ActivelyManaged ETFs Risks And Benefits For Investors

Post on: 8 Апрель, 2015 No Comment

Exchange-traded funds (ETFs), in their original incarnation, mirrored various equity market indexes. ETFs that track the S&P 500. the Dow Jones Industrial Average and nearly every other equity index imaginable are widely available and wildly popular. But they are still evolving. The second generation of ETFs does not seek to replicate the performance of a particular market index; rather, it seeks to outperform its benchmarks through active portfolio management. Here we’ll take a look at the benefits and challenges of actively-managed ETFs .

The Big Challenge: Transparency

Transparency Challenge No.3: Arbitrage

Another transparency concern involved fund pricing and arbitrage. To understand the basics of this strategy, you need to know that ETF shares can be bought and sold on the open market (the method used by most individual investors) or the shares can be returned to the firm that created the ETF in exchange for the underlying securities. For example, if an ETF holds underlying shares of two automakers, an institutional investor holding a large block of the ETF shares (known as a creation unit ), can exchange the ETF shares for shares of the automakers. Due to the large number of shares required to form a creation unit, this strategy is generally engaged in only by large institutions.

Arbitrage occurs at the creation-unit level. In the traditional ETF market, if the price of the ETF does not match the price of the underlying holdings, the professional investors create or cash in creation units in order to profit from the price difference. For example, If an ETF is trading at $12 per share, but the value of the underlying stocks is $12.50, arbitrageurs would buy enough shares of the ETF on the open market to form a creation unit and then return the ETF shares to the company that created the ETF in exchange for the underlying shares of stock. The stock would then be sold, locking in the price difference as a profit.

With an actively-managed ETF, if the firm that creates the ETF does not reveal the underlying holdings, arbitrage cannot occur. The result could be an ETF that trades at a substantial premium or discount to the actual value of its underlying holdings.

Additional methodologies will, no doubt, be developed as the number of actively-managed ETFs expands.

Benefits of ETFs

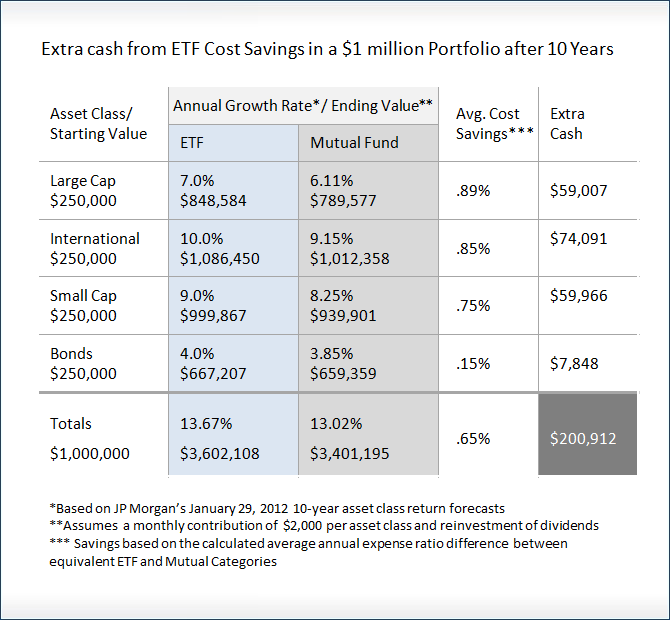

The expansion of ETFs in the actively managed realm offers nearly limitless choices. Consider, for example, an ETF that invests in 50 Nasdaq -listed securities in an effort to beat the Nasdaq 100 benchmark, or an ETF that invests in 50 securities in an effort to beat the S&P 500. The funds expand the number of available investments and result in lower costs for many investors, as the expense ratios for ETFs are often just a fraction of the cost of mutual fund ownership. Also, ETFs are able to keep costs low because trades occur on the open market or via redemption for the underlying securities. In both cases, the ETF manager has no need to keep large amounts of cash on hand to handle redemptions the way mutual funds managers must. ETFs can remain fully invested, putting all of their cash to work in an effort to generate investment returns, while mutual fund managers are forced to hold cash. Just be sure to keep in mind that ETF investors do pay to conduct trades, so dollar-cost averaging may not be a cost-effective strategy.

The Bottom Line

While actively-managed ETFs present some new challenges for the market and for investors, they also present new opportunities for diversified investment. As ETFs continue to evolve and new types emerge, it is up to investors to stay informed about the benefits and drawbacks of these securities and to take advantage of what they have to offer, while taking steps to mitigate any risk they may pose.