An InDepth Look At The Swap Market_1

Post on: 9 Апрель, 2015 No Comment

How to Adjust Your LDI Strategy under the New Ultimate Forward Rate

- The duration needs to be reduced and the curve positioning adjusted to reduce exposure to the long end of the curve (30-year and 50-year maturity buckets).

- The return target needs to increase, because the UFR curve is higher than the swap curve used previously. This means liabilities unwind at a higher rate than before. LDI strategies need to match this higher “running yield” to avoid slippage with the liabilities.

- More frequent rebalancing is needed. The artificial nature of the UFR curve means the duration of liabilities and hedges decay at different rates. If left unchecked, this introduces mismatches over time.

Article Main Body

The Dutch Ministry of Social Affairs (SZW) recently announced that liabilities are to be valued against an Ultimate Forward Rate (UFR) curve beginning on 30 September 2012. This has important implications for liability-driven investing (LDI) strategies, including:

- The duration needs to be reduced and the curve positioning adjusted to reduce exposure to the long end of the curve (30-year and 50-year maturity buckets).

- The return target needs to increase, because the UFR curve is higher than the swap curve used previously. This means liabilities unwind at a higher rate than before. LDI strategies need to match this higher “running yield” to avoid slippage with the liabilities.

- More frequent rebalancing is needed. The artificial nature of the UFR curve means the duration of liabilities and hedges decay at different rates. If left unchecked, this introduces mismatches over time.

We believe the best way to manage an LDI portfolio in this new regime is to run an actively managed portfolio versus a benchmark of swap indices that reflect the liability profile. The benchmark composition assures the correct duration and curve positioning, the alpha generates the additional return required, and the automatic rolls embedded in the swap index construction address the rebalancing needs.

A brief recap of UFR

DNB (the Dutch central bank) published the UFR curve methodology for pension funds in early October. This methodology dictates that the curve will be constructed from swap rates for maturities up to 20 years. For maturities from 21 to 60 years, the curve is constructed by calculating the one-year forwards as the weighted average of the market forward and the Ultimate Forward Rate of 4.2%. The weights are fixed per maturity, increasing from a small UFR weight(about 9%) at 21 years to a very high weight (99.8%) at 60 years. For maturities of 61 years and beyond, the forward equals the UFR of 4.2%. A full description can be found on the DNB website. Figures 1 and 2 show the resulting curves: Figure 1 shows the forward curve converging to 4.2% and Figure 2 shows the UFR spot curve above the corresponding swap curve for maturities above 20 years.

The UFR method chosen is different from the UFR implemented for insurers in early July 2012. Both UFR curves are very similar at the end of September, but the insurance curve is based on the Smith-Wilson algorithm. This method extrapolates the curve from the forwards up to 20 years and does not take any market information beyond the 20-year point into account. The Smith-Wilson method has been heavily criticised because it risks distorting the market curve around the 20-year point, and this has been the main reason for SZW and DNB adopting a different curve for pension funds. We expect both curve methodologies to be harmonized over the coming years, although it is not clear at the moment which method will prevail.

Some may ask why this curve positioning matters as long as the LDI strategy has the correct duration. The reason is that if pension funds do not adjust their strategy and the 50-year rate increases relative to the 20-year rate, for example, then the LDI strategy would likely underperform the liabilities. This could, in turn, lead to a shortfall in the coverage ratio. This rise in 50-year vs. 20-year yields (a steepening of the long end of the curve) is more likely as other pension funds reduce their 50-year exposures in favour of 20-year exposures.

Higher return target

Figure 2 shows that the UFR curve is above the swap curve, meaning that UFR liabilities will “unwind” at a higher rate than swap-based liabilities. For most pension funds, this unwind rate or running yield of the liabilities is about 0.25%-0.5% above the swap rate.

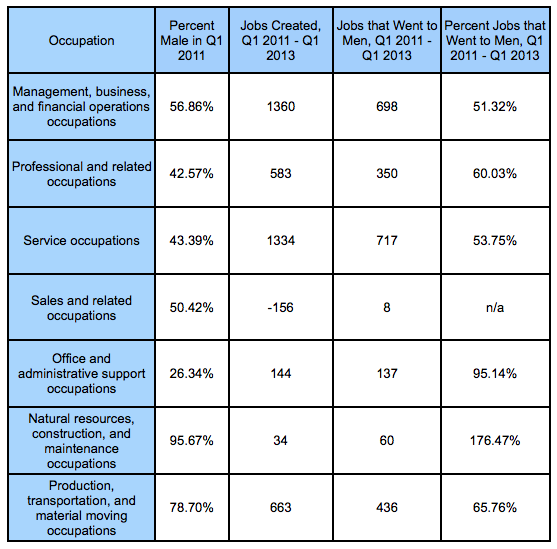

We analyzed three strategies that might be used to achieve this higher yield (an additional 0.5% of return). Each is constructed to match the duration and curve exposure of the liabilities, so they only differ with respect to the source of the additional return:

- Active management, i.e. managing a portfolio actively vs. a (swap-based) liability benchmark. Our analysis is based on the track record of a PIMCO representative account. This analysis was done on a before fees basis.

- Credit and swaps, i.e. investing part of the LDI portfolio in a broad euro investment-grade credit portfolio to earn the credit spread, and adding swaps to match the duration and curve exposure of the liabilities. We simulated this strategy based on the Merrill Lynch EMU Corporate Bond Index.

- Long-dated government bonds that yield more than swaps. We based our analysis on French government bonds (OATs) because France issues long-dated bonds offering a yield in excess of swaps.

In Figure 5, we compare each of these three strategies to a passive strategy of holding swaps and investing the underlying assets in cash earning EONIA (Euro Over Night Index Average).

This analysis shows that active management is the most efficient way to achieve the required outperformance (outperformance of 0.8% per annum for a tracking error of 1.1% pa). This is not surprising because an active strategy targets outperformance using a range of sources of excess return. The strategy is therefore inherently more diversified than the other approaches which rely on more passive exposures to market spreads (credit spreads in the case of credit plus swaps) and OAT spreads.

The credit plus swaps approach also delivered a return in excess of the 0.5% target (at 0.6%), but for a higher tracking error vs. the liabilities of 1.7%. The long-dated OAT strategy, on the other hand, would not have met the return target, as OAT swap spreads widened over the period, resulting in an underperformance of about 2.5%. The tracking error was also extremely high at over 6%.

The results for the passive strategy are also disappointing. The tracking error is low, as expected, and a passive matching approach clearly cannot generate 0.5% excess return, but the strategy actually underperforms the liabilities by 0.6%. This is driven by the six-month Euribor rate payable on swaps, which is below the rate earned on the cash allocation of EONIA. This was already an issue under the old regime, meaning passive replication of liabilities was not possible. But the passive LDI strategy presents an even larger drag on coverage ratios under UFR.

The need for rebalancing

Finally, LDI strategies need to be rebalanced to avoid mismatches that may emerge over time. Under the old regime, a matching portfolio would age roughly along the same track as liabilities. But the need to rebalance under a UFR framework relates to the way the UFR curve is constructed: Longer-dated liability cash flows are less sensitive to market moves, but as time passes and liability cash flows become shorter-dated, their sensitivity to market rates increases. This means hedges for these cash flows need to be rebalanced and increased over time.

A simple example of this need for rebalancing can be seen if we look at cash flows in 21 years. Initially, the UFR matching approach would be to invest less than 100% in a 21-year swap, because the UFR curve is only partially driven by market rates beyond 20 years. One year later, the liability has a maturity of 20 years and so does the swap hedge. However, the matching approach now would be to invest the full liability value into the 20-year swap. So the LDI portfolio needs to be adjusted to include more 20-year swaps. Under the old regime, no additional swap exposure needed to be added because both assets and liabilities were valued on the same basis.

Figure 6 expands this analysis by applying it to the full liability profile used earlier. It shows the maturity bucket mismatches after one year, when hedges need to be increased in the 20- and 30-year buckets, and reduced in the 15-year bucket to maintain an accurate hedge of the UFR liability. These changes all represent less than one year of duration, so they may not seem large. But combined they represent about 15% of the total LDI strategy. So if left unchecked, the mismatch between LDI strategy and liabilities could quickly become significant.

How would we put it all together? There are many different solutions, but in our view the closest UFR match is achieved by structuring LDI mandates as an actively managed portfolio benchmarked against a combination of swap indices. Figure 7 shows an example of such a benchmark as well as key rate duration profiles of both the benchmark and the liabilities.

Implications for pension plans

Three adjustments need to be made in liability-matching strategies as a result of UFR: reduce duration, increase return targets and rebalance more frequently. We believe our approach – structuring LDI mandates as an actively managed portfolio benchmarked against a combination of swap indices – meets these three requirements:

- The swap index weights are chosen so that the benchmark duration and curve exposures match the UFR liabilities.

- The portfolio will be actively managed with an alpha target to cover the additional yield needed under UFR.

- The swap indices can be selected to rebalance automatically every month. So every month a 30-year swap index will assume that the maturity of the swap is extended back to 30 years.

So, many pension funds, especially those with low coverage ratios and recovery plans in place, will find it hard to ignore UFR.