7 Steps to Owning Your Own Commercial Real Estate

Post on: 3 Апрель, 2015 No Comment

Last Updated March 7, 2015

1. Ask yourself a lot of questions up front

The first step in purchasing commercial real estate is knowing yourself, your situation, and what you’re looking for.

Here’s some questions to consider asking yourself to start out with:

- What kind of property are you looking for?

- Are you looking to use the building for your own business, rent it out, build equity, and/or something else entirely?

- What kind of location do you need?

- Do you need to buy or could you lease the property?

- What’s your situation regarding cash, financing, and/or ability to make a down payment?

- Would you be willing to partner with someone else on the property?

- Would you be willing to partner with someone else on the property?

- What’s your risk tolerance?

- How much time can you commit to the property?

- How much work are you willing to put into the property?

- What skills/knowledge are you bringing to the table?

- What skills/knowledge will you need to hire experts for or contract out?

- What kind of property manager might you need (or not)?

- Are you willing to do the duties of being a landlord?

- Finally, are you ready/willing to make a investment/purchase of this size?

2. Learn some commercial real estate vocabulary (and accept the learning curve)

There’s a lot of vocabulary and acronyms in commercial real estate that you’re likely unfamiliar with. It’s helpful to be savvy on some of the terms. This will make this process and working with people in the industry easier.

Here are some common terms to get started with:

- Loan-To-Value (LTV): A ratio of how much money you’re asking from a lender vs. the total value of what you want to purchase.

- Debt Service Coverage Ratio (DSC): Operating income over total debt service. Basically how much of the debt you’ll be able to cover each year with income.

- Capitalization Rate (Cap Rate): Income of the property divided by the total value of the property.

- Cash on Cash: Annual income over how much you actually invested. The amount invested could be just the amount your down payment was.

- Vacancy Rate: Percentage of properties that are vacant in a time period in a given area.

- Usable vs. Rentable Square Feet: See this excellent article we have on the difference between these.

- Ad Valorem: A tax based on the assessed value of a piece of property.

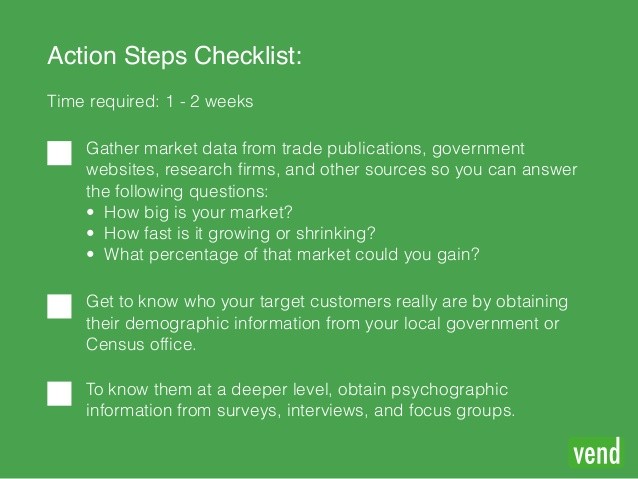

3. Visit and consider many properties. Do you homework on each.

Consider and tour many different properties. Figure out what works and what doesn’t about each of them for you. Consider the most important things for each one including price, location, condition, and allowed uses.

The importance of location can’t be overemphasized (we’ll spare you saying it three times). Properties located near universities, hospitals, or downtown areas will generally have a higher value and sell more quickly.

Above all, you’re searching for a fit with your property. Your situation and needs are unique. The property should be a fit in terms of price, location, uses, and investment required.

Key calculation for any property: It should be in the black after subtracting what’s called PITI (principal, interest, tax, and insurance) from the annual revenue earned from rent.

Here are a couple other questions to consider for each property you’re interested in:

- What is the property currently used for?

- What can/can’t it be used for?

- What kind of rent/income does the property currently generate per year?

- What kinds of taxes are there on the property?

- What things will need to be replaced or repaired soon?

- Why is the owner selling?

- How is the area around the property doing? Any major upcoming changes?

Also see this more extensive checklist of questions to ask about properties.

4. Find the experts you’ll need

Buying commercial real estate is often a complex process. You’ll likely need to hire experts to help with some of the steps. Which and how many experts depends largely on the type of property you’re purchasing.

At the very least, you’ll need to hire an accountant, commercial real estate lawyer, commercial realtor, and a mortgage broker.

If the property is more complicated, you could need other specialists like tax experts, accountants, lawyers, notaries, appraisers, engineers, and/or environmental specialists.

There are some things you can do on your own (through research) but there’s many that are better to hire an expert for.

5. Figure out your financing

If you’re like most people, you’ll need to get some financing help to be able to purchase the property.

What type of banks, credit unions or other home mortgage company could you use? What kind of credit do you have and what kind of interest rate could they give you? Answering those questions is the first part of the financing process.

If traditional financing methods don’t serve you so well, could you try a more creative method for financing/purchasing the property?

Would the owner/seller be willing to help with financing? Read up on things like seller carry back, subject-to, second mortgages, and lease options.

There’s definitely more than one way to finance a commercial real estate purchase.

6. Make an offer (with your lawyer’s approval!)

First off, don’t sign anything without your lawyer’s review first.

Your lawyer will have you sign a letter of intent(LOI) about the property and all the contracts involved. The LOI outlines the basic terms of the transaction. Your lawyer will make sure the LOI is not binding in case something goes wrong down the line with the contract.

Have your lawyer explain all details of the written agreements so you know exactly what your rights and obligations are.

7. Due Diligence and Escrow

This is where it gets a little more real. Money is about to change hands. You’ll need to dot all the i’s and cross all the t’s. You can never know too much about the property you’ll buy.

You’ll generally need to get an ALTA(American Land Title Association) survey ordered, which can be used as part of the due diligence. An ALTA survey provides valuable information such as boundary lines, location of the main building (if there is one) including improvements, location of secondary buildings, the identification of easements (which are access rights by different service companies such as water, gas, telephone, railways and other utilities).

You and the seller will need to find an escrow officer who will be the neutral 3rd party overseeing the transaction. They will help with the transfer of deeds and funds. They make sure both parties are protected in the transaction.

The final closing escrow documents will include things like a quitclaim deed, non-foreign affidavit, title affidavit, bill of sale, sale and assignment of contracts, warranties and supplier guarantees.

Finally, you (the buyer) are given a due diligence time period with which to make sure all the documentation about the property is correct. This is where you triple check that everything the seller told you about the property is true. This includes things like service/utility contracts, surveys, environments reports, rent rolls, covenants, restrictions, and many other aspects of the property.

If something strange or wrong comes up in your inspection of the property, you have the right to tell escrow to cancel the transfer of funds.

Property Metrics has an excellent checklist for the final processes involved in purchasing commercial real estate.

Buying commercial real estate can be quite a process but if you follow these steps, it should make it all work smoother. Good luck.