A Look at MIRR (Modified Internal Rate of Return) Financial Web

Post on: 10 Июнь, 2015 No Comment

The Modified Internal Rate of Return (MIRR ) is the same as the Internal Rate of Return (IRR) for a project except for one factor. With IRR, the analyst assumes the cash flows from any investment are reinvested at the original IRR. With Modified Internal Rate of Return, the analyst assumes the cash flows from any project are reinvested at the cost of capital. The MIRR is typically a more accurate measurement of the project or investment’s true profit potential.

Internal Rate of Return

This measurement analyzes the discount rate needed to bring the net present value of a project or investment to zero. The higher the IRR of a single action, the more profitable it is likely to be, and the better opportunity it presents. For example, if a business is considering two construction projects, it may estimate the IRR of both to determine which it should pursue.

Problems with IRR

The main problem with IRR is it assumes cash flows are reinvested at the original IRR. This is rare. Companies must pay out profits to investors, pay for unforeseen expenses and otherwise allocate profits from a project. It is more likely a company will reinvest at the cost of capital. This is a measurement of how much a company must earn on an investment to net a zero profit. Essentially, it is the expense of a project taking into account the cost of debt and the cost of equity. This means factors such as interest rates and financing fees are considered on one hand. Increased taxes due to the added equity will also be considered. By using MIRR instead of IRR, an analyst assumes reinvestment occurs at the cost of capital.

When to Use MIRR

You can use a formula for MIRR when you are considering two separate capital investments. For example, you may be comparing two municipal bonds. One is much more expensive than the other, but you may wonder if you have a higher likelihood for profit with this investment. Using the MIRR, you can measure how much the intrinsic value of a bond in the project is likely to increase as well as how likely you are to receive any additional incentives on the bond. It is preferable by most accounts to use MIRR to get a more realistic comparison of your two options.

Mathematical Expression

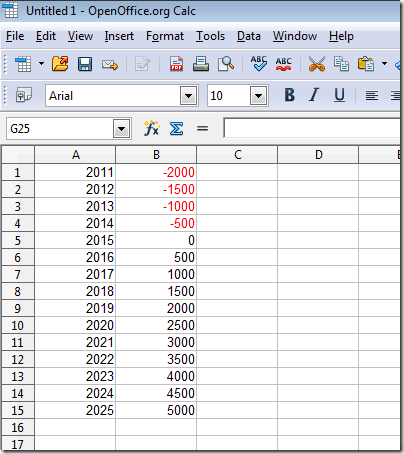

The equation for Net Present Value with IRR is as follows:

NPV = -Initial outlay + Profit in year one/(1+IRR) + Profit in year two/(1 + IRR) ^2 (and so on)

By setting this equal to zero, you can determine the IRR of an investment by estimating the returns for the first several years. Similarly, you can use this formula:

NPV = -Initial outlay + Profit in year one/(1 + cost of capital) + Profit in year two/(1 + cost of capital) ^2 (and so on)

In this formula, you will input the cost of capital to determine the NPV instead of setting it equal to zero. If the NPV is negative once the calculation is complete, the investment is likely to lose money in the length of time you have calculated for.

$7 Online Trading. Fast executions. Only at Scottrade