Analysis of merger and acquisition performance

Post on: 6 Июнь, 2015 No Comment

Chapter — 1 INTRODUCTION

Background of the study

Merger and acquisition is one of the most important phenomena to create a value for shareholders and for the company’s growth. This is not only been observed by organizations, but in accordance of political, professionals, media and individual economy considerably making more attention towards M & A. It is called as the most effective factor to consider as the integral part of long term business strategy for enhancing the corporate growth (Wijnhoven, Ton Spil, Robert, et al 2006). Over the last decades the mergers and acquisitions in world have continuous effect by increasing the deals, tender offers and leveraged buyouts from different industry (Chatterjee, Lubatkin, et al. 1992). The main objectives behind merger and acquisition is to increase the profitability, increase in revenues, faster growth in the market and it is the quickest way of becoming popular in market.

Over the years the researchers have performed various studies in accordance with M & A. virtually not everyone makes the clear picture about the performance difference which occurs from the different types of mergers (see Ranaswamy, 1997). This means there are two types of merger that takes place i.e. Vertical and horizontal mergers. There’s been a small research have been done in the field long term strategic factors that affects the performance during M & A. Corporate and managers trying to perform and to build the adequate to go on competitive and profitability.

Ramswamy (1997) has attempted to analyze the impact of post-merger performance and the process of strategic similarity in preference of banking industry. He described the success or failure that describes the strategic fit will support to view the benefit than with dissimilar strategies. On an average the efficiency and deposits strategies will enhance the merging partners to cause the improved performance (Altunbas and Marques 2004).

Indeed most of the research has conducted by examine the performance in context with financial firms and banking sector. There’s been a limited research have been made on particular industry. Considering the limited study this thesis contributes the extending literature on post-merger performance and strategic similarity by taking steel industry as a variable. The whole study is to find the gain trust that enables the profit in a steel industry under M & A.

Aims & Objectives

The research is based on the post merger integration with reference to steel industry by understanding the influence of success through merger and acquisition. The aim of study is to find, firstly whether the post performance will lead to enhance the financial growth, secondly do post-merger operating performance and strategic similarity of acquired companies is affected or not, thirdly dose Company results in improvement in gaining more profit after merger takes place and finally analyzing the success operations in post-merger integration (see e.g. Epstein Marc 2004, Altunbas and Marques 2004, P. Mntravadi, A Vidyadhar 2008, Ruback S. R Healy, Palepu K. G 1992).

The test is conducted by analyzing the financial data of pre-merger and post-merger ratios of steel industry and statistical data is calculated using professional software called Stata (P. Mntravadi, A Vidyadhar 2008). For limitation of study, recent merger that took place in 2006 with huge financial transaction were TATA- CORUS and ARCELOR-MITTAL is taken as the variables.

Research Methodology & Sample collection of data.

The study is conducted in context to steel industry.

Outline of the structure

To function properly to the above mentioned aims and to understand the thesis the structure is organised into seven chapters are as follows:

Chapter 1: Illustrates the introductory background of the entire research process and includes the application of aims, objectives, methodology and structure of the thesis.

Chapter 2: describes the concise report on the merger and its methods. In addition to that we discuss the motivations behind M & A, the factors that influence the course of action during mergers and finally the role of strategic analysis in M & A.

Chapter 3: introducing the global steel industry and explanation of its recent trend over mergers and acquisition. Besides we also study the competition analysis of steel industry.

Chapter 4: examining the relevant literature reviews that are driven to prior concept.

Chapter 5: this includes the course of methodology that provides the model that is used to analyse the post-merger performance.

Chapter 6: provides the tackled results and data analysis that is observed by assembling the steel industry financial ratios.

Chapter 7: finally the conclusion of overall report that is overcome of the research thesis.

Chapter — 2

Illustrations of Merger and Acquisition

Introduction

This chapter explains brief about the mergers and acquisitions. Mergers and Acquisitions are the ways in which to build the corporate expansion and the company’s growth. In the recent years there’s been observed in the corporate world mergers being increasingly used to gain greater profit, to strengthening the market share and to reduce the business risk during the portfolio management. Thus it’s better to start with the introduction defining M & A. Besides, it also explains the basic terms that are used during the merger process. Basically the terms are discussed due to various authors has described with different definitions depending on the situations. Therefore the above sentence directs us to understand the basic terms of merger.

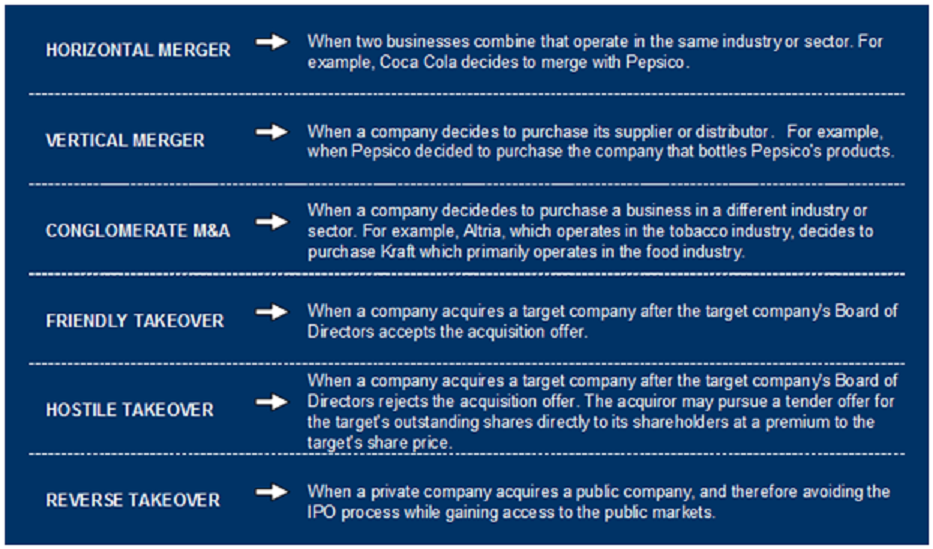

The merger occurs in different type’s vertical mergers, horizontal merger, conglomeration, geographical mergers, consolidation mergers and purchase mergers. Each merger derived with specific reasons depending on the fitting characteristics in cross boarder operation. Hence the types of mergers are discussed in this chapter.

On the other hand we discuss about the motives and strategies that formulates the acquiring firms. This part of study is very important because it explains widespread reasons behind the merger process. The main purpose of merger is to create the synergy and the value for the company. Synergy is the mean of generating the value from economies by integrating through mergers and acquisitions. Next discussion will be based on the strategic framework for evaluating the course of action in M & A. Finally the chapter will be ending by summarizing the entire chapter.

Explanation of Basic Terms/Key Words.

Before proceeding to the detailed study, it’s important to understand the basic terms which are commonly used in the research paper.

The parlances of M & A are as follows:-

v Acquisition: the one firm purchasing complete assets from the acquired firm to become the owner of that particular firm.

v Arb: it’s an arbitrage that attempts to purchase or sells the financial tool through various markets to gain the profit efficiency.

v Cross-border M&A: any company that is engaged in mergers and acquisitions whichever might be foreign or domestic firm.

v Consolidation: the process of combining companies into one functional operation to form single entity. Its transaction is known as consolidation.

v Hostile takeover: it is a corporate takeover which seeks the direct control over the Target Company with respect to management and the board of directors. Here the Hostile means if the company’s board of directors rejects the proposed offer, but the acquirer continues to persist it or the acquirer tries to proceeds without informing board of directors. It’s a quite opposite to the friendly takeover (Bhagat, Shleifer, Vishny, 1990).

v Horizontal merger: the company in which combined to form a single entity with similar industry which produces the same type of products. (Render,Stair,1997)

v Management buyouts: this is the process of transfer of proprietorship to a new authority and there will be limit or no rights to the original owner. Basically it’s a way of transfer the possession control from one owner to the other. (Wright, Robbie, et. al 1994)

v Merger: it’s a process of combining two or more companies to form one single entity.

v Proactive strategy: the strategy which involves innovative decisions to review the company’s achievement during the merger process.

v Synergy: an action that takes place during merger which gives the maximum result with strong decisions.

v Takeover: taking a control over the other firm with respect to hostile or friendly.

v Vertical merger: it’s a type of merger in which the company acquires another company having relation with suppliers or any raw material source for producing its own products.

Classifying the merger types

In perspective of merger and acquisition there are different types of mergers that host a difference between each one it. Hence the types are broadly classified as Vertical, Conglomeration, Geographical, Market-extension merger, Product-extension merger, Purchase merger and Horizontal mergers. Each type will be discussed in detail to know the differences and their characteristics.

Vertical merger

A vertical merger is a type of merger in which a firm combines with its suppliers to have a control over the sales outlets for their products. Simply vertical merger is building the relation with suppliers or distributors. Though it is more complicated and creates more rivals, this type will lead to advantage for the acquiring company to take full control over the suppliers from its competition. Somehow it makes tough for the companies to contend against the newly merged firm with different culture and management process.

Due to cost control particularly companies tends to make vertical merger. Some researchers have found that vertical merger will appreciate the financial value. R.Gil and Hartmann (2009) have attempted to prove that vertical integration has become more valuable for shareholders during vertical merger. On the whole vertical merger has special distinguishing quality compare to other merger types.

Market-extension merger & Product-extension Merger

In the modern days of merger integration these two mergers has become the frequent types and more importantly it is the best means of extending the operations through extend products and services.

Market-Extension Merger:-

In this type the merger takes place between the companies having the similar products and services in different market places. The actual intention for having market extension is to target the sustainable market for the future growth and to maximise the wealth of shareholders. The approach of this research is basically suits the market extension merger that took place between the Tata-Corus and Arcelor-Mittal. This made Arcelor-Mittal to produce the highest capacity steel production in the world about 100 million tonnes. The major advantage of this type is to become the monopoly and to have the huge market value.

Product-extension merger:-

In this type of merger organizations makes a deal were the business takes place with similar products and which operates in the same market place. Mainly this type will allow any new or any large company to unite its products and services to capture same market with bigger consumers. Certainly this method of merger will earn higher profit.

Conglomeration

The conglomeration merger is the firms in which are combined with respect to non-related industries. This type of merger is involved with two different firms doing different business. Basically it is done to diversify the risk rather than making benefit to the company, it is just to obtain the primary objectives. It is difficult to perform or obtain the market efficiency in this type of merger, due to various diversifications towards product activity (Jeffrey 2008). However with the most efficient management and with fresh management it can probably perform better with the outcomes.

Horizontal Merger

This type of merger occurs when two firms are combined having similar manufacturing goods and services (Jorge Padilla 2005). Its endeavour is to maximise the shareholders wealth and market shares to counter the competition. The other advantage is to counter the economies of scale, performance, target the major markets, and finally it gives growth being monopoly. This type of merger is playing the vital role for the researchers to analyse the performances. Many researchers have made different comments on the motivation towards horizontal merger process.

The process of enhancement in a market and to get rid of the competing firms is the main intention for many mergers. In recent studies the analysts says that horizontal mergers takes place due to the increase in market value in a business environment, management, and in the field of research & development. Thus many firms having market power will attempt to have an efficient horizontal merger.

Geographical Mergers

Most of the mergers are limited within the operating firms in the same territory (home country). Always merger activities refers to the strengthening the cross-border relation with other nations. This type of mergers has the different motives when compared to other mergers. Most of mergers will takes place within the country, but over the decades there is been numerous cross-border mergers happened between many nations (international merger). Similarly, in this part of research discussion we analyze the merger that took place between the two international firms with geographical merger. Larger firms are very much interested to merge whether it might be international or domestic. This enables the expose with different market and certainly to make more profitable.

Researchers have analyzed in corporate finance that geographical merger is an important instrument for efficient to provide sustainable growth (Berger, Ofek. 1995). It is the best means to provide risk diversification during cross border merger. Geographical mergers will provide to diversify the business in different markets which allows the acquirer to allocate basic requirements based on operation.

Motives behind Merger & Acquisition

Mergers and acquisitions are the general motives for the growth of any organization. Although the motives for mergers cannot be driven in single approach, researchers have analyzed some theories that explain the major motives for merger and acquisition. Indeed no proper reason has been found yet for motives behind M &A (Andrade, Mitchell et al. 2001). Haspeslagh and Jemison (1991) states that there are two prime motives behind mergers and acquisitions in interest of maximising the firms growth. Firstly to capture the value for the organization and secondly to create a value for the organization, apparently there are many motives that has been observed in context of growth of the organization. Trautwein (1990) has analysed using various theories of M & A motives which includes taxation, wealth maximizing, and risk diversification. However the rationale behind merger and acquisition may vary from one merger to another merger, but normally major success is to increase the value for the company through merger (Epstein 2004).

The analysis has influenced the companies to merger with special characteristics which creates profitability for the shareholders. On the other hand mergers have shows the strong influence on post-merger performance. In this dissertation I’m going to attempt to discuss what will be the other alternative method for the growth due to merger process. Trautwein (1990) stated that managerial utility will play a vital role in the internal development for the long term investment strategy, although aiming at the increase in shareholders growth will lead the overall motives for merger. And also he analysed that implementation of strategies after merger or before merger will be challenging than the procurement of ongoing business.

However in the further studies we will be discussing on both motives i.e. maximising the shareholders hypothesis and manager’s utility hypothesis that are incurred for strengthening the growth of an organization.

Shareholder Wealth Maximising Norm

In the neoclassical norms, every organization objectives is to maximize the shareholder’s wealth. The hypothesis of maximising the shareholder’s wealth will be called as neoclassical models. On the other hand for rest of the non neoclassical analysis it has been greater explanation from many failures due to the various drawbacks in perspective of ownership control, this results the lack of maximising the shareholder’s wealth or companies overall profit (Chatterjee, Lubatkin, et al 1992). According to the financial theory, any merger or similar type of investment type will lead to positive valuation of acquiring firms (Andrade, and Stafford 2004). This statement shows that the value for the post-merger performance and the determination of increase in creating the value in share markets. However this analysis shows the existence part of manager’s utility hypothesis. Some analysts explained that both internal and external factor of mechanisms will influence the managers to act in favour of the firm.

Some study says that there is a high probability of management failure in the interest of merger firm. On this issue the researchers shows that both internal and external factors will influence the managers to take action against the firm. Mainly the external factor indicates competition, company’s growth in absence of profit and the appearance in the business world for the survival. This suggests that even if the markets are improper, the competition will guarantee only if they can survive with maximise the profit. On this study Slade, E. M. (2004) says that shareholders can elect the management team who can control the effective internal factors. However for the effective external factor the market competition will recommend for mergers and acquisitions.

The increase in merger and acquisition activity understands the motives and consequences that arise for merger process. The traditional intention for merger activity includes theories and hypothesis which includes market power hypothesis, efficiency/synergies in economic scale, diversification hypothesis and so on (Sharma, Thistle 1996). In our further study we will be discussing about the main seven reasons under the shareholder profitability. The following are the six reasons that has been identified and analysed in our dissertation.

i. Efficiency/Synergy theories

ii. Market Power Hypothesis

iii. Diversification Hypothesis &

iv. Taxation Effects

All the reasons will be analysed and discussed below:-

i. Efficiency theories

According to the ‘efficiency’ or ‘synergy’ theories there will be possibility of being both efficiency and inefficiency theories during merger or takeover. Efficiency theory indicates that firm X is more efficient than compared to firm Y and both are in same sector, firm X can increase the efficiency of firm Y however in the presence of X through merger or takeover. Inefficiency theory testifies that firm Y is not capable in favour of public cognizance, so firm X can control the firm being inefficiency Y firm through merger or takeover. These two examples by taking X & Y will signify that merger will be an instrument to solve the efficiency problems in the merger performance. Therefore Copeland and Weston (1988) bring out that the efficiency theories will give the theoretical rationale for horizontal mergers and for inefficiency theory supports the conglomerate mergers.

Besides efficiency theory evokes that mergers takes place only if there is any profitable reason for both the acquiring firm and acquirer firm. On the whole efficiency can enhance by proposing new culture by merger and acquisition. Here culture will be the main rationale for successful mergers. Culture is said to the behaviour form of people, management, internal factors of the organization and the strategy implementation (Stallworthy, Kharbanda 1988).

David & Scherer (1987) analysed that the efficiency theory expresses the mergers takes place for the improvement of the merged firms through the concept of ‘synergy’. Basically ‘synergies’ results the reduction of cost exploitations by avoiding risk opportunities and other strategies which lead to the improvement for securing the capital growth.

ii. Market Power Hypothesis

Market power is defined as the ability of a market participant or a group of participants to control the price, the quality or the nature of the products sold, thereby generating extra-normal profits (Seth 1990). Some literature diligently says that market power is one of the main motives for merger and acquisition. Scherer and Ross (see e.g. 1990) say that the first and foremost motive for merger is market power particularly for horizontal merger. The analysis suggests that made by Maneesh and Thistle (1996) the horizontal merger enhance the market concentration by which increases the market power and earnings. Besides mergers and acquisitions are not likely to be in a favour of vertical, conglomerate or any other merger type, such merger types are difficult to find.

Many literatures (e.g. Seth 1990; Scherer & Ross1990) argue that the enhancing concentration may not lead to any gains which is organised by corporate mergers that created the market power. It can only convinced from market power is to sustain the markets where there are obstacles to enter and lower level of costs. The exercise of market power cannot be increased if there is threat from competitors when they enter into new market. Besides to exercise the market power it should be executed in a given market, and in few markets which are clearly defined with more competitive.

However on the whole analysis made by researchers it concludes that horizontal merger are not the means to target the controlled competitors, but other merger type is also concern. This is due to the larger firm always over prices in a particular single market and may not be more important because of its financial strength and size of the firm Seth (1990)

iii. Diversification Hypothesis

The diversification as played a cation attention in merger process during recent years. Always firm thinks in different posture to diversify the earnings to create a greater extent of cash flow in the balanced total risk (Lamont 1997). The diversification hypothesis has become the sustainable strategy to reduce the total risk and to make stable income flows. It also assures that in the modern business world diversification is the main method to survive in the market.

Many theoretical analyses suggest that diversification hypothesis is relevant to conglomerate mergers. Ross et al. (2002) argues that the value for conglomerate merger will lead to increase in the sum of the value of firms due to decrease in risk and maximisation in debt value. By diversifying the business operations will consent the strategy to minimize the risks. On the whole diversification hypothesis will also increases overall competitive business.

So far we have studied the increase through diversification will lead to maximise the earnings. Besides many researchers have discussed that potential entrant’s utilised theories to model the directly or indirectly to act by means of merger and acquisitions. From this theoretical models shows that the firms’ diversification hypothesis will not affect any positive results Ross et al. (2002).

iv. Taxation Effects

In the recent trend of mergers and acquisition there is been not much evidence for enhancing activities in market for corporate control. Only certain explanation express that the positive action that mergers and acquisition play in the portion of resource through society (Ross et al. 2002). Recently many researchers noted that taxation on mergers is also motivated for the acquirers to accumulate the shareholders earnings via tax reduction. There are several different ways on tax incentives and benefits which motivates for M & A, to avoid tax on capital gains and dividends, switching to new debt to decrease the interest payments and gaining the tax provisions and to hold capital gains over taxes (Beckenstein 1999).

However there are other means of getting advantage from corporate integrity and this advantage should not be considered to the M & A process. Mainly there is two different corporations which is considered for tax benefit activity firstly shareholder taxation and secondly corporate taxation (Auerbach and Reishus 1988).

a. Shareholder Taxation: — shareholder can also opt for many varieties of payments during the selling of shares as a process of mergers and acquisitions. There are non-taxable receipts for capital gains for shareholders which will not be considered for taxable gains. On the whole non-taxable transactions will exists for tax benefits through opting as a shareholder in the acquired firms to fulfil different portfolio without considering their share capital gain tax and paying capital gains (Auerbach and Reishus 1988).

b. Corporate Taxation: — at corporate level the tax consideration in merger and acquisition process it rely on the acquiring firm which prefers to consider the acquired company in existence of parent company by its unbroken tax credit or being bankrupt and then the company accepts in the form of component value. There are other tax benefits for merger that is available firstly in stepped-up asset process and secondly the increase in activity of tax losses and tax credits (Auerbach and Reishus 1988).

Management Related Hypothesis

As we mentioned in the above in fig 1.1 that merger motives explain two related hypothesis Shareholder hypothesis and Management related hypothesis. We have already attempted to study the shareholder related hypothesis and now we will be discussing the term management related hypothesis.

a. Managerial-Utility- Maximisation

In the modern corporate world is expressed through large corporations having commonly scattered of ownership which is separated from management. In the state of being separation of ownership from restraint, the difference between managers and shareholders can be observed as primary agents. In this agency perspective managers act as an agents and may not all time act in best interest principals. Some time managers react by ignoring principals in order to obtain their own self interest. Such self interest may result to bad merger and acquisition in perspective of the firm’s growth and loss of shareholder profit. Here a manger seeks to get more rewards and incentives to act in best interest for maximising the firms’ value. Such value crating actions can be obtained to satisfy managerial objectives are by increasing the firms’ size (Sudarsanam 1995).

Managers undertake merger and acquisition activity for the following explanations:

Ø Striving for enhancing the size of the firm, since the mangers holds reward like power, incentives, prestige and to get the job security with greater degree. These are easier to pursue in larger firms.

Ø To spread out the managerial skills and talents.

Ø To invest in various financial instruments which maximises the shareholders wealth and to avoid market risks.

Ø To keep away from being job takeover.

However, it shows that for enhancing the profit of a firm all stakeholders and managers would prefer maximising profit through merger and acquisition to not yielding profits (Ross et al. 2002). This means that there is importance in post merger performance. So that our study will be focused on how the strategic similarity of M & A firms might be a source of achievement.

b. Free Cash-flow Hypothesis

Free Cash-Flow (FCF) Hypothesis occurs when there is excess of cash and need to fund in any investment instrument that have positive values when compared to the relevant cost of capital (Jensen, 1986). FCF is provoked from the general overall gains and rents from the economic. Jensen (1986) analysed that the management will allot the free cash flow to the shareholders primarily. Besides management also thinks if free cash is distributed then it will not increase their own wealth because dividends are not their personal goal but it is just the scheme of perquisites. However this influences the management or managers to decide using this opportunity for mergers or acquisition which enhances the growth of the company. Considerably managers prompt to grow inward of FCF, besides with inefficiency strategies may lead to the negative effect over FCF diversification through merger (Gibbs 1993).

Jensen (1986) free cash flow hypothesis argues in absence of managers’ interest they seek to enlarge the company’s profit and to use proper resource for better diversification. In his words he describes managers are those who accumulate excess free cash flow by increasing the dividends and to initiate with repurchase of share plans. Nevertheless, many studies and theory suggests that ‘manager’ behaviour is difficult to observe from the management point of view in free cash flow perspective.

c. Hubris Hypothesis

Roll (1986) suggests that hubris is the excessive pride for managers to participate in the merger and acquisition activity. Managers are considered when the management of the firm directs to have a valuation analysis of acquiring firm. During this course of action managers behave extremely over confidence with their prediction and excessively hopeful about the takeover valuation. Later onwards they will start a bid possibly if valuation increases the market price objective. Scharfstein and Stein (1990) have built a model of investment decisions which is of herding activity. They argue that the managers will imitate by motivating early movers and sometime refuse their own info. [1]

The above statement says that a clustering of mergers and acquisitions over a time. Roll (1986) explains that managers with over confidence lead towards diversifying mergers and acquisition. In Rolls model he explains that these business deals are implausibly to value for the acquiring firm. Therefore we prompt that the volume of merger and acquisition would be negatively connected to the given account of M & A beneath the hubris hypothesis.

The role of strategic performance during M & A

Academic researchers has analysed that invariable competence says that on an average merger and acquisitions makes no adequate return for acquiring company. Indeed the managers and the firms are conveying through their value creation promises in merger and acquisition performance. Nevertheless there is been continuous course of action let by managers through M & A in everyday business transactions to procure firms growth and to show the ability of their leadership quality. In this regard to enrich merger performance there should be quality analysis, better planning and integrated strategic analysis to make slightly changes in takeovers. Besides there are not much failure in takeovers for the lack of analysis, but with lots of fragmented analysis causes business failure. In most of the cases mergers and acquisitions will end up what so ever whether it makes profitable or not depending on management (Andrade & Mitchell, 2001).

Even in the same sectors that took place merger and acquisition will vary with the success rates. On this basis getting the better outcome through takeovers has become an issue to consider as the profitable M & A. Acquirer should understand the possibilities of outcome that makes best fit among the potential targets.

Gennaro et al. (2006) suggests six strategies which enhance the financial performance managing the financial risk, increase in non-income interest, increasing the quality of assets, marketing financial performance, controlling the cost efficiency and effective use of capital. He suggests that these financial services can be perfect instrument for strategic performing of the mergers and takeover. In this research thesis we will be discussing about the winning strategies and other factors that influence the post merger financial performance.

Chapter Summary

In this chapter firstly we have explained the basic terms which are commonly used in the overall analysis of merger and acquisition performance. Also it explains the different types of mergers describing from vertical mergers refers in which a firm combines with its suppliers to have a control over the sales outlets for their products, conglomerate mergers is the firms in which are combined with respect to non-related industries, horizontal mergers whereby two firms are combined having similar manufacturing goods and services.

On the other hand we have explained the motives behind merger. It shows that firms can achieve market power through enhancing the size of the firm having various motives behind. On the whole the merger and acquisition are initiated by maximizing the wealth of shareholders and manager utility maximization. Besides post merger performance will enhance the eminence as a worthwhile for stakeholders. This course of action helps to distinguish the firms in accordance to the strategic preference to test the merger related having related and nonrelated firms.

Cabral (2002) says that this can be expressible for a manager to mimic other company’ M&A decisions, in despite its private information in contrast of the takeover. In this case situation, a grouping of M&A activity will not need to imply managerial hubris.