5 Investment Strategies In Down Or Volatile Markets

Post on: 18 Июнь, 2015 No Comment

Just seven years ago, the Dow reached its peak of 14,164 and then the horrible bear market began. Each month, the Dow sunk ever lower, and 17 months later it reached the bottom and was valued at just 6,443. Corrections are inevitable and unpredictable.

When the market was on the decline, investors without a plan may tend to panic. Instead of staying the course with their investments. some sold at the bottom and never recovered. Dreams of retirement were dashed and vacation homes were sold at only a fraction of their worth. In retrospect, these investors clearly did not manage their money correctly during a bear market. If only they had a better system.

If you feel a bear market is imminent, here are five options to consider for long-term investors .

FIVE WAYS TO WEATHER A DOWN MARKET

1) Keep buying. This is the exact opposite of what your emotions would have you do. When the market is falling and investors see their hard-earned money vanishing before their very eyes, the natural reaction is to sell and hold on to what they have left. Panic selling can lead to losing strategy and missed opportunity. Nobody knows what the future brings and just how long and painful a bear market may last, but everything is just paper value until an investor decides to exit.

The above hypothetical example from Lincoln Investment shows an investor dollar cost averaging by buying $100 of XYZ stock for 12 months in a row. Although the stock drops as much as 50% at one point in August, and ends up 10% lower than the initial price of $10 when the investor started purchasing, the investor has successfully lowered her average cost per share to $8.44. The investor is in the money by $79.62 given she invested $1,200, but is now currently holding stock worth $1,279.62.

Of course there are no guarantees in investing. If you’re investing for the long haul and the company fundamentals have not changed, the dollar cost averaging can be a prudent strategy to deploy during good times and bad.

2) Short the market. In its most basic form, one would borrow shares of stock and sell them with the agreement of buying them back at a later date at hopefully a lower price. As a concept, the idea sounds fairly simple, but executing it at the right time is quite difficult. Given the long term trend on stocks is up and to the right, shorting the market should be considered a short-term trading strategy.

Instead of jumping in and out of individual stocks during a bear market, investors can find inverse ETFs that are designed to outperform during periods of falling markets. Examples of such ETFs are: Short Dow 30 (DOG), Short S&P 500 (SH), and Short QQQ (PSQ).

Of course you should be aware of the risks involved with short strategies and have the tolerance, experience, and financial wherewithal to withstand the volatility. You should also be aware that leveraged and inverse ETFs are designed to achieve their investment objective on a daily basis and may not track an underlying index over an extended period of time. ETFs with Leveraged and Inverse strategies can accelerate the risk and volatility of an investment beyond that of a traditional ETF strategy.

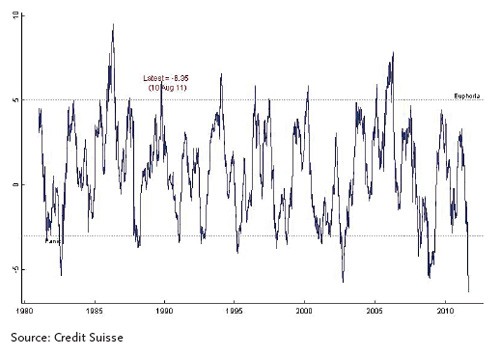

3) Consider Commodities. When the stock market falls, the value of certain commodities, such as precious metals can rise. The theory is that investors are looking for physical assets to hold onto, which appreciate in relative value vs. stocks, which have no inherent value. Take a look at the chart below. The blue line is the S&P 500 index and the red line is the gold ETF, GLD. Notice how GLD starts outperforming during the 2008 downturn. GLD begins to lose its outperformance starting in September 2012 as investors start to gain confidence in the S&P 500.

Source: Yahoo Finance Custom Chart

4) Manage your asset allocation. We all know about the importance of diversification. As the market rises and falls, your asset allocation will change. As an example, the stock market may rise 50% while the bond market may tumble 50% in one year. If you started the year with a 50/50 asset allocation. you’re now at 75/25 and probably outside your risk parameters.

It’s unknown whether stocks will correct and bonds will appreciate back to original levels over time. But what is clear is that the right asset allocation depends on your personal risk tolerance. If a 50/50 stock/bond asset allocation is ideal based on your risk tolerance, age, cash flow needs, retirement situation, and investing experience, then that is the asset allocation you should strive to maintain regardless of how the markets fluctuate in value.

5) Focus on recession-resistant strategies. Companies who have strong brand value, strong cash flow, a history of consistent dividend payouts, and inelastic consumer demand tend to perform better than companies who don’t have any such attributes. For example, a 50-year-old power company with, strong fundamentals such as a low debt-to-equity ratio and 90% dividend payout ratio may be in a better financial position to withstand a down market than a start-up internet company that is relying on venture capital funding to sustain itself.

Another “recession-resistant” strategy might be investments in companies that consumers may demand regardless of economic conditions, such as alcohol and tobacco companies, telecom companies, discount retailers, and fast-food companies.

NOBODY KNOWS THE FUTURE

Although a look at history has shown that over the long run, the stock market has shown resiliency to recover from bad times, investors can never be sure when a downturn will strike, and for how long. To avoid the temptation of selling at the wrong time, take a deep breath and remind yourself of your long-term goals.

Let Motif Investing help you achieve your financial goals in both bull and bear markets.

*************

There are unique risks associated with shorting strategies and the use of leveraged and inverse ETFs that you should be aware of prior to making an investment decision. For additional information regarding the risks associated with leveraged and inverse ETFs, please access the Support page to review the FINRA Investor Alert on Leveraged and Inverse ETFs Risks and SEC Investor Education: ETFs