5 Common Investing Mistakes and How to Avoid Them

Post on: 3 Апрель, 2015 No Comment

I have been using a new free tool called Personal Capital for a few weeks now and I am really impressed by it (if you are familiar with Mint.com, it works the same way, but does more). Today, I want to share with you 5 common investing mistakes that this tool can help you avoid. If you havent sign up for Personal Capital yet, you might want to take a few minutes to sign up and link your bank and investment accounts to it this way, you can follow along this article can see if you are checked out all okay for each of these mistakes.

5 Common Investing Mistakes

1. Using Your Retirement Accounts Like a Savings

Whether it is 401(k) or IRA, contributing money to your retirement accounts is just the first step in the process. Many people leave too much money sitting in cash or its close equivalents, such as, money market fund. After you add money to these accounts, you want to make sure you put your money to work right away in investments that fit your overall investment plan.

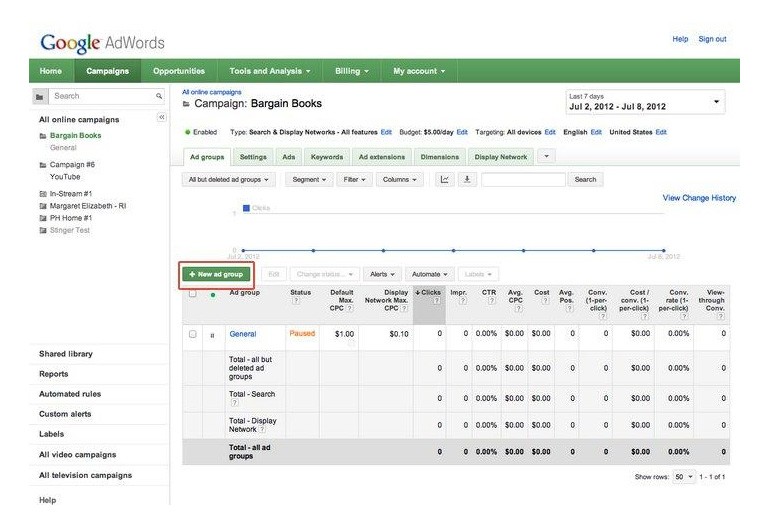

Once you linked your accounts, Personal Capitals Investment Checkup tool will help you see how much money is sitting in Cash. If you are overweight in cash, its time to figure out where to invest your money

2. Investing Too Conservatively or Too Aggressively

For retirement accounts like your 401(k) plan, it is easy to set it and forget it. As you grow older, your investment time horizon changes and you should slowly move toward the conservative end to preserve your wealth. Your risk tolerance may also have changed due to different life events.

Personal Capital let you indicate your age, retirement time horizon, and risk tolerance level; then provide you with a recommended Target Allocation. This is a good way to check how close you are to what Personal Capital recommended and you can decide whether or not to follow the advice.

For more information about asset allocation, see The Ultimate Guide to Asset Allocation .

3. Not Accounting for Target Retirement Funds Correctly

One of the major selling points for Target Retirement funds is the ability for it to integrate multiple asset classes and provide you with automatic diversification across many asset classes. However, when you start to mix up Target Retirement funds and other investments, it is easy to get your allocation off balance.

Personal Capital breaks down each of your investment and shows you what your true asset allocation looks like. This make it easier to choose investments that compliment your Target Retirement investments and make sure they work together to create an ideal allocation.

4. Segmenting Your Accounts

Another common mistake is to think about each of your account separately and not considering all of your accounts as one big investment portfolio. There are two major problems with this.

- You might not be investing in the best asset for the account type. For example, income generating investments are better in tax advantaged account because you do not have to pay income tax at your current tax rate each year. Another example is keeping your higher risk investments in non-tax advantage account so that you can take advantage of tax loss harvesting and the lower capital gains tax rates.

- The asset allocation of your total portfolio might be off balance and you might not even recognize it.

Personal Capital cannot help you with the first problem. However, once you linked all of your accounts to Personal Capital, it shows you the full picture of your overall portfolio, making it easier to have the right asset allocation even if none of your individual accounts are hitting the target allocation.

5. Avoiding High Fees

Last but not least, expensive investment fees can eat into your returns. Over a long period of time, it could severely impact your portfolio growth. Products like index funds and ETFs make it easier to find good investments with low expense ratios, but overall, it is still a lot of work to figure out exactly how much youre paying each year and what investments are the most expensive.

Personal Capitals Costs analysis tool make it very easy to see how much you are paying and what these expenses are costing you over the long-term. You can sort by Expense Ratio and Fees per Year to identify expensive investments and possibly replace them with their lower fee counterparts.

If you havent try Personal Capital yet, give it a try today and see how your portfolio is doing with regard to these 5 common mistakes.