401(K) Contribution Limits 2012

Post on: 4 Июнь, 2015 No Comment

The maximum contribution limits for 401(k)s in 2012

You can opt-out at any time.

The amount you can contribute to your 401(k) each year is capped, and the maximum limits change slightly over time. Why does the government put a limit on how much you can sock away in your retirement account? Because 401(k)s are like perks, they offer a great tax-deferred investment opportunity. If you are going to get rich investing in the stock market, you could get even richer if you’re invested within a tax-deferred account.

Most people don’t come near to maxing out their 401(k) contribution, but if you are trying to make up for lost time or just have additional cash to put away this year, it’s good to understand the limits and how these accounts work.

401(k) Contribution Limits 2012

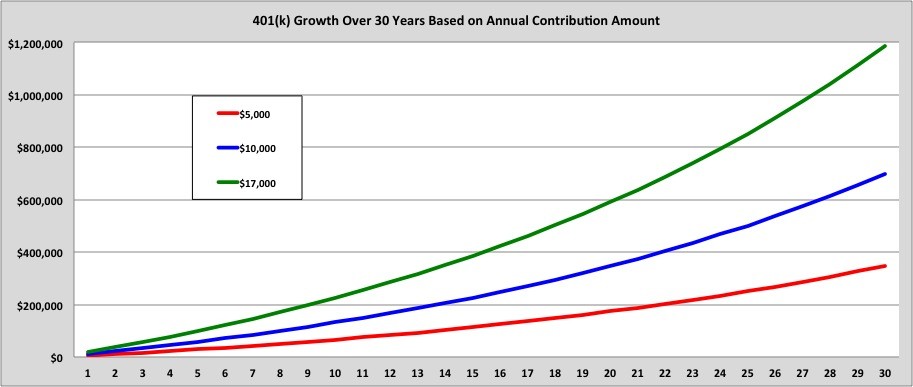

In 2012, the maximum amount that individuals can contribute before taxes to a 401(k) is $17,000. Some plans will limit this amount even further, or in some plans you may make contributions in excess of $17,000 if it represents less than 100% of your salary and doesn’t exceed $50,000. But only $17,000 of the contribution will be made pre-tax.

If you are age 50 or older, you can throw in an additional $5,500 if your plan allows it. This is called a catch-up contribution, and it’s designed to help last-minute savers bulk up late in their careers. Not all 401(k) plans offer catch-up contributions, so talk to your plan administrator or your human resources representative.

SIMPLE and SEP Contribution Limits 2012

If you have a SIMPLE 401(k) plan, the limits are different. A is a plan designed for employers with less than 100 employees. With a SIMPLE 401(k) you can contribute up to $11,500 in 2012. Plus $2,500 in catch-up contributions for those people age 50 or older. If your company has very few employees, it may choose a SEP IRA as its retirement offering. A SEP IRA has a $50,000 maximum contribution limit, but different rules than a 401(k).

Roth 401(k) Contribution Limits 2012

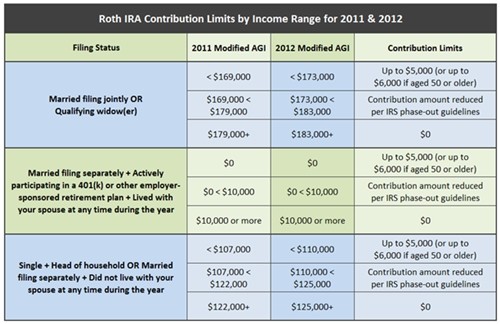

As of 2006, there’s another type of 401(k) to consider, the Roth 401(k). It differs from the traditional in the way that it’s taxed. Money does not go into a Roth 401(k) pre-taxed. You contribute from your after-tax paycheck. But once it’s in the Roth 401(k), the account grows tax free and you don’t pay taxes when you withdraw the money after age 59 1/2. If you plan to be in a higher tax bracket (i.e. more of a high roller) at retirement than you are today, that’s a good tax deal to take. Roth 401(k) contribution limits in 2012 are the same as traditional 401(k) limits: $17,000 plus $5,000 if you qualify for a catch-up contribution. (Compare this to a regular Roth IRA. which only allows you to contribute $5,000 to $6,000 in 2012, depending on your age. Plus, the Roth 401(k) doesn’t have the same income limits that a Roth IRA is subject to.)

Not all employers offer the Roth 401(k) as a retirement option. About one-third of large employers had it on their benefits menu in 2012. If it’s not on yours, consider contributing as much as your employer’s matching contribution amount to your 401(k), then put your excess savings in a Roth IRA. The maximums are much lower, but it’s still a good place to save and avoid future taxes. And it’s easier to withdraw contributions from a Roth IRA before age 59 1/2. Not that you should withdraw money before retirement, but it makes some investors more comfortable knowing that’s an option.

The limits on contributions typically change each year or every other year. It increases with the cost of living.

Forget Maximums, What’s the Minimum I Can Contribute?

How much should you contribute? Start with putting in anything you can. If it’s 1% or 2%, or $25 a paycheck, that’s fine. Don’t wait until you can invest an ideal amount, you can start small as long as you start soon. Most financial professionals will recommend that you invest either as much as your employer will match (those who offer a match usually do anywhere between 3% and 6%) or 10%. That’s a good rule of thumb, but if you can stash away more, great. And if you can’t contribute that much, don’t worry. A little savings is better than none at all.