A Primer For Investing In Gold And Silver Liberty Investor™

Post on: 7 Апрель, 2015 No Comment

A Primer For Investing In Gold And Silver

Jun 14, 2013 from Ben Bullard

PHOTOS.COM

For gold coins, look for those that are stamped in English, have their gold content stamped on them, come in convenient, well-known sizes and sell at small premiums over the value of their gold content.

While the threshold for investing in gold and silver might seem high, taking steps to acquire physical bullion now will definitely pay off if economic circumstances ever take a catastrophic turn.

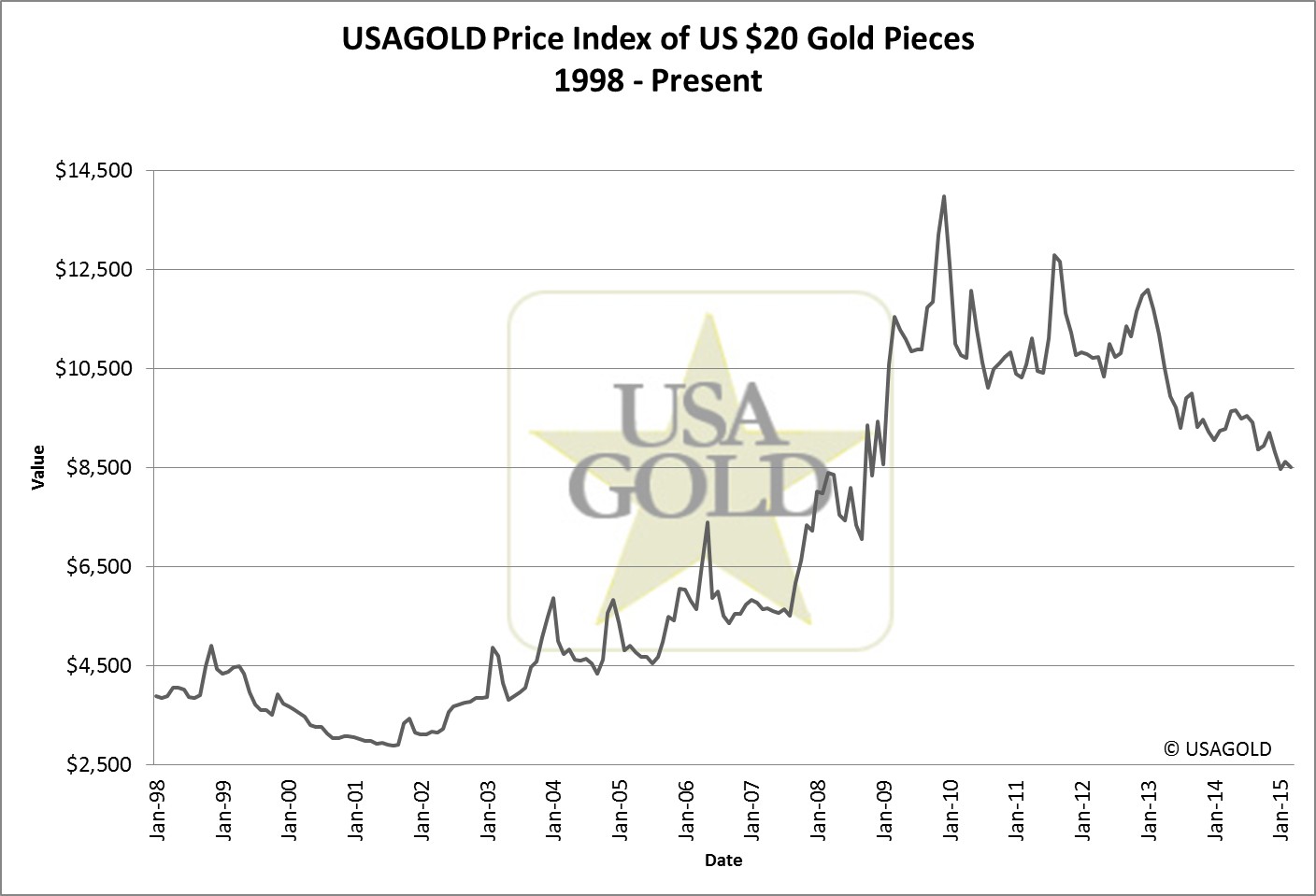

Historically, gold and silver have been stores of value against that of paper money. Why? Because economies that function under a fiat currency have the potential for a very unstable money supply, as government can create an infinite amount of it. But the supply of gold and silver is finite and inelastic.

Theres a lot more advice on how to get started in bullion than one column can cover. But a few tips, taken from Bob Livingstons book Surviving a Global Financial Crisis and Currency Collapse , are important to keep in mind from the outset:

- The simplest and most obvious way to buy gold is in its physical or bullion form. Bullion refers to the metal cast in bars or minted into coins with the weights marked on them.

- For gold coins, look for those that are stamped in English, have their gold content stamped on them, come in convenient, well-known sizes (1 oz. oz. oz. and 1/10 oz.) and sell at small premiums over the value of their gold content. The U.S. Mint also lists coins like the American Gold Eagle as legal tender.

- For silver, look for pre-1965 U.S. silver coins, which were minted using 90 percent silver. Theyre still legal tender and are worth more than their face value (which, incidentally, illustrates the dollars devaluation) because of their silver content. A convenient way to buy silver coins is in bags with $1,000 face value, which contain dimes, quarters, half-dollars and silver dollars. A bag contains 715 oz. of coins. You can also buy American Silver Eagles.

- Stay away from numismatic coins, rare and collector items whose market values exceed their bullion values. Because their prices are based on the value they hold for collectors, they trade at a premium that will vanish in the event of a profound economic crisis.

- There are many choices for buying gold and silver coins, both locally and over the internet. But local dealers give you confidence that youre shopping with a legitimate business particularly if they have been around a while and the ability to actually see and hold what youre buying.

- Although it sounds extreme, exercising relative stealth as you expand your bullion investments is smart. Why? Because in a time of real, sustained crisis, both the government and individuals who know about your bullion will seek to take it from you. But no one can take from you that which he doesnt know you have. When practical, make your purchases of gold and silver with cash from private dealers, in amounts below the $10,000 threshold.