401(K) Withdrawals

Post on: 3 Июнь, 2015 No Comment

401(k) Withdrawal Guidance

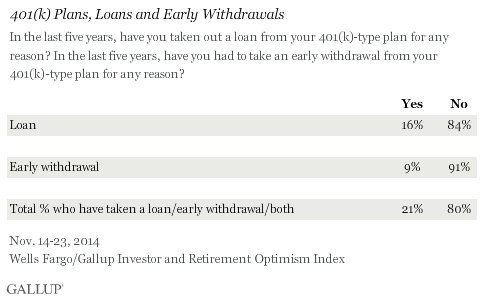

Withdrawing money early from your 401(k) will result in a penalty for most people and should only be done under the most extreme circumstances. Early withdrawal, even hardship withdrawals are usually subject to a 10% penalty from the IRS and also taxed as ordinary income. Provided you pay back the funds within five years, you may borrow from your 401(k) to fund a first time purchase of a primary residence or to pay for your childrens education. Your individual situation may vary. You should consult a tax adviser if considering early withdrawals. Withdrawal penalties end at age 59.5.

When is the Right Time to Roll Over?

Likely as soon as possible. For most people, that means whenever you retire or leave your employer. You can open a new 401(k) at a new employer and have multiple tax-deferred accounts (you can have 401(k)s and IRAs simultaneously at any point).

IRAs have the same tax structure as 401(k)s but they are individual and thus not offered through your employer. A downside is lower contribution limits (but if your new employer offers a 401(k) program, you can just open another account and reap the benefits of both). Another downside is the fear some feel at having to manage on their own or hire a professional manager.

If your 401(k) plan allows you to invest in whatever you like, there is less of a hurry to roll over (unless fees are a consideration). You may want to roll into an IRA to work with a different custodian (keeper of your assets) than the one your employer uses or maybe youd like to seek active management. With some exceptions (based on employer and custodian), 401(k) accounts cannot be actively managed to your unique situation by a professional.

How Does a Rollover Work?

There are two methods for rolling your 401(k) into an IRA if your plan permits it. Please be sure to check with your 401(k) plan administrator.

Option One: One (recommended) consists of the custodian who holds your 401(k) directly transferring the money to the new custodian who is hosting your IRA. Or if youre keeping the same custodian but changing your 401(k) to an IRA, they will simply transfer it to the new account internally.

Option Two: The second method consists of your old custodian sending you a check, which you will then deposit with the new custodian. Theres a 20% withholding penalty applied to this transaction.

Then you have 60 days to deposit with the new custodian. Youll then have to apply to get the withholding penalty refunded. You also have to fund the new account in full immediately, meaning youll need the equivalent of the 20% withholding penalty in cash ready to contribute to funding the new account. If you dont deposit it in your new IRA within 60 days its subject to ordinary income tax.

How Can Fisher Investments Help?

Since starting our Private Client Group in 1995 we have literally assisted clients with thousands of 401(k) rollovers. We ensure the process is seamless by staffing a team of rollover operational specialists, helping conduct an initial rollover call with the financial institution housing the assets, helping clients correctly complete any necessary paperwork and monitoring the asset transfer process from initiation to deposit. All the while answering client questions and keeping them up-to-date on the process. In some cases we may even be able to manage 401(k) accounts for active plan participants. We can help rollover 403(b)s, SEP IRAs, Profit Sharing Plans and most all defined contribution plans.