Adjusting Iron Condors

Post on: 4 Июль, 2015 No Comment

Despite what others might try and tell you (usually when they are trying to sell you something), adjusting Iron Condors is not rocket science. You don’t need some fancy system or training that costs hundreds of dollars, and trust me there are hundreds of websites run by slick internet marketers trying to sell these products. There is no special sauce when it comes to adjusting iron condors, all you need is a couple of different choices and a system that you stick to. I will outline a few of those choices for you here today (and you won’t need to pay hundreds of dollars for it!!)

When it comes to market neutral strategies, you can’t do much better than iron condors. This options trading strategy profits if the underlying stock remains within a specified range. What hurts this strategy is sharp moves in either direction after the trade is placed. Sometimes, and it depends on the timing and how you have structured your Iron Condor, you can still ride out these big moves and be profitable. However, at other times, these violent moves can have a negative effect on your position at which point you need to make a decision as to whether to close the trade and take your loss, or make an Iron Condor adjustment. These decisions should all be part of your trading plan and you should know what you are going to do in advance should a big move occur. What you don’t want to do, is close your eyes, cross your fingers and hope that the position comes back into profit. With Iron Condors, you can lose more than you make, so it is VERY important that you don’t let small losses turn into very big losses.

Before we get to how to adjust an Iron Condor, it’s important to have a general understanding of the strategy. The key features of Iron Condors are:

• This strategy is set up by selling a Bear Call Spread and selling a Bull Put Spread .

• They have a limited profit potential, which is limited to the premium collected on the Bear Call Spread and the Bull Put Spread.

• Potential losses are higher than potential profits.

• This is a strategy that has a high probability of success, usually around 80%. This is offset by the risk that you can lose more than you can make. Hence adjusting your losing trades is very important

• You will not win every time with Iron Condors. that’s just a fact of life. Even with adjustments, you will still have some losing trades, as with any strategy.

• The most important consideration is not incurring big losses that give back a lot of your gains from previous trades.

To give you a quick example of what can go wrong, on July 28th I entered the Bull Put side of an Iron Condor on RUT (having already placed the Bear Call Spread a few days earlier), with strike prices of 670 and 660. At the time, RUT was trading at around 799. Then, in early August, we had the mini market meltdown and on August 4th, RUT had dropped to 727. This was a worst case scenario for me, with the underlying index making a sharp move only a few days after I placed the trade. With the risk involved, I had to close the trade for a loss of $3,094. However, a few days later I was able to adjust the trade by re-entering the Bull Put Spread at 560-570 and made $1,222 on that trade which offset some of my losses from the initial position. When you take into account this and the profits from the Bear Call side of the Condor, I was only down $828 for the month, which was a very reasonable result considering the situation. This is an example of adjusting an Iron Condor by rolling the losing side to lower strike prices (if the call side was the losing side, you would roll to higher strikes). I’ll now detail out a few more options for adjusting Iron Condors:

Choice 1) Do nothing and wait for the underlying to reverse direction and the losing side comes back into a comfortable level. Yes, this is an option, but as I said earlier, you need to be careful not to let a small loss turn into a big loss. For the RUT trade I mentioned earlier, if I had not closed it on Aug 4th, my losses would have been MUCH larger when the index eventually bottomed around 640 on August 9th. The other thing to consider with doing nothing is the stress you will be under for the remaining duration of the trade and the fact that these positions become harder to adjust the closer you get to expiry.

Choice 2) Roll down (up) to lower (higher) strikes. This is what I did with the trade above, and I did what I called a delayed roll, where I closed the trade and then waiting a few days before rolling it to the lower strike. This allowed me to get further away from the market and also receive more option premium due to the further spike in volatility.

Choice 3) Roll down (up) and out. So, in addition to rolling your strikes down (up), you also roll out for 1 more month. This allows you to get even further away from the market and also pick up extra premium due to the increased time to expiry. The downside to this is that you now have the position open for an extra month, and you may not want the exposure to be open for that long. When trading Iron Condors, you do not want to go too far out in time as the time decay benefits are reduced.

Choice 4) You could roll both the Bull Put Spread AND the Bear Call Spread. In the RUT case above, in addition to rolling my Put Spreads down, I also rolled down my Call Spreads down from 910-920 to 720-730. This resulted in an additional $897 in income for the month which further helped offset my losses from the initial Bull Put Spread loss. The risk with this is that you roll the calls down only for the underlying to move back in the other direction and then you could be faced with losses on BOTH sides of the Condor.

Choice 5) Another option that works, is to HEDGE your position by either buying the underlying OR buying some out-of-the-money options. The easiest way to do this is with stock and using delta. Assume your delta on the Put Spread is around 0.15. You could sell 7 shares to hedge half of your current delta (or whatever ratio you decide is appropriate). The risk with this is that if the underlying rises, you end up giving up some of your profits on the Iron Condor, but that’s the price you pay for protection I guess. The other issue is that the delta will change over time, so you may need to buy or sell more of the underlying to adjust your hedge which again could erode some of your profits and also incurs transaction costs. If you chose to hedge with options, you could look at buying some puts (calls) further out of the money than your Condor strikes. Again, use delta as a guide here.

Choice 6) The final option is to simple cut your losses, walk away and wait for another opportunity. As with doing nothing, this is also a decision that you can make, remember that cash is a position! Sometimes it can be better to just close things out, clear your head and come back with a fresh look at things. In this case, you could choose to close both sides of the Condor, or just the losing side.

These 6 scenarios presented above are really the main options when it comes to adjusting Iron Condors. So, there you have it, information that took probably 10 minutes to read that could have potentially cost you hundreds of dollars if you were on a different site. Please feel free to share this post on Facebook or Twitter.

I publish my trading results each month, be sure to check them out HERE .

Here’s to your ultimate success!

UPDATED INFORMATION FEB 9TH, 2012

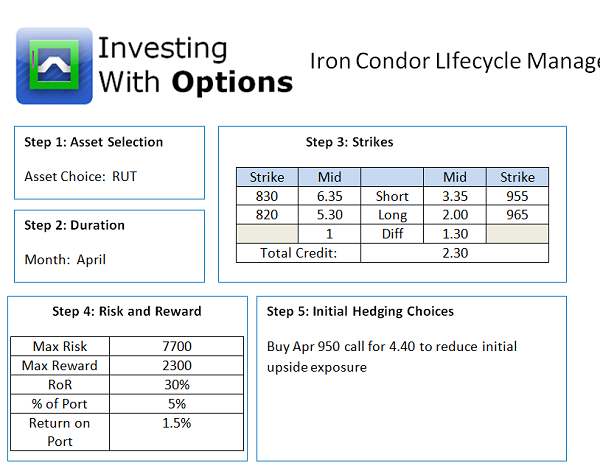

I’m running a coaching class at the moment and we had a session yesterday where we looked at some of the choices for adjusting an RUT Feb Iron Condor. Below is a 45 minute video where I take an in depth look at the trade and how to adjust out of a trade that has moved against us. I also go through details of the trades I have placed over the last month and how I plan to manage them into expiry next week. This trade was an option alert trade as part of my IQ Trade Alert service. The original details of the trade as given to IQ Alerts subs is as follows:

Date: January 13, 2012

Strategy: Iron Condor – RUT (Half Position Size)

Current Price: $768

Trade Set Up: Sell RUT Feb 16th, 840 CALL, Buy RUT Feb 16th 850 CALL for $0.50 ($50) or better.

Sell RUT Feb 16th, 640 PUT, Buy RUT Feb 16th 630 PUT for $0.45 ($45) or better.

Premium: $95 (0.95) Net Credit or better.

Trade Management / Adjustment Points: Adjustment points if either spread gets to $150 ($1.50) and /

or RUT breaks above 820 or below 680. If this occurs, I will do one of the following depending on market

conditions:

‐ Take losses

‐ roll up to higher / lower strikes

‐ roll up to higher / lower strikes and / or add the second half of our position

Margin / Return Details: For this trade we are risking roughly $905 in margin to make $95, for a return of 10.50%. This trade will be profitable if RUT finishes above 640 and below 840 at expiry. We have a 16.23% margin for error on the downside and a 9.95% margin on the upside.

Profit Target: If either Spread trades down to 0.05 or 0.10, we will take our profits.

Comments: I’m just trading half positions size today as I feel the market is due for a big move shortly. If that happens within the next week, I will add the second half of the position, otherwise I will look to ride this one to expiry. Technical the market are looking a bit overbought, but in a strong uptrend that can remain for some time, I think any pullback will be shallow and if that occurs I’ll add the second half of our position if we get a nice spike in the VIX. We still have a Bear Call Spread expiring next week, so keep that in mind when looking at this trade. The selloff today has seen a nice increase in volatility allowing us to get in at a nice entry point. We’re placing our strikes a little closer on the upside due to the overbought conditions and the fact that if that side gets in to trouble it will be easier to adjust.

Concerns: Markets are overbought and a sharp pullback could hurt this position, so risk management will be key with this one. If things start to move around a lot next week, I may look to hedge with some weekly options.

If you’re more risk averse you may want to wait a day or so to enter the trade in case the market

continues to rally as you may be able to get a better price, or move your strike prices higher.

Get a Free Copy Of All My Trading Tools and Resources