5 Wrong Turns That Could Wreck Your Nest Egg

Post on: 2 Апрель, 2015 No Comment

Its easy to chalk your nest eggs successes and failures up to the stock market. When its up, youre up. When its down, youre down. Whaddya gonna do about it?

Well, the truth is you can do a lot. Like it or not, your choices impact your retirement savingsmaybe even more than the stock market. You may not set out to wreck your nest egg, but research shows many people do just that by making poor investing choices.

Are you to blame for your nest eggs downfall? Here are five common mistakes to help you decide.

You Wait Too Long to Start Investing

When it comes to investing, you cant make up for lost time. Thats why you should invest early, no matter how small the amount, to take advantage of compound interest. For example, a $2,000 lump sum invested when youre 40 years old can grow to $40,000 by the time youre 65. But that same $2,000 investment could be worth $237,000 if you invest it 15 years sooner. Thats the power of compound interest!

You Dont Invest for Retirement at All

A recent survey by Deloitte Center for Financial Services found that nearly 60% of preretirees dont have a retirement plan, and 20% expect to live on their Social Security benefits alone in retirement. The average monthly benefit from Social Security is only $1,294, so its clear that any savings are better than no savings. No matter how far behind you think you are, make a plan and start investing now for a better retirement.

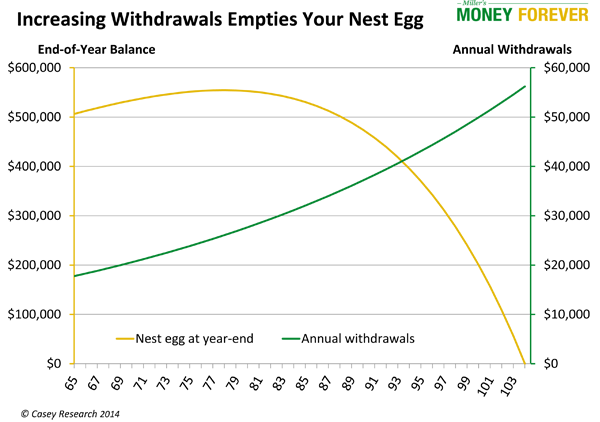

You Dont Invest Enough for Retirement

The same survey showed that while saving for retirement is a main goal for most people, they want to split their disposable cash between paying off their home, saving for a childs college fund, and socking away cash for retirement. Multitasking with your money is fine, as long as you first invest 15% of your income for retirement. Why? A paid-for home wont help you cover your expenses in retirement. Neither will paid-for college tuition. Junior can get a part-time job to avoid student loans, but theres no scholarship for your golden years! Focus on retirement investing first, then you can tackle your other financial goals.

You Cash Out or Take a Loan Against Your Retirement Savings

Roth IRAs and 401(k)s allow you to withdraw or borrow funds under certain circumstances. But doing so will not only lower your balance, youll also miss out on that moneys growth potential. You could also be subject to taxes and penalties. Pay off your debt and build an emergency fund before you start investing, and use that cushion to pay for unexpected expenses. Keep your retirement fund for retirement only!

You Invest on Your Own

Investing on your own may seem like a great way to save money, but you could lose more money in the long run by not hiring a pro. Thats because you simply dont have the time or expertise to find the best funds or understand the markets cycles. As a result, youre more likely to jump in and out of the market at all the wrong times. knocking big percentage points off your returns. Dave is as hands-on as it gets when it comes to moneybut even he knows the value of a pro in growing his investments.

Theres Still Hope for Your Nest Egg

Maybe youve made some of these mistakes already. Thats okay! One wrong turn wont doom your future as long as you grab hold of todays opportunity to choose differently. Ask a pro how you can improve your retirement outlook. An experienced advisor can look at where you are today and guide you toward a confident tomorrow.