An Internship Report on Foreign Exchange Operations of Mercantile Bank Limited Assignment Point

Post on: 16 Март, 2015 No Comment

An Internship Report on Foreign Exchange Operations of Mercantile Bank Limited

Introduction:

Bank is defined as a financial institution that collects deposits from various individual and organizations and provides loans to those who need it. But modern banks do not mean only the means of collecting and disbursing money to various entities. Rather it provides various services to various entities which facilitate their business operations. A foreign exchange operation of banks is one of those services that not only facilitates the business of businessmen but also contributes to the development of the economy as a whole. Foreign exchange is defined as the mechanisms by which the currency of one country is converted into the currency of another country. Foreign exchange is the means and methods by which rights to wealth in a countrys currency are converted into rights to wealth in another countrys currency. Foreign exchange department of banks plays significant roles through providing different services for the customers.

1.1. Background of the Mercantile Bank Limited (MBL):

Mercantile Bank Limited, incorporated on May 20, 1999 and commenced business on June 02, 1999, is now one of the most important entity in the banking industry of Bangladesh. With the passage of time it has expanded its number of branches and variety of services along with its core business of taking deposits and granting loans. Now MBL has emerged as a new commercial bank to provide efficient banking services and to contribute socio-economic development of the country. Rising trend of the banks profitability over the last 8 years is also materialized. The MBL is committed to the delivery of the superior shareholders’ value. Foreign Exchange Department of the bank is one of the most important departments. Now it has become the backbone of the bank. With the aim to be the ‘Bank of choice’, it is operating in the industry with a team of devoted personnel to excel both their own career and the bank’s future.

1.2. Origin of the study:

This report is originated as the course requirement of the BBA program under the business studies faculty of Stamford University Bangladesh. Under this program students of every department of this faculty must go through an internship program of 3(Three) months duration. As practical orientation is an integral part of the BBA degree requirement, I was sent by the department of Finance to take real life exposure of the activities of banking financial institutions from July 16, 2009 to October 18, 2009.

1.3. Background of the Study:

Mercantile Bank Limited (MBL) is one of the risen Banks in Bangladesh. This year they have declared 40% dividend to their shareholders. This Bank has already 42 branches located in different places and also going to establish more branches.

The Internship program is an essential and mandatory of the BBA Program of Stamford University Bangladesh. After completion of four years theoretical training, I got the opportunity as a practical exposure to business horizon through internship program. Mercantile Bank Limited is one of the well- reputed private commercial bank of Bangladesh with paid up capital of BDT 1,798.68 (in million, 2008). Banks strong capital base allows it to make large chunk of advances to its corporate clients.

My internship supervisor and respected teacher Md. Ifte Kharul Alam, Assistant Professor & HOD Finance, Department of Business Administration, Stamford University Bangladesh, assigned me the topic “A study on the Foreign Exchange Operations of Mercantile Bank Limited.” I hope this report would able to portray the real picture of the operation of foreign exchange department of Mercantile bank Ltd.

1.4. Rationale of the Study :

This report is broadly organized into two broad parts. The first part (first 3 chapters) is an overview of the organization itself. The second part concentrates on the assigned topic “A study on the Foreign Exchange Operations of Mercantile Bank Limited.” Finally it includes the evaluation of Foreign Exchange performance, findings, and recommendation to make understood the scope of overall Foreign Exchange with its constraints of MBL.

1.5. Objective of the study :

The objective of the study is to obtain an understanding of the practical banking activities and relate them with theoretical knowledge that I gained through the theoretical training in the university and from various documents of the bank. Beside this, the followings are the specific objectives which I will try to cover in my report:

1.5.1. Primary objective :

The primary objective of preparing this report is to represent the Mercantile Bank Limited and to have a clear conception about all of the essential parts of the internship program.

1.5.2. Secondary objective:

1. To give an idea about the evolution of the banking business.

2. To give an idea about the evolution of banking in Bangladesh.

3. To give an overview of the current Bangladesh economic scenario.

4. To give an overview of the MBL.

5. To give some idea about the international trade, different types of exchange rates, process of executing transactions relating international trade, accounting of these transactions, etc.

1.6. Scope of the study:

As I was sent to Mercantile Bank Limited, Main Branch, the scope of the study is only limited to this branch. The report covers its overall foreign exchange function. The report covers import, export and remittance activities about MBL. Besides it covers topic such as evolution of banking business, evolution banking business in BD, Bangladesh economy scenario, background of MBL has also been discussed.

1.7. Internship at Mercantile Bank Limited:

My Three months at the Mercantile Bank Limited as an internee had been the most enjoyable time of my life. Doing my internship at one of the leading private commercial banks in Bangladesh, I believe I have accumulated an experience unmatched to any other.

I was assigned to the project of “A study on the foreign exchange operations of Mercantile Bank Ltd.” as my project report. I am extremely happy to work in such a project. Though as a student of finance it was a new situation to me.

For the internship program the contact person of the head office sent me to the Main branch of the bank. My objective was to get a clear idea about the function of the foreign exchange of the branch. But my host supervisor sent me first to the Local Export department to have a preliminary idea and to be acquainted with various types of local export bills and related matters; I worked there for 60 days and learned the procedure of issuance of pay order, demand draft (DD), and method of maintaining books for the above mentioned activities. Then I was sent to the clearing section, of worked there for 20 days and learned how inward and outward checks are cleared, how transfer delivery from one branch to another branch is made. After that, I was sent to the IT department of this branch. I worked there for 5 days. Here I learn how to give bank statement, Tax purpose statement. After that I was sent to the export section of the foreign exchange department of this branch. I work there for the rest of the period of my internship program. In the export section I mainly observed the export procedures, files and documents of different exporters, export proceed collection procedures and compliance of export procedures with the set rules of export policy and Bangladesh bank rules. Actually this period was my area of concentration and activities of this period is mainly focused in my report. I extended my best effort to collect as much information as possible to prepare my report. The working environment of this division of the Mercantile Bank Limited is conductive and friendly. The staffs are specialized in their respective fields. Each of them works on their own and there is supervision from the top. The motivation of the staff, I believe comes from the very sense of responsibility for his or her work.

1.8.Limitations of the study:

On the way of the study, I have faced the problems that are given below that may be terms as the limitation or shortcoming of the study-

Short Time Period:

The first obstruct is time itself. Due to the time limit, the scope and dimension of the study has been curtailed. For an analytical purpose adequate time is required. But I got a short time period to prepare the report.

Data Insufficiency:

It was very difficult to collect data, because the branch of Mercantile Bank Limited is very large. But the data is very essential to prepare the report. All of the employees of this branch are very busy. For the time limitation they could not able to supply my topic related data.

Lack of Records:

Sufficient books, publications, facts and figures narrowed the scope of accurate analysis. If this limitation were not been there, the report would have been more useful and attractive.

Poor Library Facility:

Most of the commercial banks have its own modern, rich and wealthy collection of huge and various types of banking related books, journals, magazine, papers, case studies, term papers, assignment etc. But the library of Mercantile Bank Limited is not well ornamented and decorated.

Lesser Experience:

Experience makes a man efficient. I do such kind of research activity for the first time. That’s why inexperience creates obstacle to follow the systematic and logical research methodology.

1.9. Methodology of the study :

The study requires a systematic procedure from selection of the topic to final report preparation. To perform the study the data sources are to be identified and collected, they are to be classified, analyzed, interpreted and presented in a systematic manner and key points are to be found out. The over all process of methodology is given in the following page in a form of flow chart that has been followed in the study.

A. Selection of the topic: The topic of the study was assigned by our supervisor. Before assigning the topic it was discussed with me so that a well organized internship report can be prepared.

B. Identifying data sources: Essential data sources both primary and secondary are identified which will be needed to complete and work out the study. To meet up the need of data primary data are used and study also requires interviewing the official and staffs were necessary. The report also required secondary data. Information collected to furnish this report is both from primary and secondary sources.

i) The primary sources are:

Face to face conversation with the officers.

Practical desk work.

Relevant files study as provided by the concerned officers.

ii) The Secondary sources are:

Annual reports of MBL.

Foreign exchange of MBL.

Periodic reports of MBL.

Annual Reports of Bangladesh Bank (BB).

Publications of Bangladesh Bank (BB).

Publications of BIBM.

Office circulars of MBL.

Publicly published documents.

Relevant books, newspapers, journals, etc.

MTO recruitment materials of MBL.

Information kept by branch manager, operations manager in their own files.

C. Collection of data: Primary data are collected by using interviewing technique. The reports are an exploratory research and for qualitative survey open ended question were ask to the Bank official.

D. Sampling:

Population: All the Branches of MBL located in everywhere in Bangladesh has been taken into consideration as population.

Sample: MBL, Main Branch, is the vital sample.

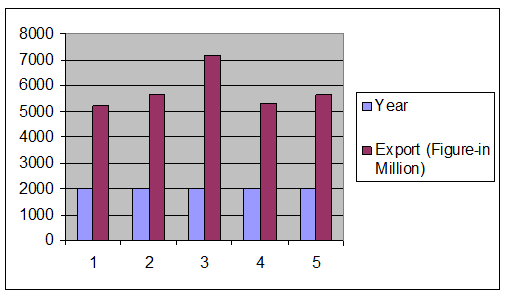

E. Classification, analysis, interpretations and presentation of data: some arithmetic and graphical tools are used in this report for analyzing the collected data and to classifying those to interpret them clearly.

F. Findings of the study: The collected data were scrutinized very well and were pointed out and shown as findings. Few recommendations are also made for improvement of the current situation.

G. Final report preparation: On the basis of the suggestions of our honorable faculty advisor some corrections were made to present the paper in this form.

CHAPTER- 2

Evolution of Banking Business

2.1. Evolution of Banking Business:

The word bank, which means a financial intermediary that collects deposits from savers and disburses loans to the fund seekers and acts as the principal medium of internal resources mobilization of an economy, is not the result of a short period. Instead, it has to pass through a very long period.

In the ancient age, people had to satisfy all of their needs by themselves. At this stage, there was no surplus production. Hence the concept of transaction was yet to be introduced. But, as the division of work took place in the society, there was surplus as well as deficit production in each society. This lead to the introduction of ‘BARTER SYSTEM’ in which commodities were exchanged for commodities directly. But this transaction system could not last for a long time for some problems such as,

1) Double coincidence of needs: this means the needs of two persons must meet the surplus that they have. For example, one person has some surplus rice and another person has some surplus cloths. If they the person with rice has the need of cloths and the person with cloth needs rice, only then the transaction will take place. But it was difficult.

2) Indivisibility of goods: all goods are not divisible and not of same worth. This caused a big problem for transaction. For example, a cow is not exchangeable for 1 meter cloth, neither it can be dividable in smaller units.

As a result, people had to think for a mechanism that would solve these problems and facilitate the transaction process. This resulted in the introduction of money in the form of stone, metals, bones etc.

After the introduction of money, the volume of transactions increased to a great extent. People with surplus money started to feel insecure about their money. At that stage, goldsmiths, priests, businessmen were the most honorable and trusted people in the society. People started to keep their surplus money and jewelry deposited with them. They lent this money without any charge to those who needed money. This was the ‘transaction of utmost faith’. From here, the history of bank counts.

The previous discussion can be presented in the following diagram:

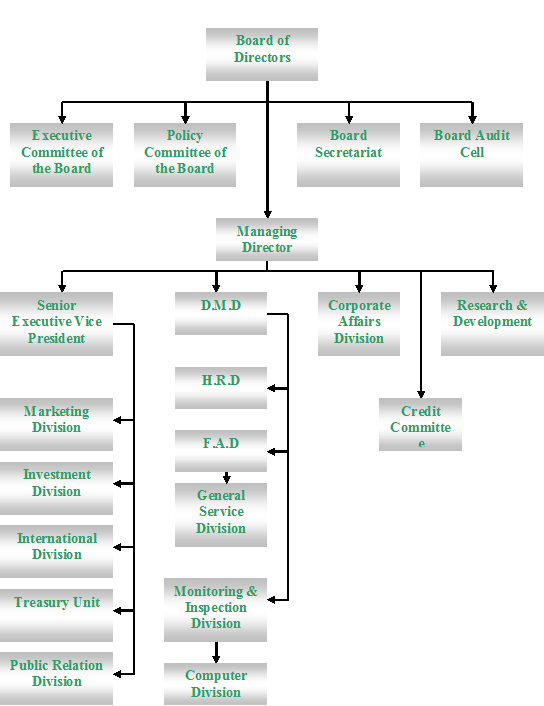

Figure 2.1: Diagram of evolution of banking business

After some time, businessmen started to charge some charges on those who took loan from them. It was the goldsmiths who introduced the ‘deposit slips’ in the history. Day by day, volume and complexity of transactions kept increasing, so as the concept of bank.

The banking systems of ancient age and the banking systems of modern age are two distinctively separate entities. The situations and flaws that resulted the banking systems in the present form are highlighted below:

As early as 2000 B.C. Babylonians had developed a system of bank. In ancient Greece and Rome the practice of granting credit was widely prevailed. ‘Traces of Credit by compensation and by transfer’ orders were found in Assyria, Phoenicia and Egypt before the system attained full development in Greece and Rome. The book of old Hindu saw giver, MANU, is full of regulations for governing credit. He speaks of judicial proceedings credit instruments were called for, interest on loans, on bankers, users and even of the renewals of commercial papers.

In Rome, bankers were called Argentarii. Some banks carried business on their own account and others were appointed by the Government to receive the taxes. Loan banks which lent money to the poor without any interest on the security of land for a period of 3 of 4 years were also common in Rome.

The Bank of Venice, established in 1157, is supposed to be the most ancient bank. It was not a bank in the modern sense being simply an office for the transfer of public debt.

History shows the existence of a ‘Monte’ in the Florence in 1336 the meaning of ‘Monte’ is given in the Italian Dictionary 1959 as ‘a standing bank or mount of money, as they have in diverse cities of Italy’. Banbrigge, an English writer, speaks about ‘the three banks of Venice’ meaning the three public loans of Monte.

The beginning of the English banking may correctly be attributed to the London goldsmiths. They used to receive their customers’ valuables and funds for safety custody and issue receipts acknowledging the same. These notes, in the course of time, became payable to bearer on demand and hence enjoyed considerable circulation. In fact, the goldsmiths’ notes may be considered as the precursor of the bank note. The business of the goldsmiths got a rude shock by the ill treatment of the Government of Charles II, under the Cabal ministry. In the words of Bagehot; “It had perpetrated one of those monstrous frauds which are likewise gross blunders”. The goldsmiths used to deposit their reserve of treasure in the ‘Exchequer’ with the sanction and under the care of government. But Charles II shut down the Exchequer and paid nothing to the goldsmiths. However, the ruin of goldsmiths marks a turning point in the history of the English banking. It led to the growth of private banking and the establishment of the ‘Bank of England’.

In the India, as early as Vedic period, banking existed in the crudest form. The bloods of Manu contain references regarding deposits, pledges and policy of loans and rates of interest. Truly, banking in those days largely meant money lending and they did not know the complicated mechanisms modern banking. This is true not only in case of India but also in case of other countries. The evolution of banking institutions became more and more organized as the time passed. In various periods, different amendments were made in different countries throughout the world. So, different countries have different contributions to the banking institutions to appear in the present form.

Figure 2.2: At a glance-Evaluation in Banking Institutions in World According to Different Age

2.1.1. List of some important Ancient Banks: