Acquisition Valuation Methods

Post on: 6 Июнь, 2015 No Comment

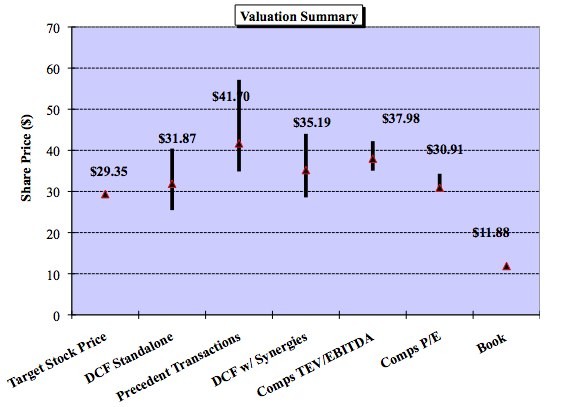

When contemplating the acquisition of another business, a key issue is the price to pay for the acquisition target. There are many ways to value a business, which can yield widely varying results, depending upon the basis of each valuation method. Some methods assume a valuation based on the assumption that a business will be sold off at bankruptcy prices, while other methods focus on the inherent value of intellectual property and the strength of a companys brands, which can yield much higher valuations.

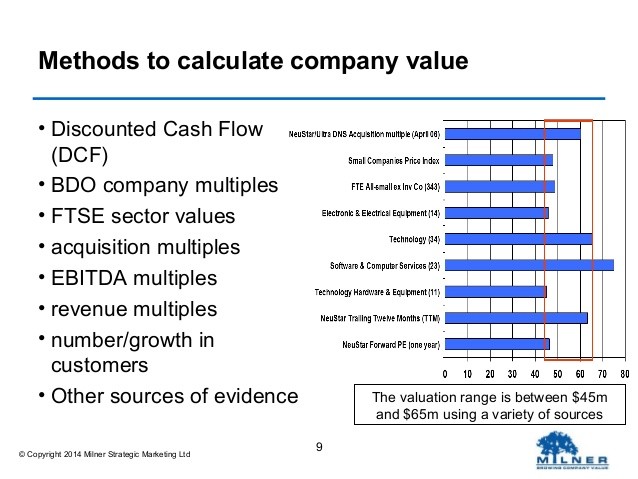

There are many other valuation methods lying between these two extremes. The following are examples of business valuation methods:

- Liquidation value. Liquidation value is the amount of funds that would be collected if all assets and liabilities of the target company were to be sold off or settled. Generally, liquidation value varies depending upon the time allowed to sell assets. If there is a very short-term fire sale, then the assumed amount realized from the sale would be lower than if a business were permitted to liquidate over a longer period of time.

- Real estate value. If a company has substantial real estate holdings, they may form the primary basis for the valuation of the business. This approach only works if nearly all of the assets of a business are various forms of real estate. Since most businesses lease real estate, rather than owning it, this method can only be used in a small number of situations.

- Relief from royalty. What about situations where a company has significant intangible assets, such as patents and software? How can you create a valuation for them? A possible approach is the relief-from royalty method, which involves estimating the royalty that the company would have paid for the rights to use an intangible asset if it had to license it from a third party. This estimation is based on a sampling of licensing deals for similar assets. These deals are not normally made public, so it can be difficult to derive the necessary comparative information.

- Book value. Book value is the amount that shareholders would receive if a companys assets, liabilities, and preferred stock were sold or paid off at exactly the amounts at which they are recorded in the companys accounting records. It is highly unlikely that this would ever actually take place, because the market value at which these items would be sold or paid off might vary by substantial amounts from their recorded values.

- Enterprise value. What would be the value of a target company if an acquirer were to buy all of its shares on the open market, pay off any existing debt, and keep any cash remaining on the targets balance sheet? This is called the enterprise value of a business, and it is the sum of the market value of all shares outstanding, plus total debt outstanding, minus cash. Enterprise value is only a theoretical form of valuation, because it does not factor in the effect on the market price of a target companys stock once the takeover bid is announced. Also, it does not include the impact of a control premium on the price per share. In addition, the current market price may not be indicative of the real value of the business if the stock is thinly traded, since a few trades can substantially alter the market price.

- Multiples analysis. It is quite easy to compile information based on the financial information and stock prices of publicly-held companies, and then convert this information into valuation multiples that are based on company performance. These multiples can then be used to derive an approximate valuation for a specific company.

- Discounted cash flows. One of the most detailed and justifiable ways to value a business is through the use of discounted cash flows. Under this approach, the acquirer constructs the expected cash flows of the target company, based on extrapolations of its historical cash flow and expectations for synergies that can be achieved by combining the two businesses. A discount rate is then applied to these cash flows to arrive at a current valuation for the business.

- Replication value. An acquirer can place a value upon a target company based upon its estimate of the expenditures it would have to incur to build that business from scratch. Doing so would involve building customer awareness of the brand through a lengthy series of advertising and other brand building campaigns, as well as building a competitive product through several iterative product cycles. It may also be necessary to obtain regulatory approvals, depending on the products involved.

- Comparison analysis. A common form of valuation analysis is to comb through listings of acquisition transactions that have been completed over the past year or two, extract those for companies located in the same industry, and use them to estimate what a target company should be worth. The comparison is usually based on either a multiple of revenues or cash flow. Information about comparable acquisitions can be gleaned from public filings or press releases, but more comprehensive information can be obtained by paying for access to any one of several private databases that accumulate this information.

- Influencer price point. A potentially important point impacting price is the price at which key influencers bought into the target company. For example, if someone can influence the approval of a sale, and that person bought shares in the target at $20 per share, it could be exceedingly difficult to offer a price that is at or below $20, irrespective of what other valuation methodologies may yield for a price. The influencer price point has nothing to do with valuation, only the minimum return that key influencers are willing to accept on their baseline cost.

- IPO valuation. A privately-held company whose owners want to sell it can wait for offers from potential acquirers, but doing so can result in arguments over the value of the company. The owners can obtain a new viewpoint by taking the company public in the midst of the acquisition negotiations. This has two advantages for the selling company. First, it gives the companys owners the option of proceeding with the initial public offering and eventually gaining liquidity by selling their shares on the open market. Also, it provides a second opinion regarding the valuation of the company, which the sellers can use in their negotiations with any potential acquirers.

- Strategic purchase. The ultimate valuation strategy from the perspective of the target company is the strategic purchase. This is when the acquirer is willing to throw out all valuation models and instead consider the strategic benefits of owning the target company. For example, an acquirer can be encouraged to believe that it needs to fill a critical hole in its product line, or to quickly enter a product niche that is considered key to its future survival, or to acquire a key piece of intellectual property. In this situation, the price paid may be far beyond the amount that any rational examination of the issues would otherwise suggest.

A discussion of acquisition valuation methods is available on Episode 76 of the Accounting Best Practices podcast. Listen Now .

Related Topics