Advantages and Disadvantages of Investing in Bond ETF

Post on: 8 Апрель, 2015 No Comment

Advantages and Disadvantages of Investing in Bond ETF

by Frank Luca 0 Comments

Are you looking for high yield investment options? In this case, it would be expedient for you to invest in bond ETF s. Bond exchange traded funds will be the best option for people who want to put their money in a short term investment, and yet, can still get good earnings.

Despite the fact that an exchange traded fund tracks a market, sector or index, it can be traded like a stock. The ETFs are considered to be a reliable investment option. This can be explained by the fact that if you invest in bond ETF. you are actually putting your money in high-quality and short-term securities. Nevertheless, there are certain risks as well.

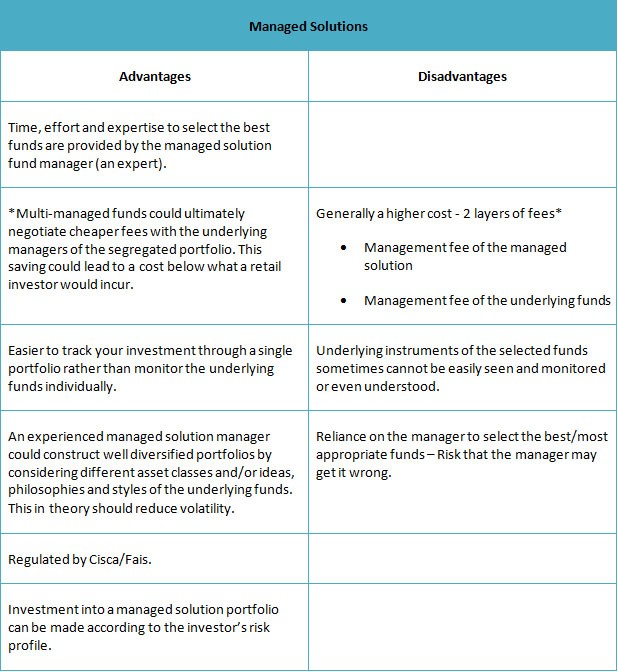

Like many other investments, bond exchange traded funds have also their pros and cons. Here, we will tell you about the main advantages and disadvantages of bond ETFs.

The Main Benefits of Investing in Bond ETF

Bond exchange traded funds are available in a vast variety of investment options. This means that investors can select short term and high yield bond ETFs for their portfolio. Do you want to put your money in foreign currencies? In this case, you should definitely need to consider such bond exchange traded funds as the WisdomTree Dreyfus Euro Fund and WisdomTree Dreyfus Chinese Yuan Fund.

Bond ETFs are a very liquid investment option. Due to the fact that bond ETFs are traded like stocks, they can easily be converted into cash almost at anytime of the day.

Bond exchange traded funds demonstrate a great performance. That’s why they are considered to be one of the most profitable investment options which are available for investors today. Investors who are searching for high yield investments should definitely draw their attention to corporate bond funds. They perform well and provide investors with a great profit potential.

The Main Disadvantages of Investing in Bond ETF

When putting money in bond exchange traded funds. investors can lose their principal. Such investor’s risk is explained by the fact that the prices of bond ETFs are not stable. Nevertheless, investors can minimize their risks significantly if they put their money in bond exchange traded funds for a short period of time.

Bond ETFs may provide investors with negative returns. Thus, investors who put their money in bond exchange traded funds can’t be sure that their capital will be preserved. You may ask experienced investors to giveyou ideas about this disadvantage.

Some bond ETFs pose huge investor’s risks. The point is that their holdings list includes lower-quality bonds which can’t provide investors with high returns. Thus, it would be expedient for investors to know how funds are traded before investing in bond ETF s.