5 Biggest Economic Reports that Sway Mortgage Interest Rates

Post on: 31 Март, 2015 No Comment

June 5, 2014 / in Interest Rates / by tim

Investors, both large and small, seek out information that might provide a guiding light to the future. Economic forecasts can impact where an investor will arrange assets in a particular sector. When times are looking good, more money tends to flow into stocks. And when times are not looking so good, funds gravitate toward bonds and other fixed instruments away from riskier stocks.

Investors both here and abroad pay attention to the array of economic reports that are released by a government agency or industry specialist. On any given day, there may be multiple economic reports released that may provide a glimpse into the future for any hints of what might lie just a few more months down the road. In essence, good news = higher rates and bad news = lower rates. At least that’s the general theory. But with so many reports available, what should someone pay the most attention to when tracking mortgage rates? Here are the top five:

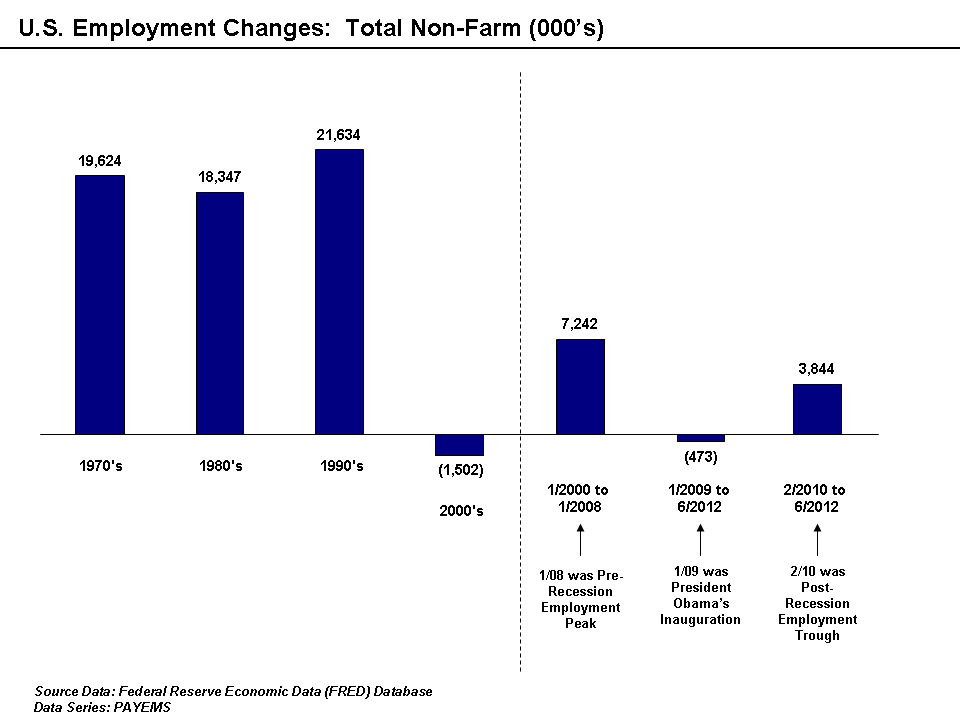

1. Unemployment Report: Released on the first business Friday of each month, the Unemployment Rate Report tallies the estimated number of citizens who are currently out of work but are looking for work. The unemployment report doesn’t count those who have quit the job market entirely either by force or by retirement. The numbers are released by the U.S. Bureau of Labor Statistics and it follows that the fewer people who are out of work the better the overall state of the economy. To arrive at this rate, approximately 60,000 different individuals are surveyed each month.

And perhaps just as important, and some say even more so, is the Non-Farm Payroll count tallied while compiling the unemployment rate. A strong economy creates jobs and is a monthly indicator of future economic growth. When employers are confident about the economic future, they begin to hire. Month to month, if more hiring is evident, the economy is in a recovery mode.

2. Gross Domestic Product (GDP): The Gross Domestic Product, or GDP, is the tally of all goods and services produced by private companies, public ones and government services. The GDP report is released every three months and accounts for the previous quarter’s activity. Quarter 1 is January through March, Quarter 2 is April through June, and so on.

A positive GDP number shows economic growth while small growth or negative growth indicates a weak economy. Economists use the GDP number when determining whether or not an economy is officially in a recession. When the GDP number is negative for two consecutive quarters, the economy is in full recession mode.

3. Retail Sales: When consumers are confident about their financial future they’re more likely to buy things both with cash and with credit. The higher the retail sales number, the rosier the economic picture. Retails account for nearly 70% of the total Gross Domestic Product and is watched closely. Because this report is released every month, just like the Unemployment Report, it provides a clear picture of the current economic environment. The retail sales number is report is compiled and released by the Department of Commerce on or about the 13 th of each month. Strong retail sales also mean more tax revenues for local and state governments that rely on sales tax revenue to fund public services. Weak or otherwise tepid retail sales will cause rates to fall.

4. Inflation: The Consumer Price Index (CPI) and the Producer Price Index (PPI) follow prices consumers and businesses pay for a predetermined set of goods. Calculated monthly and released by the U.S. Department of Labor, any signs of inflation can cause the Fed to begin raising interest rates to cool down a potential overheating economy. Anything above 2.00% inflation both on the retail (CPI) and wholesale (PPI) level can cause investors to move money away from bonds, causing rates to rise.

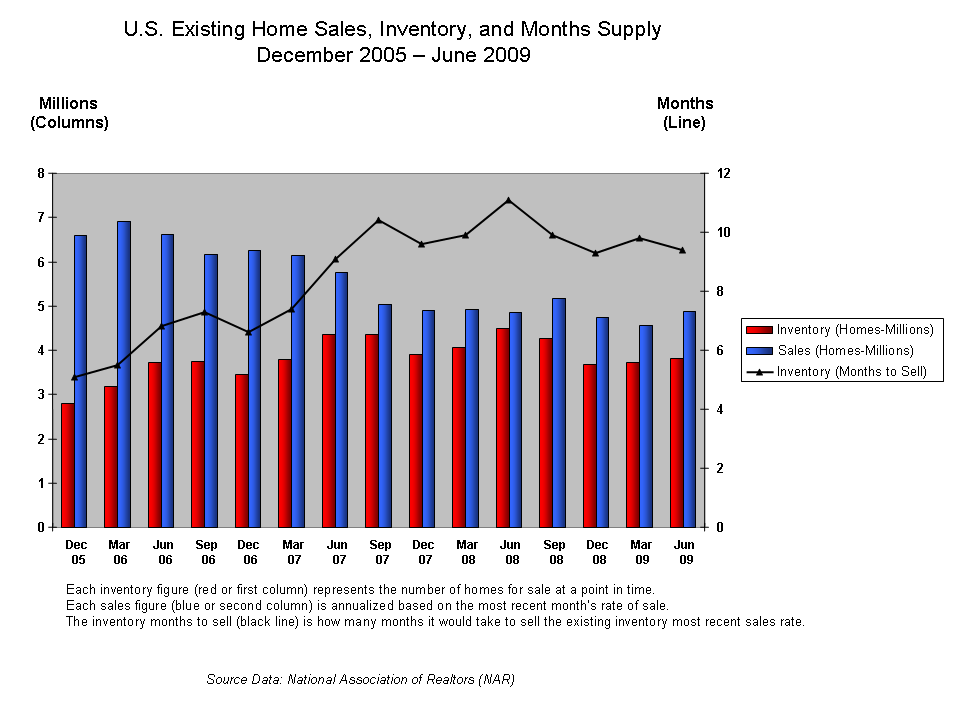

5. Home Sales: There are two reports, one for existing home sales released by the National Association of Realtors and New Home Sales by the Department of Commerce. The housing industry is extremely important to the economy and a strong housing market is an indication of the overall health of the economy. As more people are employed and are confident of their future they will buy a home as well as real estate investors who buy to hold for long term appreciation and monthly cash flow. Both reports are released monthly on or about the final business day of each month.

These five reports have more impact on mortgage rates than any other set of data. By themselves, they can cause rates to go higher, remain the same or fall. There are other influences such as geopolitical events that can have a major impact but with regard to the jumble of reports released each month, these are the most important.

Mortgage Refinance Rates

It only takes a minute and it’s FREE!

Disclosure to Vermont Consumers