A LEAP Further With XLE

Post on: 24 Июнь, 2015 No Comment

Timothy Collins

Stock quotes in this article:

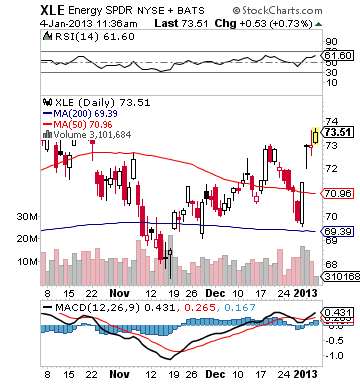

xle

Yesterday. I hit on the idea of using LEAPS (Long-term Equity AnticiPation Securities) as a replacement strategy, especially if you are trying to catch a falling knife on something such as the energy sector. First, I think it is important to reiterate the long-term concept. This approach is not meant as a flip. You aren’t trying to call a bottom or looking to sell into a small rally. My thesis would always be long term. However, I do build in the idea of profit-taking, hedging and even averaging down, which I’ll touch on now.

If you recall yesterday’s column, the idea of using the LEAPS to replicate a 300-share position in the Energy Select Sector SPDR ETF (XLE) utilized only $7,000, rather than $22,200, and one of the biggest keys to this approach is utilizing that extra cash. The first option is simply to keep it as cash. There can be worse things than having a pile of cash around while still having your market exposure. You could also use the cash to diversify and buy something non-energy, non-equity related. However, how can we use that cash against the existing position?

A simple approach is just to use some of the cash to buy puts. For instance, an investor could buy the June $60 or $65 puts to place a floor under the position. Another way is to simply sell puts supported by cash. I like this idea when it is combined with the tactic of buying more at lower prices or averaging down. For instance, I would use a trigger as an area to buy more, somewhere between 10% and 20% lower dependent upon your risk tolerance. For instance, if you were to place a 20% drop as your trigger, then you could sell the June $60 puts for around $2.00. If XLE drops, then you buy more and if not, then you do a good job of replicating any dividends you sacrificed using the LEAPS rather than the shares.

In the end, I prefer to marry the two, using a ratio put spread to act as a partial hedge but also my trigger into more exposure. In this case, I would have been a buyer of the June 2015 $65 put and seller of two June 2015 $60 puts for a net credit around $0.70 this morning. While the net credit is not as large as selling a put outright, I bring in $5 of downside protection and an extra $3.70 lower on my average cost if the stock is put to me. So in the end, it provides a net credit, a lower cost basis if stock is put to me and I lessen my loss by $3.70 per ratio put spread all the way down to $60. It acts as potential income, a hedge and an automatic trigger.

Of course, being long LEAPS affords you the luxury of adding in ratio call spreads to the upside in an attempt to enhance returns. Or you could simply sell far out-of-the-money calls to bring in additional income. I don’t see any issues with this as long as you don’t place the short call too close to the LEAPS strike or eliminate your ability to turn a profit if the holding pushes strongly higher in a short period of time after entry.

LEAPS afford ample opportunity to expand a position beyond a simple buy and hold, and with the proper use of leverage can position a long-term holding significantly better than simply buying shares.

At the time of publication, Collins had no positions in any of the securities mentioned.