8 Ways You Can Profit From the Coming Rise In Inflation

Post on: 5 Июнь, 2015 No Comment

Is there any doubt that both inflation and interest rates are going up soon? Few business owners I speak to think otherwise. And recent reports like this one and this one are warning of the same. No one’s expecting to see rates at early-1980s levels, which is a relief. But we’ve lived for the past decade in an environment of historically low interest and inflation. And this will change, mostly for two reasons:

- There’s more cash in the system. During the financial crisis, central banks around the world offered unprecedented amounts of liquidity to bolster markets. And now, as the world continues to recover and economies grow, they are working to reduce their bloated balance sheets of excess reserves in a controlled way. No matter how well they do this, an excess supply of cash will circulate, and the only way to counteract the inflationary pressures caused by this will be to raise interest rates.

- There are more people working. Meantime, employment is increasing, which is putting pressure on the level of wages. As business owners, we haven’t seen significant pay increases in years. But now employees have more options and are already demanding higher salaries. Adding to that are increases in basic cost-of-living expenses (e.g. food, clothing) and a general rise in prices brought about by a growing economy. Wages are our biggest line item, with the exception of taxes. As they go up, so will prices.

Smart business owners are always thinking ahead. Are you? If you know that inflation (and interest) will be rising over the next few years, are you getting ready? Here are a few things you should be considering.

1. Lock in long-term loans. Variable-rate loans are, of course, good in a low- (or decreasing) interest-rate environment. But now it’s time to renegotiate. If you have any debt outstanding that’s reliant on interest fluctuations, now is the time to lock them in at longer term, fixed rates.

2. Buy now. Thinking of buying new equipment? Or a piece of property? Maybe your truck is showing wear and tear. Have an order in hand from a large customer that will require a large amount of materials over the next six months? Now is the time to buy, particularly for those longer term assets that will require financing. Or even for short-term assets, like inventory, that you know you’ll turn over. You might as well do the deal now and take whatever discount you can get by purchasing in bulk. As prices and interest rates inevitably rise, waiting will cost you.

3. Sell assets. You’re not the only one thinking of buying. There are plenty of others thinking the same thing. So reverse your thinking. Any equipment you don’t need any more? Large chunks of inventory that are sitting around? A piece of property you no longer need. Or even bigger. a less-than-profitable division? Maybe. wait. your entire business? With rates as low as they are, many buyers are looking to snap up deals now and lock in their financing while they can. This may be the time for you to unload some extra assets. Maybe even your entire business, too.

4. Lock in long-term suppliers. Do you have a supply agreement with your biggest vendors? Now may be the time to consider this. If you’re in a position to commit to purchasing over the next 12 to 18 months, you’ll likely find suppliers are willing to lock in prices and deliveries, too. If you know that there will be inflationary pressures, this is the way to better control your future margins. Maybe you should do the same with your current customers—figure on a 3 percent to 4 percent price increase, and see if they want commit to future business.

5. Lock in long-term employees. As mentioned above, the employment tide is turning. People are emerging and looking for jobs. And more jobs are becoming available. You’ll be challenged to offer incentives to keep your better people around. But most important, you’ll want to make sure your key employees aren’t going anywhere—and their cost to you remains affordable. So now is the time to show how much you care by entering into employment agreements with them. But try to avoid things like cost-of-living increases. Instead, offer bonuses and incentives based on performance. And lock in a reasonable salary for the next three to five years. That will also help control a big line item on your P&L.

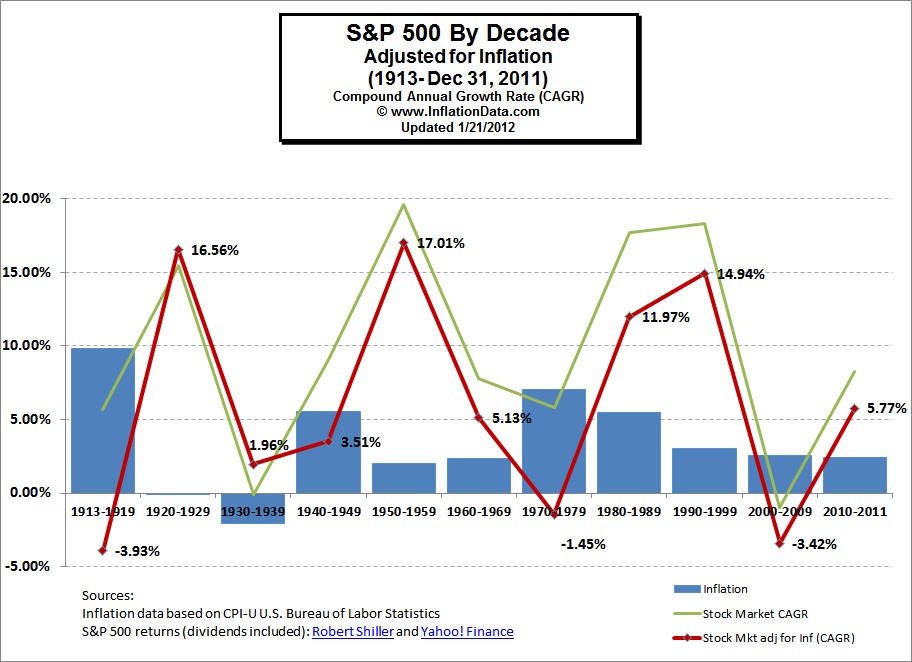

6. Buy real estate. Some think that the stock market is a good place to put their money in an inflationary environment, and this may be true. I’m not a stock expert. And I’m not a real estate expert either. But I do know that real estate prices generally tend to keep pace with inflation, and oftentimes rise more. Buying a building, a piece of land, or an office space is usually a good hedge against inflation. And the added bonus, as noted above, is that you can do this at very low interest rates. For now.

7. Revisit your pricing. Do this exercise: take 20 jobs, products, or services that you did over the past six months, sit down and do a thorough cost analysis. Were your margins as good as you thought? Now, look at the materials, wages, and overhead expenses that go into those products. Which ones are subject to inflationary pressures? How likely will those prices rise? How significant an impact will those increases have on your margins? It is your job to keep these margins consistent. If you can’t control costs, you’ll need to increase prices. Are you prepared to do this? Have you prepared your customers?

8. Outsource, and keep your overhead low. Higher interest and inflation has all sorts of macroeconomic effects. Many economists believe that it could be healthy. Many others are concerned that it will hurt confidence, depress markets, cause uncertainty, prohibit investment, and limit consumer spending. As we’ve all figured out over the past few years, no one has a clue. But most of the business owners I know, particularly the ones who survived the last recession, are still very wary of adding people and overhead to their operations. They’re outsourcing everywhere they can. They are holding their expenses steady. They are storing away cash for that inevitable time when the economy dips again. You should be doing the same.

Great business people aren’t just profitable now. They’re thinking about how they’ll be profitable two years from now. These same people see the trend, and they know that prices and interest rates will be rising. No one’s panicking. But trust me, they’re all preparing. Hopefully, you are too.