Accounting Principles and Guidelines

Post on: 26 Май, 2015 No Comment

- Part 1

Introduction to Accounting Principles, Basic Accounting Principles & Guidelines

Other Characteristics of Accounting Information, How Principles and Guidelines Affect Financial Statements

Other Characteristics of Accounting Information

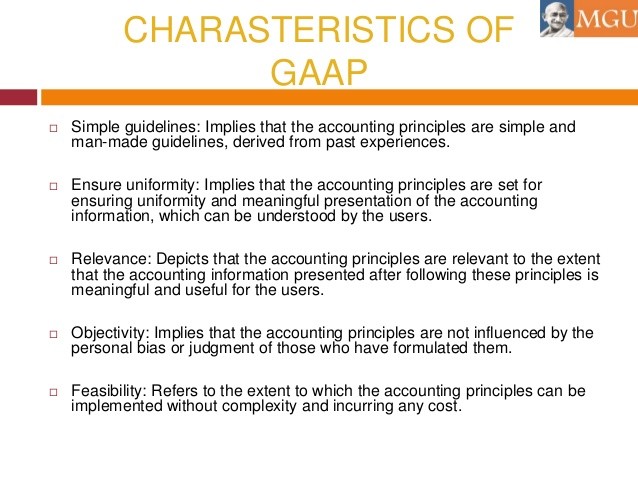

When financial reports are generated by professional accountants, we have certain expectations of the information they present to us:

- We expect the accounting information to be reliable, verifiable, and objective .

- We expect consistency in the accounting information.

- We expect comparability in the accounting information.

1. Reliable, Verifiable, and Objective

In addition to the basic accounting principles and guidelines listed in Part 1, accounting information should be reliable, verifiable, and objective. For example, showing land at its original cost of $10,000 (when it was purchased 50 years ago) is considered to be more reliable, verifiable, and objective than showing it at its current market value of $250,000. Eight different accountants will wholly agree that the original cost of the land was $10,000they can read the offer and acceptance for $10,000, see a transfer tax based on $10,000, and review documents that confirm the cost was $10,000. If you ask the same eight accountants to give you the land’s current value, you will likely receive eight different estimates. Because the current value amount is less reliable, less verifiable, and less objective than the original cost, the original cost is used.

The accounting profession has been willing to move away from the cost principle if there are reliable, verifiable, and objective amounts involved. For example, if a company has an investment in stock that is actively traded on a stock exchange, the company may be required to show the current value of the stock instead of its original cost.

2. Consistency

Accountants are expected to be consistent when applying accounting principles, procedures, and practices. For example, if a company has a history of using the FIFO cost flow assumption . readers of the company’s most current financial statements have every reason to expect that the company is continuing to use the FIFO cost flow assumption. If the company changes this practice and begins using the LIFO cost flow assumption . that change must be clearly disclosed.

3. Comparability

Investors, lenders, and other users of financial statements expect that financial statements of one company can be compared to the financial statements of another company in the same industry. Generally accepted accounting principles may provide for comparability between the financial statements of different companies. For example, the FASB requires that expenses related to research and development (R&D) be expensed when incurred. Prior to its rule, some companies expensed R&D when incurred while other companies deferred R&D to the balance sheet and expensed them at a later date.

How Principles and Guidelines Affect Financial Statements

The basic accounting principles and guidelines directly affect the way financial statements are prepared and interpreted. Let’s look below at how accounting principles and guidelines influence the (1) balance sheet, (2) income statement, and (3) the notes to the financial statements.

1. Balance Sheet

Let’s see how the basic accounting principles and guidelines affect the balance sheet of Mary’s Design Service, a sole proprietorship owned by Mary Smith. (To learn more about the balance sheet go to Explanation of Balance Sheet and Quiz for Balance Sheet .)

A balance sheet is a snapshot of a company’s assets, liabilities, and owner’s equity at one point in time. (In this case, that point in time is after all of the transactions through September 30, 2013 have been recorded.) Because of the economic entity assumption . only the assets, liabilities, and owner’s equity specifically identified with Mary’s Design Service are shownthe personal assets of the owner, Mary Smith, are not included on the company’s balance sheet.

The assets listed on the balance sheet have a cost that can be measured and each amount shown is the original cost of each asset. For example, let’s assume that a tract of land was purchased in 1956 for $10,000. Mary’s Design Service still owns the land, and the land is now appraised at $250,000. The cost principle requires that the land be shown in the asset account Land at its original cost of $10,000 rather than at the recently appraised amount of $250,000.

If Mary’s Design Service were to purchase a second piece of land, the monetary unit assumption dictates that the purchase price of the land bought today would simply be added to the purchase price of the land bought in 1956, and the sum of the two purchase prices would be reported as the total cost of land.

The Supplies account shows the cost of supplies (if material in amount) that were obtained by Mary’s Design Service but have not yet been used. As the supplies are consumed, their cost will be moved to the Supplies Expense account on the income statement. This complies with the matching principle which requires expenses to be matched either with revenues or with the time period when they are used. The cost of the unused supplies remains on the balance sheet in the asset account Supplies.

The Prepaid Insurance account represents the cost of insurance that has not yet expired. As the insurance expires, the expired cost is moved to Insurance Expense on the income statement as required by the matching principle. The cost of the insurance that has not yet expired remains on Mary’s Design Service’s balance sheet (is deferred to the balance sheet) in the asset account Prepaid Insurance. Deferring insurance expense to the balance sheet is possible because of another basic accounting principle, the going concern assumption .

The cost principle and monetary unit assumption prevent some very valuable assets from ever appearing on a company’s balance sheet. For example, companies that sell consumer products with high profile brand names, trade names, trademarks, and logos are not reported on their balance sheets because they were not purchased. For example, Coca-Cola’s logo and Nike’s logo are probably the most valuable assets of such companies, yet they are not listed as assets on the company balance sheet. Similarly, a company might have an excellent reputation and a very skilled management team, but because these were not purchased for a specific cost and we cannot objectively measure them in dollars, they are not reported as assets on the balance sheet. If a company actually purchases the trademark of another company for a significant cost, the amount paid for the trademark will be reported as an asset on the balance sheet of the company that bought the trademark.

2. Income Statement

Let’s see how the basic accounting principles and guidelines might affect the income statement of Mary’s Design Service. (To learn more about the income statement go to Explanation of Income Statement and Quiz for Income Statement .)

An income statement covers a period of time (or time interval), such as a year, quarter, month, or four weeks. It is imperative to indicate the period of time in the heading of the income statement such as For the Nine Months Ended September 30, 2013. (This means for the period of January 1 through September 30, 2013.) If prepared under the accrual basis of accounting . an income statement will show how profitable a company was during the stated time interval.

Revenues are the fees that were earned during the period of time shown in the heading. Recognizing revenues when they are earned instead of when the cash is actually received follows the revenue recognition principle and the matching principle . (The matching principle is what steers accountants toward using the accrual basis of accounting rather than the cash basis. Small business owners should discuss these two methods with their tax advisors.)

Gains are a net amount related to transactions that are not considered part of the company’s main operations. For example, Mary’s Design Service is in the business of designing, not in the land development business. If the company should sell some land for $30,000 (land that is shown in the company’s accounting records at $25,000) Mary’s Design Service will report a Gain on Sale of Land of $5,000. The $30,000 selling price will not be reported as part of the company’s revenues.

Expenses are costs used up by the company in performing its main operations. The matching principle requires that expenses be reported on the income statement when the related sales are made or when the costs are used up (rather than in the period when they are paid).

Losses are a net amount related to transactions that are not considered part of the company’s main operating activities. For example, let’s say a retail clothing company owns an old computer that is carried on its accounting records at $650. If the company sells that computer for $300, the company receives an asset (cash of $300) but it must also remove $650 of asset amounts from its accounting records. The result is a Loss on Sale of Computer of $350. The $300 selling price will not be included in the company’s sales or revenues.

3. The Notes To Financial Statements

Another basic accounting principle, the full disclosure principle . requires that a company’s financial statements include disclosure notes. These notes include information that helps readers of the financial statements make investment and credit decisions. The notes to the financial statements are considered to be an integral part of the financial statements.

Additional Information and Resources

Because the material covered here is considered an introduction to this topic, many complexities have been omitted. You should always consult with an accounting professional for assistance with your own specific circumstances.