About Our Dividend Growth Newsletter Valuentum Securities Inc

Post on: 9 Июнь, 2015 No Comment

About Our Dividend Growth Newsletter

About the Dividend Growth Newsletter

At Valuentum, we seek to deliver to our members the best investment ideas. And the Dividend Growth Newsletter does just that for income investors. We provide the following in each edition of our monthly newsletter, released on the 1st of each month:

- A portfolio of the best dividend growth stocks that we think will generate a safe and growing stream of cash flows in your portfolio. A forward-looking assessment of the dividend safety of hundreds of firms through our innovative, predictive dividend-cut indicator, the Valuentum Dividend Cushion. We use our future forecasts for free cash flow and expected dividends and consider the firms net cash position to make sure that each company is able to pay out such dividend obligations to you — long into the future. Learn more about the Valuentum Dividend Cushion >> Commentary and analysis about the firms we hold in the portfolio and on any new dividend growth ideas for you to consider. We also cover any dividend-related news. Helpful screens that overlay our Valuentum Buying Index with dividend-payers that have safe and growing dividends. We also publish a list of dividend yields to avoid. Email alerts notifying you of any changes we may make to our portfolio, and whether material events have happened to companies held within it.

Sign Up to Receive Our Dividend Growth Newsletter! Home of the Valuentum Dividend Cushion!

The Benefits of Dividend Growth Investing

History has revealed that the best performing stocks during the previous decades have been those that shelled out ever-increasing cash to shareholders in the form of dividends. In a recent study, S&P 500 stocks that initiated dividends or grew them over time registered roughly a 9.6% annualized return since 1972 (through 2010), while stocks that did not pay out dividends or cut them performed poorly over the same time period.

20payers%20outperformance.png /%

Such analysis is difficult to ignore, and we believe investors may be well-rewarded in future periods by finding the best dividend-growth stocks out there. As such, we’ve developed a rigorous dividend investment methodology that uncovers firms that not only have the safest dividends but also ones that are poised to grow them long into the future.

<< View Our Dividend Reports

How did we do this? Well, first of all, we scoured our stock universe for firms that have cut their dividends in the past to uncover the major drivers behind the dividend cut. This is what we found out: The major reasons why firms cut their dividend had to do with preserving cash in the midst of a secular or cyclical downturn in demand for their products/services or when faced with excessive leverage (how much debt they held on their respective balance sheets).

The Importance of Forward-Looking Dividend Analysis

Armed with this knowledge, we developed the forward-looking Valuentum Dividend Cushion, which is a ratio that gauges the safety of a dividend over time.

Most dividend analysis that weve seen out there is backward-looking meaning it rests on what the firm has done in the past. Although analyzing historical trends is important, we think assessing what may happen in the future is even more important. The S&P 500 Dividend Aristocrat List, or a grouping of firms that have raised their dividends for the past 25 years, is a great example of why backward-looking analysis can be painful. O ne only has to look over the past few years to see the removal of well-known names from the Dividend Aristocrat List (including General Electric and Pfizer) to understand that backward-looking analysis is hardly worth your time. After all, youre investing for the future, so the future is all you should care about.

We want to find the stocks that will increase their dividends for 25 years into the future, not use a rear-view mirror to build a portfolio of names that may already be past their prime dividend growth years. The Valuentum Dividend Cushion measures just how safe the dividend is in the future. It considers the firms net cash on its balance sheet (cash and cash equivalents less debt) and adds that to its forecasted future free cash flows (cash from operations less capital expenditures) and divides that sum by the firms future expected dividend payments. At its core, it tells investors whether the firm has enough cash to pay out its dividends in the future, while considering its debt load. If a firm has a Valuentum Dividend Cushion above 1, it can cover its dividend, but if it falls below 1, trouble may be on the horizon.

In our study, the Valuentum Dividend Cushion process caught every dividend cut made by a non-financial, operating firm that we have in our database, except for one (Marriott). But interestingly, the Valuentum Dividend Cushion indicated that Marriott should have never cut its dividend, and sure enough, two years after the firm did so, it raised it to levels that were higher than before the cut.

Here are the results of the study (a Valuentum Dividend Cushion below 1 indicates the dividend may be in trouble). The Valuentum Dividend Cushion score shown in the table below is the measure in the year before the firm cut its dividend, so it represents a predictive indicator. The measure continues to do well by members in real-time as well (beyond the constraints of any academic study).

Please view this article to learn more: Our Dividend Methodology is Rocking!

Sign Up to Receive Our Dividend Growth Newsletter!

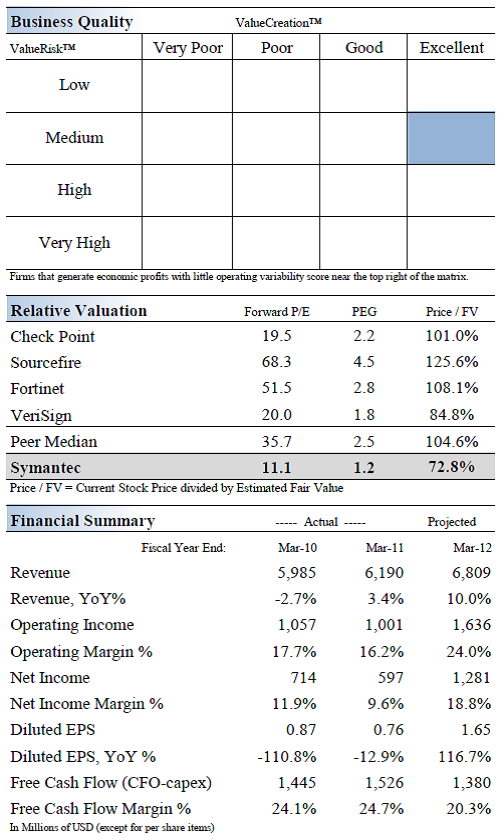

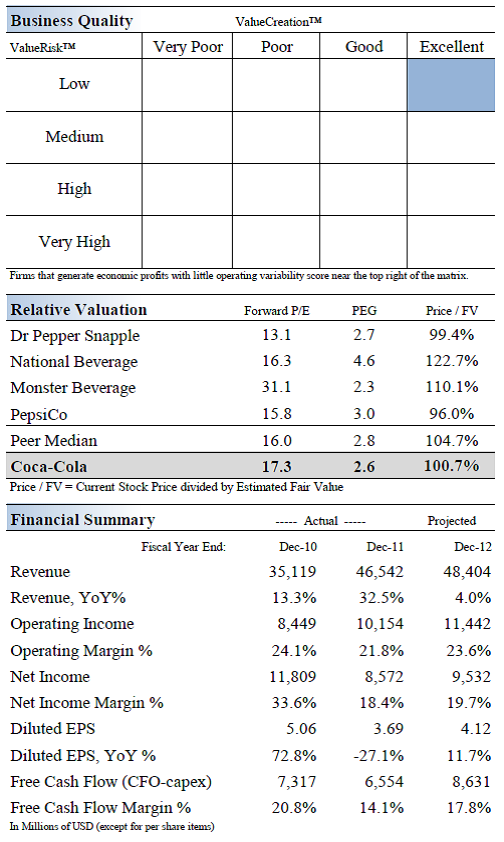

At the very least, using the Valuentum Dividend Cushion can help you avoid firms that are at risk of cutting their dividends in the future. And we are the only firm out there that does this type of in-depth analysis for you. We provide the Valuentum Dividend Cushion score in the dividend reports and monthly Dividend Growth Newsletter, and we also scale the safety of a firms dividend based on this measure in simple terms: Excellent, Good, Poor, Very Poor.

Heres a glimpse of the Valuentum Dividend Cushion score (as of November 2011) for a sample set of firms in our coverage universe. Please note that the current score on these and hundreds more are available with a membership to our website:

Understanding Dividend Growth

It takes time to accumulate wealth through dividends, so dividend growth investing requires a long-term perspective. We assess the long-term future growth potential of a firms dividend, and we dont take managements word for it. Instead, we dive into the financial statements and make our own forecasts of the future to see if what management is saying is actually achievable. We use the Valuentum Dividend Cushion as a way to judge the capacity for management to raise its dividend how much cushion it has and we couple that assessment with the firms dividend track record, or managements willingness to raise the dividend.

In many cases, we may have a different view of a firms dividend growth potential than what may be widely held in the investment community. Thats fine by us, as our dividend-growth investment horizon is often longer than others’. We want to make sure that the firm has the capacity and willingness to increase the dividend years into the future and will not be weighed down by an excessive debt load or cyclical or secular problems in fundamental demand for their products/services. We scale our dividend-growth assessment in an easily-interpreted fashion: Excellent, Good, Poor, Very Poor.

<< View Our Dividend Reports

What Are the Dividend Ideas We Seek to Deliver to You in Our Newsletter?

First, were looking for stocks with annual dividend yields that are greater than the average of the S&P 500, or about 2% (but preferably north of 3%). This excludes many companies, but we think such a cutoff eliminates firms whose dividend streams arent yet large enough to generate sufficient income. Second, were looking for firms that register an ‘EXCELLENT’ or ‘GOOD’ rating on our scale for both safety and future potential dividend growth. And third, were looking for firms that have a relatively lower risk of capital loss, as measured by our estimate of the companys fair value. We strongly prefer dividend growth gems that are underpriced.

Sign Up to Receive Our Dividend Growth Newsletter!

About Our Name

But how, you will ask, does one decide what [stocks are] attractive? Most analysts feel they must choose between two approaches customarily thought to be in opposition: value and growth,. We view that as fuzzy thinking. Growth is always a component of value [and] the very term value investing is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1993

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from a complete understanding of all investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value to momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

Valuentum has developed a user-friendly, discounted cash-flow model that you can use to value any operating company that you wish. Click here to buy this individual-investor-friendly model now! It could be the best investment you make.

Our Best Ideas Newsletter and Dividend Growth Newsletter are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of our newsletters, reports, and other publications and accepts no liability for how readers may choose to utilize the content. Valuentum is not a registered investment advisor and does not offer brokerage or investment banking services and adheres to professional standards and abides by formal codes of ethics that put the interests of clients and subscribers ahead of their own. Valuentum, its employees, and affiliates may have long, short or derivative positions in the stock or stocks mentioned on this site.