401(K) Plans as Employee Ownership Vehicles Alone and in Combination with ESOPs

Post on: 6 Июль, 2015 No Comment

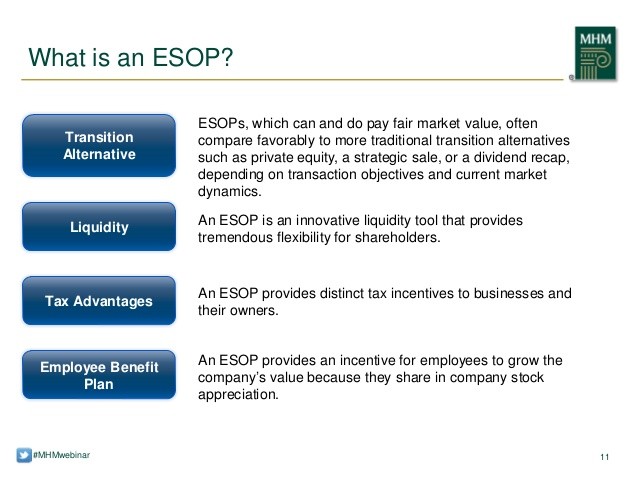

While ESOPs are the most tax-favored and fiduciarially sound way to share ownership with employees, 401(k) plans provide an alternative that may be appropriate in some cases. These plans can also operate in conjunction with an ESOP.

If you have a private company and you want to sell your stock to employees, it is just not possible to beat the tax and financing advantages of an ESOP. But if your goal is simply to reward and motivate employees with ownership, a 401(k) plan may provide a simpler alternative to an ESOP.

Many public companies make their shares available as an investment option and/or match employee deferrals with company stock. In the wake of Enron, WorldCom, Lucent and many other companies that saw severe drops in their stock in the early 2000s, and then again in recession of 2008 and 2009, this practice became markedly less common, with employee investment in company stock in 401(k) plans dropping from about 19% of all assets to under 11%. The stock-drop companies faced numerous lawsuits, and while few have actually been decided in favor of the plaintiffs, there have been a number of settlements for tens of millions of dollars each. In the Pension Protection Act of 2006, Congress also made changes to these plans to allow employees to diversify out of company stock quickly.

401(k) Plans as Employee Ownership Vehicles

401(k) plans allow employees to make tax-deferred contributions to a trust and direct their investments among a variety of choices, getting their money back at departure or retirement. Most companies match the employee investment, usually at between 25 and 75 cents per dollar up to a defined maximum (such as 6% of pay). The match may be necessary in order to make sure enough lower paid employees participate in a 401(k) plan to meet the anti-discrimination rules that regulate these plans. Most private companies match employee contributions with cash, which the employee may then direct into various alternative investments.

To use a 401(k) plan for employee ownership, a company can match employee contributions with its own stock. The stock can be from treasury or new shares, shares bought by the company, or shares bought by the 401(k) plan with company cash contributions. The repurchase would allow a company to use pretax dollars to buy shares, but the proceeds of the sale would not be subject to the tax-deferred rollover available to ESOPs. Theoretically, the company could allow employees to buy employer shares, but in a private company this would raise securities issues usually too expensive even to consider. In public companies, however, this is very common. This approach has several pros and cons:

- Share contributions could be dilutive if funded with share contributions.

- In private companies, shares would need to be valued and repurchased.

- Share allocations would be based on the amount of employee contributions to the plan: This is not necessarily a pro or con, but it is different from an ESOP, where shares are normally allocated to all full-time workers after a year of service on the basis of relative pay or some more equal formula. In the 401(k) approach, to make sure everyone gets at least some contribution, a plan can be structured so that all employees meeting a certain minimal requirement get a minimum allocation (such as one or two percent of pay in shares). Some people like the 401(k) allocation method, however, because it requires employees to make a financial commitment to the plan in order to get their shares.

- If you already have a 401(k) or intend to set one up, total costs will be lower than a separate ESOP.

- 401(k) plans are now the primary retirement plan for most employees. An excess of company stock may be too risky: 401(k) plans were designed as a supplemental retirement plan, but have become a primary plan for most employees, with well-known consequences for retirement security. Concentrating investments in any one asset in a 401(k) plan, company stock or otherwise, can be excessively risky.

- Fiduciary issues are of more concern: Courts have come to mixed conclusions about just how much a 401(k) plan fiduciary is shielded from participant lawsuits by virtue of the fact that the plan a) mandates employer stock be the match or b) allows employees to invest in company stock. In ESOPs, it is clear that fiduciaries have great deference. Only in the case where there is knowledge that the company is in imminent danger of collapse is this deference overridden. In 401(k) plans, this degree of deference has been granted by some courts but not others. Similarly, the duty of fiduciaries to inform participants about problems wit company stock has seen conflicting rulings from courts.

Contribution Limits

Many ESOP companies want to provide employees with a 401(k) plan to enhance employee retirement security. In many companies, the 401(k) plan and the ESOP are operated separately. Employers doing this need to be aware of several issues:

- Deductible employer contributions to the combined ESOP/401(k) plan (plus any other defined contribution retirement plans the company may have) cannot exceed 25% of pay. Dividends paid on ESOP shares in a C corporation to repay an ESOP loan do not count towards these limits. When calculating eligible pay (for 2009, pay over $245,000 does not count. Employuee deferrals do not reduce eligible pay or count as employer contributions.

- Total annual additions to employee accounts cannot exceed 100% of pay or $46,000 (in 2009). Employee deferrals do count here for the 100% of pay or maximum dollar limitation, but continue not to reduce the definition of eligible pay.

- Third, the plans should be set up with identical plan years. Otherwise, contribution limits can be inadvertently exceeded due to timing problems.

- Fourth, allocations resulting from contributions used by the ESOP to pay interest on a loan will be included in the annual addition limits if more than one-third of the contributions are allocated to highly compensated employees.

- Fifth, forfeitures are included in the allocation limits except for reallocation of certain leveraged shares.

Combining 401(k) Plans and ESOPs (KSOPs)

Many ESOP companies, particularly public companies, want to go one step further and combine a 401(k) plan and an ESOP (by using ESOP contributions to match employee contributions to the 401(k) plan; this is sometimes called a KSOP. Employer matches are often necessary to attract enough participation in the 401(k) plan by lower-paid employees to avoid violating 401(k) anti-discrimination rules. Stated very generally, in prior years these rules required that the average percentage of pay deferred by higher income employees could not exceed the average of non-highly compensated employees by more than 1.25 times. Alternatively, the excess percentage deferral for highly paid employees could not be greater than two percent more than that of lower paid employees and could not be greater than two times that contributed by lower paid employees (e.g. a 4% contribution by the higher paid and a 2% by the lower paid would qualify, but a 3% and 1% would not). A match could help a company meet these rules by inducing more people to participate.

There are alternatives to meet these anti-discrimination rules through company matching contributions. To simplify somewhat, a company can qualify its plan, even if the above tests are not met, through one of the following two methods:

- It matches employee elective deferrals at 100% up to at least 3% of pay and matches at 50% at least for contributions between 3% and 5%. The matching contribution rate cannot be higher for highly compensated employees than for other employees.

- The employer makes a contribution to all eligible participants, whether they make an elective deferral or not, of at least 3% of pay.

The importance for employee ownership purposes of these anti-discrimination alternatives is simply that many companies may now decide to enhance their match to qualify their plans and let highly compensated employees contribute more than under current law. One way to do this would be to combine an ESOP with a 401(k) plan and use stock contributions for the match, or simply to contribute company stock as the match.

Aside from the benefit of avoiding anti-discrimination rule violations, an ESOP can be a more cost-effective way to match 401(k) contributions because it allows a company to borrow money and repay it in pretax dollars, as well as use tax-deductible dividends to repay the loan. And if the value of the ESOP shares goes up as the loan is repaid, the company, in effect, can pay for part of the future match out of appreciation in the share price rather than cash.

From the employee’s point of view, there are advantages as well. A leveraged ESOP commits the employer to continue to make matching payments. In some plan structures, there may be a windfall match if the stock price appreciates more rapidly than anticipated, or employee contributions are less than planned. ESOP distributions in stock also receive somewhat more favorable tax treatment than cash distributions because they may not be not subject to the 20% withholding rule, and appreciation of their value may be taxed as capital gains.

Meeting Discrimination Rules

Companies need to make sure that their ESOP and 401(k) meet complex participation and allocation rules. There is one set of rules governing what percentage of employees must be in either or both plans and another set for allocation. The participation rules aim to prevent under-participation by less highly compensated people. There are several alternative tests for this. For the 401(k) portion of a plan, employers must show that the average deferral percentage and the average contribution percentage (the match made by the employer) each meets the 1.25 or two times/two percent rule described above. Companies should discuss this with counsel, however, as the rules for using this two times/two percent rule depend on the situation. If the company is making ESOP contributions only to match 401(k) deferrals, the ESOP allocations are not tested differently than the 401(k) matches would be. If there are additional ESOP contributions, these must meet ESOP allocation rules. The ESOP contribution can be designated as a match and used to meet the alternative safe harbor test mentioned above. In any event, this complex area needs to be discussed with a professional.

In a leveraged ESOP, care must also be taken that not more than one-third of the contributions are allocated to highly compensated employees. If they are, contribution limits to the ESOP will include contributions used to repay interest on the ESOP loan and forfeitures of leveraged shares.

Diversification

For public companies with 401(k) plans (including those integrated with ESOPs), the Pension Protection Act of 2006 requires that employees be able to diversify out of any employer stock they have purchased with their own deferrals. In addition, employees must be able to diversify out of employer stock that was contributed by the employer if they have three years of service or more. This requirement phases in at one-third of employer stock contributed by the employer in 2007, 2008, and 2009 plan years. Employers must also provide quarterly statements explaining the importance of diversifying plan assets.

Structuring the Match

If a company is not borrowing money through an ESOP, the match is simply made each year for whatever amount is needed. If the ESOP borrows money, however, the situation is more complicated. The loan is for a fixed amount, but the amount that employees defer in the 401(k) varies. How can companies plan for this?

One approach is to project how much will be needed so that the value of the shares released each year is the same as the amount employees defer. If that turns out to be too high, employees get a windfall; if it is too low, employees get less. Alternatively, some companies agree to top off in low years by making discretionary nonleveraged contributions. In either case, many companies will increase their matching percentage if the stock is replacing a cash match. The lower risk of a cash match is compensated for by the larger amount of the stock match.

A more sophisticated, and common, approach has the company borrowing the money and reloaning it to the ESOP. The loan is then structured so that most of the principle is paid off towards the end of the term. Companies can prepay on the loan, however, to meet the exact amount employees defer. In some cases, this could change the number of years over which the loan is actually paid.

However the plan is structured, companies need to decide whether to use the repayment amount of the contributions or the value of the stock allocations to test for meeting discrimination rules. This issue is not yet a settled area of the law and should be discussed with legal counsel.