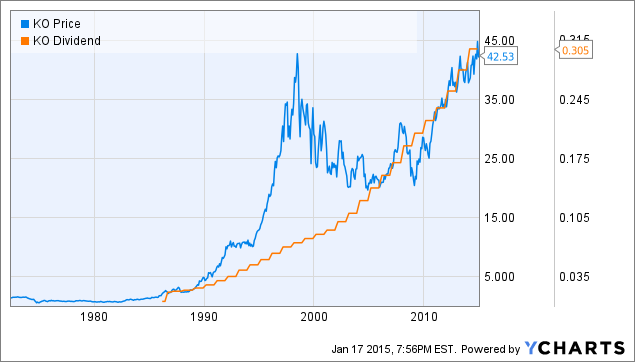

At the same time, it has a dividend aristocrat history that looks just like this:

Perhaps I do not even need to go any further, but let’s review the staggering array of products that PG offers.

Products By Category (From the website )

*Authors note: Duracell has been purchased by Berkshire Hathaway

Each one of the products is a brand name unto itself and probably more well known than the PG brand name. To me, that gives each product a life of its own, to grow, evolve, renew, and continue to be sold around the globe.

The Fundamentals

This company has a balance sheet that is just about bullet proof for any economic environment.

- One of the largest companies on the planet with an enterprise value of about $250 billion.

- Total assets over the last 3 fiscal years:

From Yahoo Finance

- Complete cash flow picture over the last 3 fiscal years:

From Yahoo Finance

While the latest earnings results were less than stellar, is there any question that this company has the size and wherewithal to turn itself around?

The October — December 2014 quarter was a challenging one with unprecedented currency devaluations, said Chairman, President and Chief Executive Officer A.G. Lafley. Virtually every currency in the world devalued versus the U.S. dollar, with the Russian Ruble leading the way. While we continue to make steady progress on the strategic transformation of the company — which focuses P&G on about a dozen core categories and 70 to 80 brands, on leading brand growth, on accelerating meaningful product innovation and increasing productivity savings — the considerable business portfolio, product innovation, and productivity progress was not enough to overcome foreign exchange.

Of course, these remarks did little to gain investor confidence in the short term, as did these forward guidance remarks:

The outlook for the year will remain challenging. We have and will continue to offset as much of this currency impact as we can through productivity driven cost savings. And we will continue to invest in our businesses, brands and product innovation, because it is the right thing to do for the mid- and long-term, while we deliver another year of strong cash returns to shareowners. We are adjusting fiscal year earnings targets accordingly. We are mobilized to deliver another fiscal year of modest organic sales growth, and to continue to grow market share on more category-leading brands. We are working to deliver core earnings per share as close as possible to those of last fiscal year.

These comments alone led to a selloff in the share price from roughly $92.00 to its current price of $85.39. A 7-8% drop in less than 2 weeks. As others have said, this might be a compelling time to start a position if one were to look at share price alone, but the dip in price has also given PG a dividend yield of 3.02%.

The average rate of dividend increases over the last 5 years is about 7-8%. and dividends have been paid and raised for 58 consecutive years . While the payout ratio is a bit higher right now than in the past (77%), who can argue with the very long-term success of this enormous mega cap, blue chip, consumer product company?

The ebbs and flows of business will occur with any company, but the historical facts have proven to any dividend growth investor that PG will find its way, no matter what the currency fluctuations might be at any given time.

Who would dispute this graphic?

The Bottom Line

If an investor is looking for an undiscovered growth story, then PG might not be a stock to buy at these levels. On the other hand, as a dividend growth investor who is focusing on income and long-term income growth with much less risk, PG is a must own in any portfolio of that type, no matter what age you might be.

For a dividend growth investor, the question you might ask yourself is why wouldn’t you own shares of PG forever?

Disclaimer: The opinions of the author are not recommendations to either buy or sell any security. Please remember to do your own research prior to making any investment decision.

Disclosure: The author is long PG. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.