Active Investment Management Misses The Mark

Post on: 7 Апрель, 2015 No Comment

The Deutsche AWM team represents a diverse universe of talents and collaborates across all businesses to provide seamless access to our organization.

The Deutsche AWM team represents a diverse universe of talents in terms of cultural scope and expertise and collaborates across all businesses and markets to deliver lasting value.

Deutsche AWM follows a one-team-collaboration-approach to provide seamless access to all resources of our network.

Deutsche AWM‘s scale and expertise are the foundation of financial strength and Thought Leadership.

We strive to deliver leading investment strategies, a highly efficient investment platform and superior client services to institutional investors, private clients and intermediaries.

Business facts of Deutsche AWM including assets under management, target countries and markets, number of employees etc.

Deutsche AWM unites all asset and wealth management capabilities of DB Group under one roof. We deliver lasting value for our clients as one team across all our businesses.

Our mission is to create lasting value for our clients. As one team we are fully committed to designate all our capabilities to find the best solutions for your individual needs.

Our Client Value Approach summarizes the unique strengths of Deutsche AWM: Financial stability and strength, Thought Leadership and our one-team approach.

Deutsche AWM serves private investors, institutional investors and intermediaries in any financial market for any investment need.

For our demanding clients – no matter if private or institutional — our dedicated coverage teams are designed to pull together the entire expertise of our global organization.

Our Value Approach combines our financial strength and stability, our thought leadership and our one-team-approach to create lasting value for our clients.

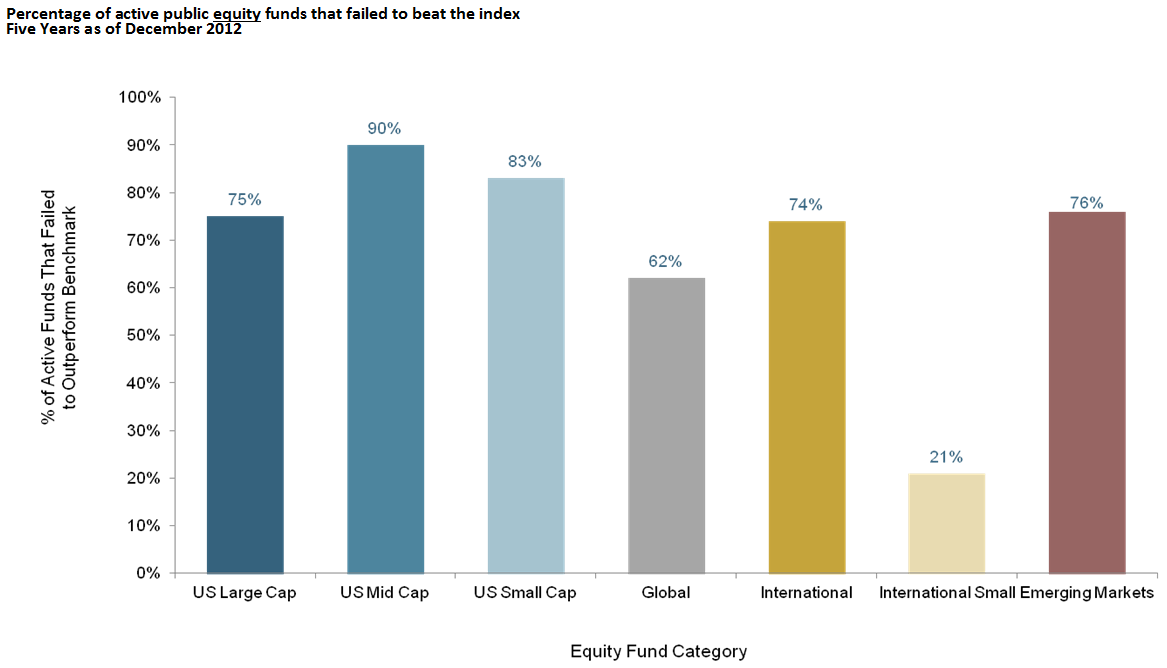

We believe in active investment management and use deep market expertise to create innovative solutions for our clients, investing assets worldwide.

Deutsche Asset & Wealth Management provides transparent and cost-effective passive investment products to institutional and private investors.

As one of the world’s largest managers of alternative investments, Deutsche Asset & Wealth Management is designing and managing various investment solutions.

Within Deutsche Asset & Wealth Management, dedicated cash and liquidity management specialists create compelling liquidity management solutions.

We offer our clients various management services. These solutions are delivered by our global organization.

Our investment process is run by the Wealth Management Global Investment Committee (GIC). The function of the GIC is to create a formal asset allocation

We offer our clients a banking, investment management and fiduciary platform that delivers proprietary and open architecture solutions of superior quality.

We offer traditional and alternative investments across all major asset classes and provide wealth management and private banking solutions to high-net-worth clients and family offices.

Our house view and the proprietary outlook for global economies and financial markets are developed in the Chief Investment Office.

Find out more about the team around our CIO Asoka Woehrmann.

Find out more on the setup of our Chief Investment Office and access all current CIO publications.

Global Financial Institute’s publications combine the views of our investment experts with those of leading academic institutions in different countries.

The Economist Intelligence Unit is a unique resource for economic and business research, forecasting and analysis.