Accounting for the Great Recession

Post on: 18 Май, 2015 No Comment

Why and how did the 2007-09 U.S. recession differ from all others?

Abstract

The 2007-09 U.S. recession was much different from other U.S. recessions since World War II. It was also unlike recent recessions in other advanced economies. Qualitatively, it closely resembles the Great Depression, particularly in its large impact on labor markets. This policy paper describes defining characteristics of the recent recession, analyzes distortions in economic relationships during it and other recessions, and examines two hypotheses for the Great Recession’s severity and length in the United States.

Empirical examination indicates that the decline in economic output and income in the recent U.S. recession (unlike the others mentioned) was due exclusively to severe distortion in labor markets. a key commonality with the Great Depression.

Analysis of potential distortions in economic relationships reveals virtually no deviation in productivity and very little distortion in capital investment during the 2007-09 U.S. recession. By contrast, U.S. labor markets exhibited extremely large distortion; labor income was essentially being taxed at nearly 13 percent.

Two hypotheses for the Great Recession—financial markets dysfunction and poor government policy—are discussed in the context of these diagnostic findings. The paper ultimately concludes that serious questions remain regarding the financial explanation. The policy explanation is more promising, but requires significant further research.

Introduction 1

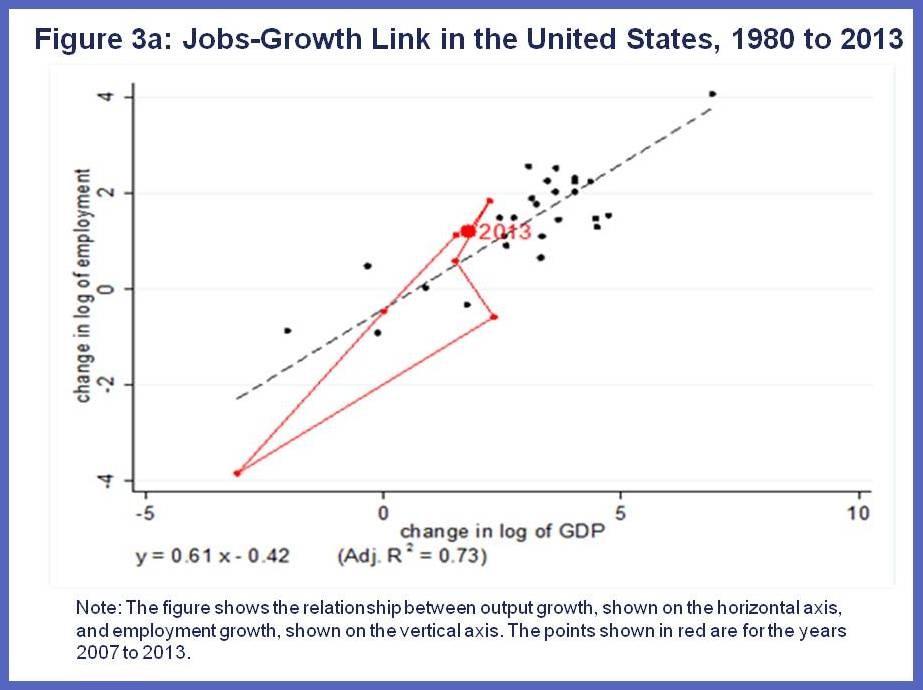

The 2007-09 recession in the United States was, by almost any measure, exceptional. It was markedly different from other post-World War II U.S. recessions; it was also quite unlike near-simultaneous recessions in other advanced economies. Indeed, in a qualitative sense, the U.S. Great Recession resembled the Great Depression far more closely than it did any of the postwar recessions. And similarly, economists have yet to reach consensus on what truly caused the Great Recession. Why was it so severe? Why did it last so long? Why, in particular, did it have such a major impact on labor markets? This economic policy paper describes some of the defining characteristics of the recent U.S. recession and examines two potential explanations for its impact and duration.

A close analysis of the 2007-09 recession reveals that the central commonality between the Great Recessionat least as experienced in the United Statesand the Great Depression is not the role of financial panic, as many have claimed, but rather severe distortion in labor markets. The fact that labor market dysfunction, not banking panic, was at the heart of both episodes of chronic high unemployment leads to very different conclusions about policy.

There is little doubt that a panic in financial markets, sparked by a collapse in housing prices and the value of mortgage-backed securities, led to the financial crisis that coincided with the worsening of the recent U.S. recession. But strong questions remain as to whether this dysfunction in the financial system, or poorly designed government policies seeking to ameliorate the recession or perhaps a combination thereof, was responsible for the recessions depth and duration. Similarly, the role of government policy in the onset and development of the Great Depression, particularly as it affected labor markets, deserves greater attention.

The goal of this paper is to diagnose the recent recession with an eye toward clarifying the factors that caused it to last as long as it did, with such harsh impact, especially on labor markets. The paper begins with a description of the significant differences among recessions just mentionedparticularly by pointing out that in the United States, unlike other countries recently and the United States in other recessions, the decline in economic output and income is due exclusively to a drop in labor input. It then proceeds with a diagnosis of the recession through analysis of factors behind these empirical findingsespecially that of lower labor inputusing a technique known as business cycle accounting.

The next step is a discussion about whether two potential theories for the recession are consistent with this diagnosis. That is, how well do the financial dysfunction and poor policy hypotheses jibe with the finding of dramatically lower labor input? The paper ultimately concludes that serious questions remain regarding the financial explanationquestions relating to corporate cash positions, small-firm dynamics, contraction in financial intermediation and the duration of economic weakness. It further suggests that the policy explanation, while promising, requires further research, much of which is under way. The views expressed here are those of the author, and not necessarily of others in the Federal Reserve System.

How this recession differed

The 2007-09 U.S. recession differed considerably from earlier post-World War II recessions both in the behavior of key variables like output, consumption, investment and labor as well as in the possible factors that might account for fluctuations observed in these variables. This section will discuss the first: the differences seen in major economic variables in this recession compared with others. The next section will diagnose factors behind the fluctuations.

Table 1 shows the percent changes in U.S. economic variables during the recent recession and during the average postwar recession. (These are calculated on a per capita basis for the peak-to-trough span of each recession. Peak values for each variable are normalized to 100.) Clearly, the 2007-09 recession was more severe than the average postwar recession, and this is particularly true for labor hours and consumption. Per capita hours worked declined 8.7 percent during the recent recession compared with a postwar average decline of 3.2 percent. The declines in output (real gross domestic product, GDP), consumption, investment and employment were also much larger in the 2007-09 recession than in prior recessions.

Table 1: 2007-09 Recession versus Postwar Recessions, United States