Alternative ETF Strategies For Everyday Portfolios

Post on: 8 Июль, 2015 No Comment

Alternative ETF Strategies For Everyday Portfolios

Seeking Alphas Jonathan Liss recently spoke with Gary to find out how he planned to use ETFs including alternative ETF strategies not frequently found in more typical investor portfolios to position clients in 2013.

Jonathan Liss (JL): How would you describe your investing style/philosophy?

Gary Gordon (GG): Information processing is the best way to describe the way that I invest. I gather information (e.g. fundamental, technical, contrarian, economic, historical, etc.), select exchange-traded funds based on that information, and control the investment outcome of every decision. Information is the input, choosing ETFs with stop-limit loss order protection is the process, and the outcome is always a big gain, small gain or small loss. Whether using a hedge, a stop or a trendline for controlling the outcome of an investment decision, no big losses are permitted in portfolios.

JL: Ive been meaning to ask you this for awhile now. As you just noted and frequently note in your writings, you actively manage downside risk via stop-limit loss orders but dont spell out what the exact parameters are. Do you use the same percent stops for every holding, or does it vary by fund? If it varies, is that based on riskiness of asset class, historical standard deviation, or some other factor or set of factors?

GG: Stops vary by two primary factors – the risk of the asset and the weight in the portfolio. In general, although volatility can change on any asset (i.e. TLT is a good example), fixed income assets are less risky than higher-yielding income; large cap dividend stocks are not as risky/volatile as large cap growth or small caps, which are not as risky as foreign and emerging equity and so forth.

The second factor is the weight in the portfolio. If the SPDR S&P 500 ETF (SPY) is 10% of your portfolio, one might select a hard trailing stop at 7.5%. If SPY is only 5% of the portfolio, however, the impact on the portfolio is half as much, and a 15% stop would have the same impact. That said, 15% stops are much wider than I would ever use, and I might employ trendlines to make the sell determination. Or, I might sell ½ a position at 8% and the other half at 12%.

In sum, there are many ways to reduce risk, with stops being one of them. And please don’t ask when you “by back in.” There are 1,500 other ETF choices to buy when you sell something. Or if one insists on buying the same asset, one can use the exact same parameters coming off a low reached from the point at which you sold i.e. a 7.5% climb off of a low that is reached.

JL: As we approach 2013, are you bullish or bearish?

GG: The question is somewhat irrelevant for an information processing approach to market-based securities. Technical weakness can arise during the 2013 year, though strength and value is evident in a number of emerging market stocks. I expect many to offer double digit returns, so that may be viewed as bullish.

I believe in the China turn-around theme, and am bullish on the country’s Asian neighbors like Malaysia and Singapore. Pacific providers like Australia and Latin American resources standouts (e..g, Chile) should be among the leaders.

On the other hand, I am less excited by high-flying emergers from 2012 like Turkey. And I am not sold on MENA (Middle East & North Africa). I expect Europe to be the source of enormous consternation yet again, and do not recommend any unhedged exposure to the region.

JL: Which asset classes are you overweight? Which are you underweight? Why?

GG: In U.S. stocks, I am currently overweight telecom as well as consumer staples and discretionary. I am underweight domestic common stock utilities. I like Asian country and regional stock ETFs.

In income, I have zero exposure to any developed world treasuries. I am sticking with emerging market sovereign debt. I have plenty of exposure to emerging and U.S. corporates, investment grade and high yield… and believe that ETFs diversify the risk adequately. I like preferreds, excluding banks via Market Vectors Preferred Securities ex Financials ETF (PFXF). In fact, most of the exposure here to income is via ETF.

JL: Which benchmark do you use?

GG: We manage money for all different client needs, from non-stock ultra-conservative to 100% stock ultra-aggressive, so there is no single appropriate benchmark for performance. That said, for moderate investors where we may target 65% growth/35% income in uptrending markets, and where we may be closer to 40%/40%/20% cash in downtrending markets, it’d be appropriate to benchmark against a classic 65%/35% buy-n-hold stock/bond index or a Lipper Balanced Fund average.

JL: Do you mean capital appreciation when you say 65% growth, or something else? Does 65% growth/35% income mean thats the stock/bond divide, or would things like high dividend stocks, REITs and MLPs count towards the income side of things? Where do commodities fit in to that mix?

GG: Growth is primarily capital appreciation. It does not mean that that there aren’t dividends or distributions of some kind involved. It simply means that in the course of total return, one’s expectation is for more of the total return to come from capital appreciation. Income is primarily interest and yield that one expects to be the larger component of the total return (on that side of the portfolio). Investment grade bonds through convertibles, high yield, preferreds both foreign and domestic fit the bill for income.

Of course there are a few exceptions. I might expect 5% growth and 5% yield from an MLP or REIT but that is essentially growth. Here you have to take into account the volatility of the asset as well. Is the standard deviation more like a fixed income vehicle or a stock vehicle? That will be the primary determining factor. Commodities fall out on the growth side.

I realize that whether you are talking about stop losses or allocation, you’d like black-n-white… but investing involves plenty of shades of gray. You wouldn’t use a 200-day moving average for the S&P 500 SPDR Trust (SPY) to buy or sell the Global X Columbia 30 (GXG) or iShares MSCI Chile (ECH) or iShares Preferred (PFF) or PowerShares Bank Loan (BKLN). They all have their own trendlines for that decision-making. Same with stop-losses.

Asset Allocation is the same. Its not black and white across every asset. For the most part, you can use growth when the largest contributing component to total return expectations is capital appreciation and you use income when the largest contribution comes from the expected cash flow (yield).

JL: Perhaps more than any popular portfolio manager on Seeking Alpha, you have been a consistent early proponent of ETFs offering alternatives to standard market cap weighted funds.

GG: Why thank you.

JL: Among funds you have advocated in just the past few months are the WisdomTree Europe Hedged Equity ETF (HEDJ) which allows investors European equity exposure while hedging a declining euro as well as low volatility alternatives like Emerging Markets MSCI Minimum Volatility ETF (EEMV) and PowerShares S&P 500 Low Volatility Portfolio ETF (SPLV). How do you determine which newer products/strategies are worthy of further consideration, and which are just a passing fad? What are the minimum liquidity and AUM requirements before you seriously consider a fund?

GG: I recently gave a presentation at the Global Indexing and ETF Conference in Phoenix AZ on this very topic. If you’re talking about a person, a product, a business, a team or even a country, the key ingredients are the same: One part innovation, one part motivation and one part “right place, right time.”

So, in determining ETFs that are worthy of consideration versus a passing fad, an excellent idea must be accompanied by great timing and phenomenal fund provider commitment. It’s not enough to open up shop and declare a “Small Cap Emerging Markets Materials and Infrastructure ETF” a masterpiece.

Take SPDR Barclays Capital Short Term High Yield Bond (SJNK). Before March of 2012, if you wanted access to a diversified basket of short-term high yield corporates, you had to go with a single year in the Guggenheim BulletShares series. Not that there’s anything wrong with that. On the other hand, the folks at State Street designed SJNK with greater tradability and one-stop access to the asset class in mind. $520 million in inflows in 8 months is probably a great sign that SJNK’s 5.2% via 338 holdings (avg maturity 3.5 years) has a great shot at enduring.

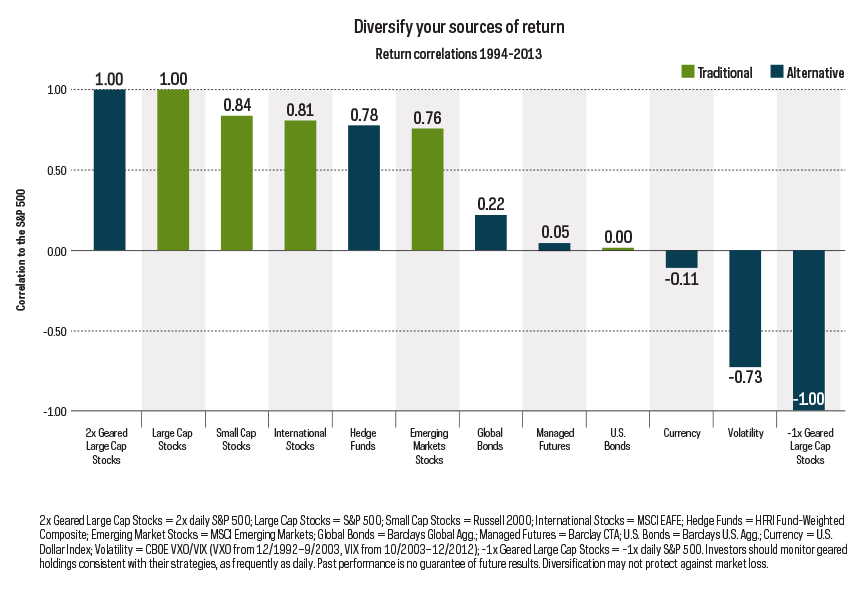

As for the idea that “low volatility” may be just a passing fad, don’t expect investors to abandon “New Normal” thinking anytime soon. Sure they will lose some luster in a raging bull market, but as long as there’s a place for tradable alternatives to buy-and-hold, expect money managers to look for something that diversification alone isn’t able to provide a smoother ride. And yes, that makes a staples/health care/utilities heavy iShares Emerging Minimum Volatility ETF (EEMV) a worthy alternative to Vanguard Emerging Markets Stock ETF (VWO).

Average daily dollar volume for an ETF must be greater than $100,000. And I prefer ETFs with at least $50 million in AUM.

JL: How much of an allocation do you feel alternative investing strategies generally deserve alongside ‘core holdings’?

GG: I genuinely do not view the alternatives as being altogether different than “core.” If the info is pointing to non-cyclical strength, perhaps EEMV is chosen over VWO. If strong evidence is suggesting cyclical success, core ETFs like iShares Russell 1000 Index ETF (IWB) and iShares S&P MidCap 400 Index ETF (IJH) would be preferable to SPLV. And if I want access to Europe, why do I need a “core” unhedged Europe like Vanguard European Stock ETF (VGK) when the dollar-hedged HEDJ is less of a risk.

JL: Which alternative equity strategies do you feel offer the best upside potential/downside protection heading into 2013 and beyond?

GG: Best upside potential? If we consider Asia ex-Japan an alternative equity allocation, then iShares MSCI All Country Asia ex-Japan Index ETF (AAXJ) fits the bill. We’ve already discussed EEMV. Also PowerShares DWA Emerging Markets Technical Leaders Portfolio ETF (PIE) is on my radar.

To be clear, I don’t believe in buying any investment without active management of the downside risk. I do not buy and hold for the upside potential. I always make sure that an outcome is a big gain, small gain or small loss. PFXF has downside protection built in from eliminating financial stock volatility, but even here, I actively manage downside risks.

JL: How many portfolio holdings is too many to properly manage? How many is too few to offer proper diversification?

GG: When it comes to ETFs, 15 tends to be the upper limit. Less than 8 is unlikely to provide enough diversification across U.S./foreign/emerging growth and income.

JL: Let’s revisit the fixed income space. You were also an early adopter of Emerging Market sovereign debt ETFs. Are you still bullish on these funds? Do you prefer the plain vanilla or local currency versions of these funds?

GG: Honest to goodness, I think investors should be looking at all fixed income from emergers, from local currency to dollar hedged, from sovereign to corporate, from investment grade to high yield. The choices are as much about risk tolerance and diversification, and would be just as important to consider as everything in the U.S. fixed income space.

Personally, I see little value in Treasury ETFs, and only consider them as a short-term safe haven move. Even then, I prefer short-term iShares Barclays 1-3 Year Credit Bond ETF (CSJ), or money market cash. For at least as long as the world’s central banks artificially depress rates, one has to look at the better yielding alternative and the historical spread. If the historical spread between emergers and U.S. treasuries were tight, I might reduce exposure. But as long as the spreads remain historically favorable, as long as technical trends tell me to stay there, emerging debt works.

JL: Where have you been having retirees turn for income in this record low rate environment? How have potential changes to the tax code affected your assessment of interest-paying investments?

GG: I’ve had to trim MLP ETFs from client portfolios. This was an asset class that I normally used as a go-to winner. Yet dividend uncertainty as well as MLP structure uncertainty has sent them into a downtrend. I haven’t backed out of Muni ETFs, even with the selloff on chatter of reducing tax-exempt status for the wealthy. I will let the long-term trend and stop-losses dictate that decision.

Retirees simply can’t get CDs or short-term investment grade bonds to do the trick in this environment. I’ve simply needed to move up to intermediate and long-term investment grade, senior notes, convertibles, preferreds and emerging debt. I actively monitor the downside risk, so we are watching the possibility of interest rates rising as a catalyst to trim exposure.

JL: Which global issue is most likely to adversely affect U.S. markets in the coming year? Issues which feature prominently in our minds at present include continued Eurozone contagion risks; the Iranian nuclear threat/potential disruption to global energy markets; a Chinese economic slowdown; and accelerated climate change and weather-related events.

GG: China’s economy has already stabilized and will continue to show recovery signs. I’m not on the China hard landing wagon. It is already a soft landing from my perspective. The Eurozone is, was, and will continue to be a major problem in my book. The Middle East and Israel’s diminishing patience with many of its border enemies could also create havoc.

JL: Do you believe gold and other precious metals are a genuine hedge in uncertain markets? If so, how much exposure do you have?

GG: Yes I do, but 5% is the most direct exposure (IAU, GLD) I place in portfolios. There may be some indirect exposure at times.

JL: What advice would you give to a ‘do-it-yourself’ investor in the present investing environment?

GG: Keep costs as low as possible by using ETFs, and where possible, no cost trading of those ETFs. TD Ameritrade has more than 100 that trade at no cost. Strive for a total portfolio yield that is at least 2x the current 10-year treasury yield. That’s a good yardstick, if your cash flow is 3.5% when the 10-year is 1.75%.

Also, spend at least 45 minutes a week, perhaps on Friday, making sure that your individual positions remain in a long-term uptrend. If not, consider the circumstances under which you would sell that position to secure a big gain, small gain or small loss. In that manner, you won’t ever have the one bad apple that spoils your entire basket.

You can listen to the ETF Expert Radio Show “LIVE”, via podcast or on your iPod. You can follow me on Twitter @ETFexpert .

Disclosure Statement: ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc. and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Share this post: