5 Lessons Learned About Investing

Post on: 23 Июнь, 2015 No Comment

Five years ago I opened a discount brokerage account – transferring $25,000 from my HSBC mutual fund account to TD Waterhouse – to start investing in individual stocks.

Here are 5 lessons learned about investing over the last five years:

A rising tide lifts all boats

I’ve learned to recognize the difference between skill and luck. When the S&P/TSX 60 went up 32 percent in 2009, many investors, like me, who went the do-it-yourself route. started patting themselves on the back.

“Hey, my lousy advisor had me in mutual funds that lost 30 percent last year! Look how easy it was for me to turn that around!”

The Canadian stock market has averaged an annual return of 8.8 percent since 2009. The Canadian Dividend Aristocrats Index, as tracked by the iShares ETF CDZ, returned 15 percent annually since 2009.

Many investors wrongly credit superior stock picking skills for their recent returns. But only through diligent tracking of your portfolio rate of return and comparing to an appropriate benchmark (like the S&P/TSX 60) can you conclude that your decisions added any value at all.

Don’t chase yield

I’ve learned about the pitfalls of chasing high yield stocks . Two of the first 10 stocks I purchased were Yellow Media and TransAlta. Both were paying out dividends well north of 6 percent – a rate that far exceeded earnings.

A high dividend payout ratio and low prospects for earnings growth is typically a recipe for disaster. Anyone with a working pulse could see that Yellow Media – publishers of the Yellow Pages phone directory – was headed to zero as advertisers fled the print directory business to focus on digital ads.

The result was predictable – Yellow Media slashed its dividend, eventually eliminating it altogether, and the stock tumbled 94 percent.

TransAlta, which operates power plants across North America and Australia, has been a disaster for shareholders over the past five years. Poor management, lack of long-term contracts, and plant shutdowns have plagued the company for years.

The company refused to cut its dividend while paying out well over 100 percent of earnings. The stock flirted with $24 in early 2010 and trades below $13 today. Earlier this year, TransAlta finally caved and slashed its dividend by nearly 40 percent.

Thankfully I came to my senses early with these two stocks – selling both in 2010 for a decent profit. But the lesson might be rearing its ugly head again with high yield stocks like Liquor Stores and Rogers Sugar, which have struggled this year.

Embrace simple solutions

I’ve learned to embrace simple solutions. One of the greatest stock pickers of all time – Warren Buffett – raised a few eyebrows when he revealed his plan for investing the funds left from his estate after he dies:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. I believe the long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.”

We tend to reject simple solutions because, well, they’re too simple. But when it comes to investing, a simple and boring approach can work in your favour.

Complicated strategies like technical analysis and momentum trading take time to understand and execute, and there’s no evidence that you’ll come out ahead. You can pay someone to do it for you, but that comes at a steep price.

My favourite portfolio to manage right now is the RESP I have set up for my kids. Each month, I put $200 into one of three e-series funds – a Canadian index, a U.S. index, and an International index – and then sit back and watch it grow.

Avoid market timing

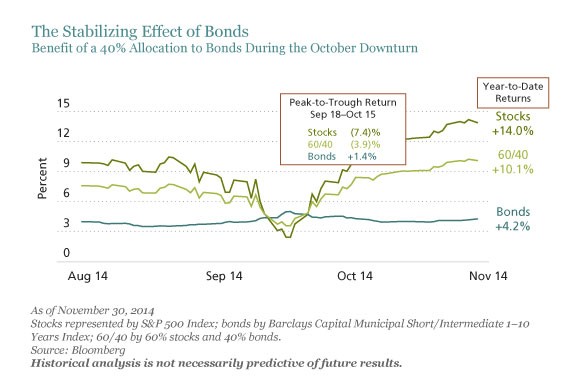

I’ve learned to stick with my long term strategy and ignore everything I “think” about where the market is headed.

I used to spend a lot of time monitoring my portfolio and watching daily events unfold. But over time it became clear that events like the Japanese nuclear meltdown, the Greek government debt crisis, or the flash crash, had little effect on the long term direction of the stock market.

You’ll always hear investors say things like, “I’m waiting for a correction before I buy again,” or, “I’ll wait for the economy to improve before I get back into the market.”

I’ve learned the best approach is to invest regularly and stick with a strategy for the long term . It’s better to be in the market than to try and time the market to your advantage.

What if you’re sitting on a lump sum of cash? Should you invest it all at once or gradually over time?

A study examined 20-year periods from 1926 to 2009 and concluded that lump sum investing produced superior results 69 percent of the time .

“The reason is simple: More often than not, stocks move higher. You benefit more from being invested more of the time than you do trying to avoid near-term wiggles.”

Costs matter

I’ve learned that costs have a big impact on investment returns. When you compare actively managed mutual funds to index funds and ETFs. the difference in performance often comes down to fees.

Most bank-sold mutual funds have fees in the range of 1.5-2.5 percent a year. ETFs and index funds, on the other hand, cost a fraction of that amount.

Index funds are designed to give you market returns, minus a small fee. When you buy a Canadian equity mutual fund, there’s a good chance it holds the same investments as the index itself, so you’re essentially paying your bank and advisor to own an expensive index fund.

As for buying individual stocks and ETFs, we’ve seen per-trade prices at big brokerages come down from $29 to $9.95. You can also buy ETFs for free at certain discount brokerages like Questrade. That’s a big win, especially for the small investor.

Final thoughts

I’ve learned a lot about investing in the last five years, but it will take a major stock market correction to really test my resolve.

It’s at that point when investors must have the conviction to stick with their plan and avoid the type of investor behavior that leads to bad decisions and ultimately poor returns.