401K Rollover Options

Post on: 16 Март, 2015 No Comment

401k Rollover Options

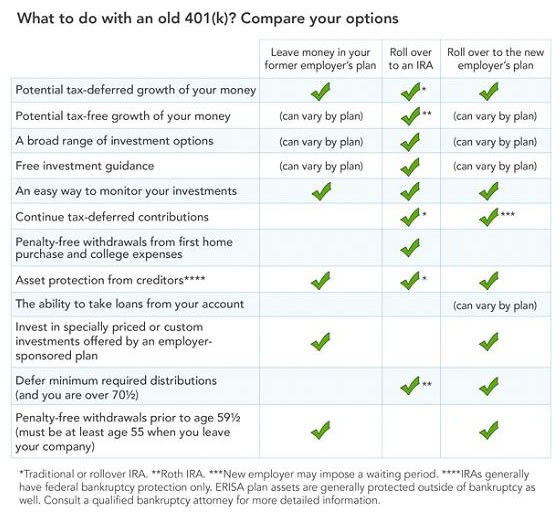

If you are in the process of changing jobs or retiring

you’ll want to consider your 401k rollover options.

If youve left a job where you had a 401k, you might consider rolling over your 401k into an account that

you can have more control over. You generally dont have the ability to move your 401k without incurring a

penalty, but once you change jobs you have the flexibility to move your 401k without paying penalties and

taxes as long as you move the 401k within a certain period of time.

A 401k rollover lets you move the money in your retirement account into another one, perhaps one that

you like better.

Your New Employers Qualified Plan

If your new employer has a 401k or 403b a 403b is a retirement savings for some non-profit employers

and schools you may be able to transfer your previous 401k savings into a plan offered by your current

employer. If you decide to rollover into a new 401k you wont be able to touch the money without penalty

unless you take out a loan or you change employers again.

Different employer plans have different contribution rules. Your new employers 401k plan may not allow

you to transfer money into your account or there may be a minimum investment amount that prevents you

from transferring your money if you dont have enough. Before you initiate the rollover process, check with

your new employers retirement plan administrator to learn whether there are any limitations on 401k

rollovers.

If youre now self-employed, you may rollover your 401k into an Individual 401k, a retirement option for

self-employed individuals. You can open an Individual 401k if you are self-employed with no employees,

even if your business is incorporated.

Rollover Into an IRA

You can move your retirement savings into an IRA. Individual Retirement Account. IRAs allow you to

continue to contribute tax-deferred money for retirement and they give you more choices for investing

than your employers 401k plan. You can rollover a 401k into a traditional IRA, Roth IRA, or SEP-IRA.

Note that if you rollover into a Roth IRA, you wont be able to rollover those same funds into a different

employer-sponsored retirement plan.

Keep in mind that if you make a IRA rollover. you wont be able to access the funds via loan as you could

with a 401k. Your only option, if you have no choice but to tap into retirement savings, is to take a

withdrawal and pay the penalty and taxes.

401k Time Limit

To avoid penalties, it may be best to transfer your 401k

savings directly into your new retirement plan. Otherwise,

if you plan to do an indirect 401k rollover where you get

a check for the balance of your 401k that you can

deposit into your new account you have 60 days to

make deposit the check into your new retirement plan.

Otherwise, you face the early withdrawal penalty.

Rolling Over With an 401k Loan

If you left your previous company with a 401k loan. you

may be required to pay the balance of the loan in full

before you can rollover the rest of your 401k savings.

Unfortunately, if you cant afford to repay the loan, the

amount you borrowed will be treated as a withdrawal and youll face early withdrawal penalty. This will

reduce the amount youre able to rollover into a new plan.

Is a 401k Rollover Required?

You dont have to rollover your 401k after you leave your employer. Instead, you can cash out your 401k.

Your employer will send you a check for the balance of your 401k minus a 20% mandatory penalty

imposed by the IRS if you receive the 401k distribution before you turn 59 . You also have to report the

distribution as taxable income and pay an additional penalty.

Alternatively, you can leave your 401k right where it is, especially if your ex-employers retirement plan

had lower fees than an IRA or your new employers retirement plan. You might also leave your 401k if you

prefer the smaller number of investment options offered by your old employers plan.