5 Reasons why asset allocation is important for your Financial Goals

Post on: 7 Апрель, 2015 No Comment

If you are an avid reader of our articles, you may have realized that we often emphasize on maintaining proper asset allocation. You see, building an investment portfolio through optimal asset allocation is imperative while you endeavour to achieve your financial goals. So in this article we thought of explaining you in detail about asset allocation citing the benefits it offers to you as investors.

What is Asset Allocation?

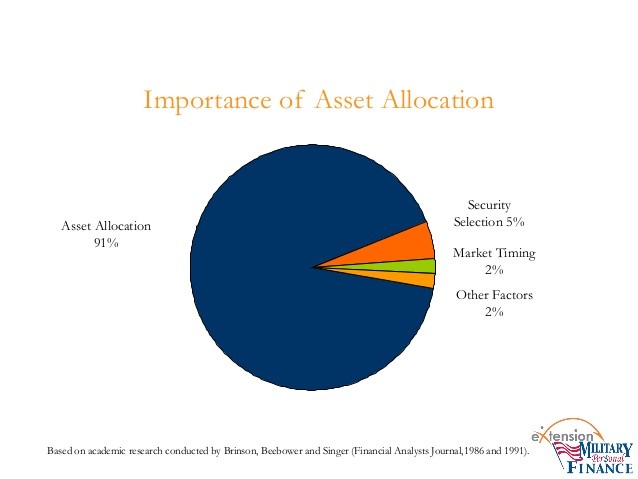

As the name implies, asset allocation refers to distributing your investible surplus across asset classes such as equity, debt, gold, real estate or even holding cash for that matter. So by allocating assets, you are essentially adopting an investment strategy which can balance your portfolio’s risk and reward keeping in mind your risk profile, your financial goals, and your investment time horizon. The below chart shows you an example of optimal asset allocation.

What are the benefits of proper Asset Allocation?

- Optimal Return

In the absence of proper asset allocation, many individuals invest in an ad-hoc manner. This in turn makes it difficult for them to determine whether the return on investments is sufficient enough to achieve their short and long term financial goals. Some investors are either too aggressive or conservative and invest accordingly, so they are unable to earn adequate returns on their investments. Proper asset allocation will help you determine how much return you can expect on your investments on the basis of investment risks you are taking.

Risk Minimization

Based on your past investment experience or your willingness to take risk you will make your future investments decision. If you have earned good amount of returns in the past, you might become too aggressive and invest only into equities. While if you have already burnt your fingers in the past by investing into equities you may become too conservative and invest only in fixed income instruments such as Fixed Deposits. Recurring Deposits etc. You see, past experiences can lead to you being either too aggressive or too conservative about your investments. And mind you, while learning from past experiences is good, it is vital to follow a proper asset allocation actually meant for you in order to achieve your financial goals. This will help you minimize risk on your investments and will also infuse more certainty on achieving your financial goals.

Help investments align as per Time Horizon

Along with the risk profile. your time horizon is also a key factor to decide the asset allocation, while you endeavour to achieve your financial goals. Your time horizon will determine in which asset class you should invest a dominant portion of your investible surplus. Just remember, longer your time horizon of your financial goal, the more you can tilt your asset allocation towards equity and less towards debt. Equities are considered very risky in the short term while less risky in the long term, as they will have more time to recoup from turbulent phase(s) of the equity markets. While debt is considered less risky, the returns clocked by the asset class are usually insufficient to beat inflation, thus mainly for this reason it doesn’t help you to achieve your long term financial goals. Proper asset allocation will help you to determine the correct mix of equity, debt, gold, real estate and even cash based on your time horizon to achieve your financial goals.

If you happen to be under 30% tax bracket and invest all your savings in fixed deposit to keep your investments safe, then you are making a big mistake by paying huge amount in taxes, which otherwise could have been legitimately saved. Tax consequences are different for every individual and for every scenario so you should always view investment returns from the point of view of post-tax returns on investments rather than pre-tax returns as post-tax return is the return which you get in your hand. Proper asset allocation will not only help you to determine the right asset class, but also the right investment product which will help you to minimize taxes.

Adequate Liquidity

Liquidity is also one of the vital factors while making investment decision as some investments have a lock in period and can’t be redeemed within that period. For e.g. If you are investing in a Public Provident Fund (PPF) account or Equity Linked Saving Scheme (ELSS) mutual fund and are in need of money in next 1 year, then they aren’t the right investments for you no matter how good these investments are. Prudent asset allocation will make sure that you have sufficient liquidity to pay for your financial goals as and when required.

Conclusion

Defining an optimal asset allocation is not as easy as it might seem to you, because you need to take into account, host of factors to reap the benefits of prudent asset allocation. But once prudent asset allocation is in place, you can be rest assured that you will earn adequate return, minimize risk and taxes, have sufficiently liquidity and even achieve your financial goals.

If you are unsure of what’s the optimal asset allocation for you to achieve your financial goals, PersonalFN can help you in setting your asset allocation right and help you achieve your financial goals. You can either call us on 022-61361200 or write to info@Personalfn.com or Click Here to Schedule a call with our investment advisor.