401K Asset Allocation

Post on: 17 Июль, 2015 No Comment

If you answered the latter, you probably have a good idea of what asset allocation is about. If you answered finding the hot fund, you need to pay especially close attention to this article.

Asset allocation is a strategy used by long-term savers to spread their money over several investment classes. Its goal is to maximize returns for a given risk level. It’s not an exciting strategy, but it has a good track record of helping savers reach their goals.

If you want excitement, asset allocation may not be for you, said Terence Reed, Certified Financial Planner (CFP) and author of The Eight Biggest Mistakes People Make with Their Finances Before and After Retirement with Sigma Financial in Ann Arbor, Mich.

Allocation Compromises

In developing your allocation you will have to accept compromises. The first is giving up potential premium returns and high portfolio volatility in exchange for consistent better-than-average returns with lower volatility, said Rich Chambers, principal and CFP with Investor’s Capital Management in Palo Alto, Calif.

Asset allocation is one of the most important things to do to minimize risk, said David Reiser, CFP, senior vice president of investments with UBS Paine Webber and co-author of Wealth Building.

The idea is to spread your money across a broad spectrum of investments, such as cash, bonds and stocks, that don’t move in synch with each other. Indeed, the more your investments act independently of each other, the better, Reed said. That way, if one asset goes through a rough time, the other assets support the portfolio.

But that doesn’t mean that if one investment is tanking, you should get out and put your money elsewhere. That’s called market timing and it’s a practice that financial planners discourage.

Bad Timing

Here’s why timing is bad idea. If you bailed out of stocks today, to catch the next rally you would need the market-reading skills to figure out when it was starting and then to quickly buy in. But, reading markets is difficult because they don’t move in a straight line.

Consider the following statistics. They are based on the following assumption — you invest $1,000 in January 1926 and leave it alone until December 2000.

- If you invested it all in Treasury bills, by December 2000 you would have $16,644.

- If you invested it all in stocks, by December 2000 you would have $2,562,976.

- If you invested it in stocks, yet missed being in the market the 40 best months over those 75 years, by December 2000 you would only have $15,050.

Asset allocation keeps your funds always invested in the market so you participate in rallies as they develop.

Building Your Allocation

This article won’t offer you a single, best allocation. What’s best depends on your situation. But we can offer guidance to help build your allocation.

Two issues to consider are your time horizon and investment-risk tolerance.

Time. The longer until you need your savings, the more money you will be able to save and the more investment risk you can tolerate. You can assume more risk because your portfolio will have time to recover from losses.

Risk. The investment risk we’re talking about refers to the fluctuation or volatility of returns on your investment. In assessing your risk tolerance keep in mind your time horizon, your retirement goals, whether you have the money to take risk and whether you feel comfortable taking risk.

Allocation Steps

The first step is to set up reserves equal to several months of living expenses. This money should be used for emergencies such as temporary job loss. The reserves should be invested in liquid, low-risk investments such as money market funds, financial planners recommend.

The next step is to create an investment allocation for your remaining savings — how much you put into equities, bonds or cash.

While most folks think of allocating their retirement portfolios, many planners recommend you apply this strategy to the investments used for all your long-term savings goals, such as a child’s college education or buying a second home.

Don’t rush creating an allocation because it’s one of the most important decisions you will make.

For the long-term individual investor who maintains a consistent asset allocation and leans toward index funds, asset allocation determines about 100 percent of performance, according to the January 2000 Ibbotson study The True Impact of Asset Allocation on Returns.

Many employers don’t offer index funds in their 401k plans, but the lesson remains valid: over the long term, your allocation will have a significant impact on your portfolio’s performance.

In creating your allocation, you will have to balance the risks inherent in each investment against their respective returns. From 1925 through today, cash investments generated average returns of 3 percent a year, bonds averaged a little over 5 percent and stocks averaged about 11 percent.

Cash. In a 401k plan, a cash investment would be a money market fund. These are considered extremely low risk and generally earn a small return. With this investment your original investment is not supposed to fluctuate.

Fixed income. In a 401k plan, this asset class is represented by bond funds. Many bond funds invest in a mix of government and corporate bonds. These funds typically offer a higher rate of return than cash-type investments and carry a modest amount of investment risk.

Equities. Within 401k plans this asset class is often represented by a myriad of funds. Equities have higher investment risk than cash or bond funds. In exchange for assuming this risk you gain the potential for higher returns. Indeed, equities are the one type of investment that, historically, has consistently beaten inflation over the long term. Retirement savers with a long time horizon should consider inflation the leading risk they face. That suggests equities should be a dominant asset in their portfolio, Lummer said.

Most 401k investors aren’t offered a single fund to serve as a proxy for the stock market. Typically, plans offer large-cap, small-cap, growth, value and international funds, and various permutations of these. You will need to create an allocation among these sub-classes of equities. It will be up to you to choose the funds to cover these different sub-classes. Carefully research their holdings by reading the fund prospectus to ensure that you are covering each category only once. If you invest in funds with overlapping assets you risk inadvertently putting too much money in a particular stock class.

Yet, if you can’t stomach the risk associated with equities don’t force (yourself) into an asset allocation that is scary, Chambers said. That may be a mistake.

You can make up for lost returns by saving more, or saving for a longer time.

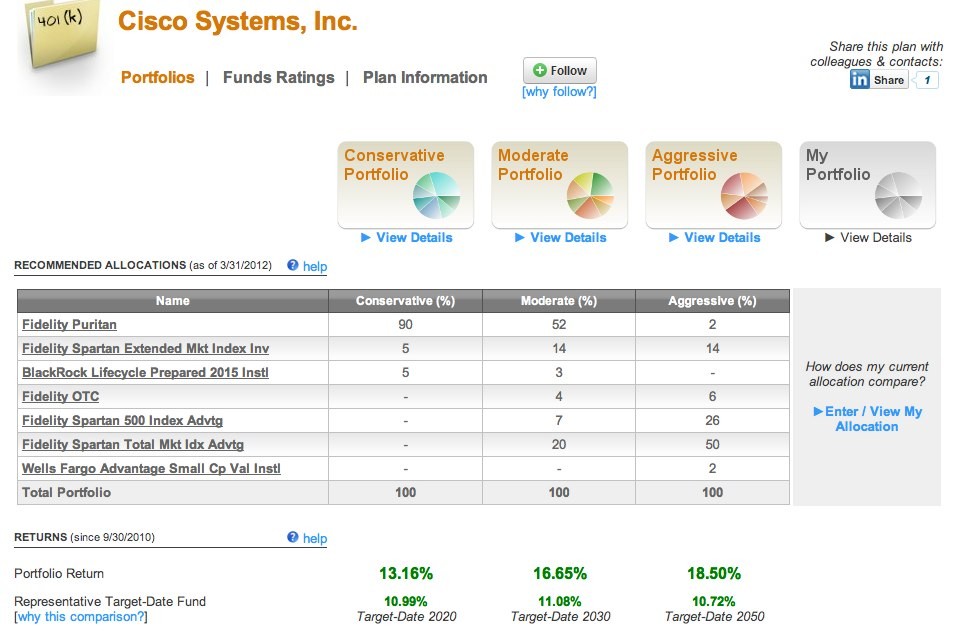

Here are three sample allocations, neither aggressive nor conservative, that Lummer created based on various time horizons. More aggressive investors could put more in stocks, while conservative investors could put more in bonds and cash.

When to Change Allocation

The recent market turmoil might tempt you to change your allocation. Don’t, say financial planners. That’s market-timing.

Your allocation is a long-term plan based on assumptions about your time horizon, your savings rates and your goals. Recent events have probably done little to change those assumptions.

The time to consider changing your allocation is when a major event occurs in your personal life (such as a major medical problem or accelerated retirement date) that changes your retirement outlook. If this occurs, you should run through the same decisionmaking process you used to develop your asset allocation, but now using your new set of assumptions.

Even as planners advise against changing your allocation, they do recommend regularly rebalancing your portfolio. To do this, compare your current allocation with your original allocation. If they’re not the same, sell assets that make up too large a percentage of your portfolio, and buy assets that make up too small a percentage, to return to your original allocation.

The information provided here is intended to help you understand the general issue and does not constitute any tax, investment or legal advice. Consult your financial, tax or legal advisor regarding your own unique situation and your company’s benefits representative for rules specific to your plan.