401K Rollover Options How to Transfer Your 401k Fund

Post on: 9 Июнь, 2015 No Comment

Who is Eligible for a Rollover

You are eligible for a rollover when you leave your job, voluntarily or involuntarily. Some plans also offer what is called an “In Service 401(k) Distribution,” which allows you to rollover your 401(k) fund even while you are still working.

Your Options

1. Cash Out Your 401(k): A BAD idea

Don’t do it. This is the worst thing you could do with your 401(k). When you cash out your 401(k), you are taxed on the withdrawal and potentially penalized.

Any amount withdrawn is subjected to federal, and possibly state and local, taxes. The increased income could also push you into a higher tax bracket. Also, you may be subject to a 10% early withdrawal penalty if you are younger than 59 1/2. Assuming an effective combined federal and state tax rate of 35%, a $100,000 cash out could cost you $45,000 in taxes and penalties, leaving you with only $55,000.

2. Keep Money in Your Current Plan

Typically, you only want to do this if your current plan offers great investments at low costs. Check with the current plan administrator to see if this is an available option for your plan. If it is, ask if there are extra fees for keeping your money in the current plan, and if you can roll the plan over down the road if you change your mind. If everything checks out, work with your current

3. Rollover to Your New 401(k) Plan

If you have access to your new employer’s plan right away, and it offers great low-cost investments, then this might be a good option for you. To rollover into your new plan, work with the new plan administrator to coordinate the process.

4. Rollover to an IRA (usually the best option)

Compared to the options above, a rollover to an IRA is usually the best option. You can usually lower your investment expenses and gain access to a much wider variety of investment options. You can even switch among the many different brokerage firms to take advantage of different investment options, tools, features, prices, fees, and other benefits.

As of 2008, you also have the option of converting your 401(k) to a Roth IRA. which allows your retirement savings to grow tax-free.

Tax Implications

We already discussed what happens if you cash out your 401(k) — not good.

When you keep your 401(k) in your current plan, roll it over to your new employer’s plan, or rollover to a Traditional IRA, there are no tax problems as long as you do it right; make sure you use a trustee-to-trustee transfer (also called a direct transfer. see below).

A rollover from a Traditional 401(k) to a Roth IRA does trigger a taxable event, however. It will increase your taxable income, and potentially bump up your tax marginal rate into the next tax bracket.

- If you anticipate high taxable income this year, it might be worthwhile to hold off on the rollover to a Roth IRA. You can either keep your money in your current employer’s plan (if you are allowed a rollover at a later date), or rollover to a traditional IRA, and then convert it to a Roth IRA later.

- Rollover into a Roth IRA does not increase your Modified AGI, so your ability to contribute to an IRA should not be impacted by the rollover. (See clause 1b under Modified AGI on the IRS.gov web site)

How to Rollover Your 401(k) to an IRA

Now that you’ve decided on the 401(k) rollover to IRA option, here is what you need to do:

- Open an Individual Retirement Account (IRA) with any financial institution that offers an IRA. A good choice is one of the many discount brokers. In general, you want to pick the investment company that offers the type of investments you want, and that are accessible at low trade commissions and fees.

- Inform your employer that you want to rollover to an IRA. Make sure your employer makes the check payable to the investment company that you choose. This is called a trustee-to-trustee transfer, and it helps you avoid the automatic 20% tax withholding (see below).

- Invest Your Money. Once the transfer is complete, your money will sit in some sort of interest bearing investment account, such as a money market account, with a very low yield. You will have to invest your money according to your asset allocation plan. The exact investment options you have depend on your broker. In general, you want to invest in a well-diversified portfolio of low cost and passively managed mutual funds (try index funds) and ETFs.

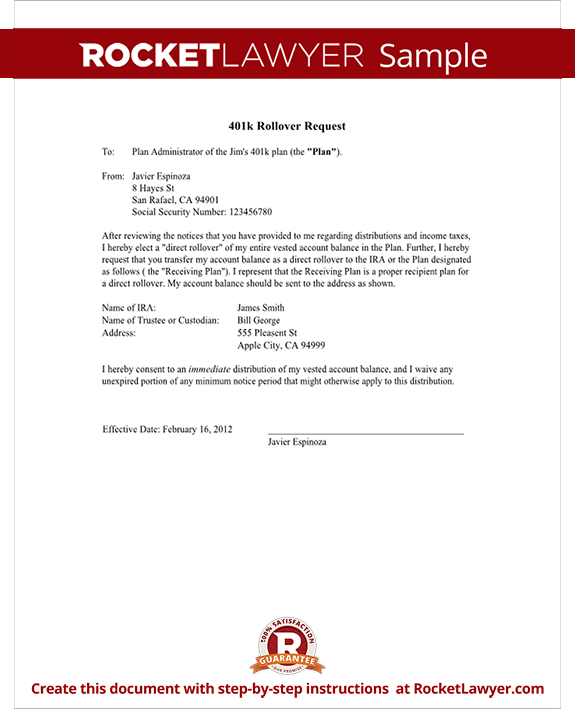

Trustee-to-Trustee Transfer (Direct Transfer )

Trustee-to-Trustee transfer is an instruction to your plan administrator to send money directly to your new 401(k) plan, or to your IRA custodian. In the event that you fail to specify this action and an indirect transfer occur, i.e. the check is made out to you instead, several things happen:

- You current plan will automatically withhold 20% of the fund. Assuming it’s a $100,000 transfer, you will receive an $80,000 check.

- You will have to come up with the additional $20,000 and deposit the full $100,000 into the new 401(k) plan or IRA account within 60 days. If you only deposit $80,000, the remaining $20,000 will be treated as a withdrawal (and subjected to taxes and penalties as explained in Cash Out option above). If you fail to deposit any of the money within 60 days, the entire amount is considered withdrawn.

Bottom Line

If you are facing this decision, consider performing a 401(k) rollover to IRA to take advantage of the opportunity to lower your costs and gain greater flexibility. Remember to research the investment company well before you open an IRA with them, and do your due diligence when selecting your investments. If you are uncertain, its usually a good idea to consult a professional to help guide you through this process and answer your questions.

Alternatively, you can use the following service to help with your rollover:

Betterment offers a set-it-and-forget-it investment service that allows you to rollovers into both Traditional and Roth IRAs. With a fee of only 0.15% to 0.35%, Betterment empowers you to put more of your hard-earned income toward a comfortable future.